- United States

- /

- Construction

- /

- NYSE:FLR

Does Fluor’s Recent Share Slide Create a Long Term Opportunity in 2025?

Reviewed by Bailey Pemberton

- If you are wondering whether Fluor at around $40 a share is a bargain or a value trap, you are not alone. This breakdown is designed to help you decide with a clear, valuation-led lens.

- The stock has slipped 5.9% over the last week and is still down 17.2% year to date, yet long-term holders are sitting on a 153.0% gain over five years. This shows that sentiment around the name can swing quickly.

- Recently, investors have been reacting to a mix of contract wins and project updates in Fluor's core engineering and construction markets, which can shift expectations for future cash flows and risk. Broader infrastructure and energy transition spending themes have also kept the company on the radar of investors who are looking for cyclical exposure if the macro picture improves.

- On our checklist-based approach, Fluor scores a 5/6 valuation score, suggesting it screens as undervalued on most of the key metrics tracked. Next, we will walk through the different valuation methods behind that number, before finishing with a more holistic way to think about what the market is really pricing in.

Find out why Fluor's -18.8% return over the last year is lagging behind its peers.

Approach 1: Fluor Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting the cash it can generate in the future and discounting those cash flows back to the present. For Fluor, this is done using a 2 Stage Free Cash Flow to Equity approach, which assumes a period of higher growth followed by a more mature phase.

Fluor generated roughly $189.5 million in free cash flow over the last twelve months, and analysts expect this to rise meaningfully in coming years. By 2029, free cash flow is projected to reach around $540 million, with intermediate years stepping up from about $390.9 million in 2026 to nearly $599.0 million by 2028 before normalizing. Beyond the analyst horizon, Simply Wall St extrapolates these trends to complete a 10 year cash flow profile.

When those projected cash flows are discounted back and combined with a terminal value, the DCF model indicates an intrinsic value of about $44.71 per share. Relative to the current market price, this implies Fluor is trading at roughly an 8.8% discount, which is close enough to count as broadly in line with fair value.

Result: ABOUT RIGHT

Fluor is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Fluor Price vs Earnings

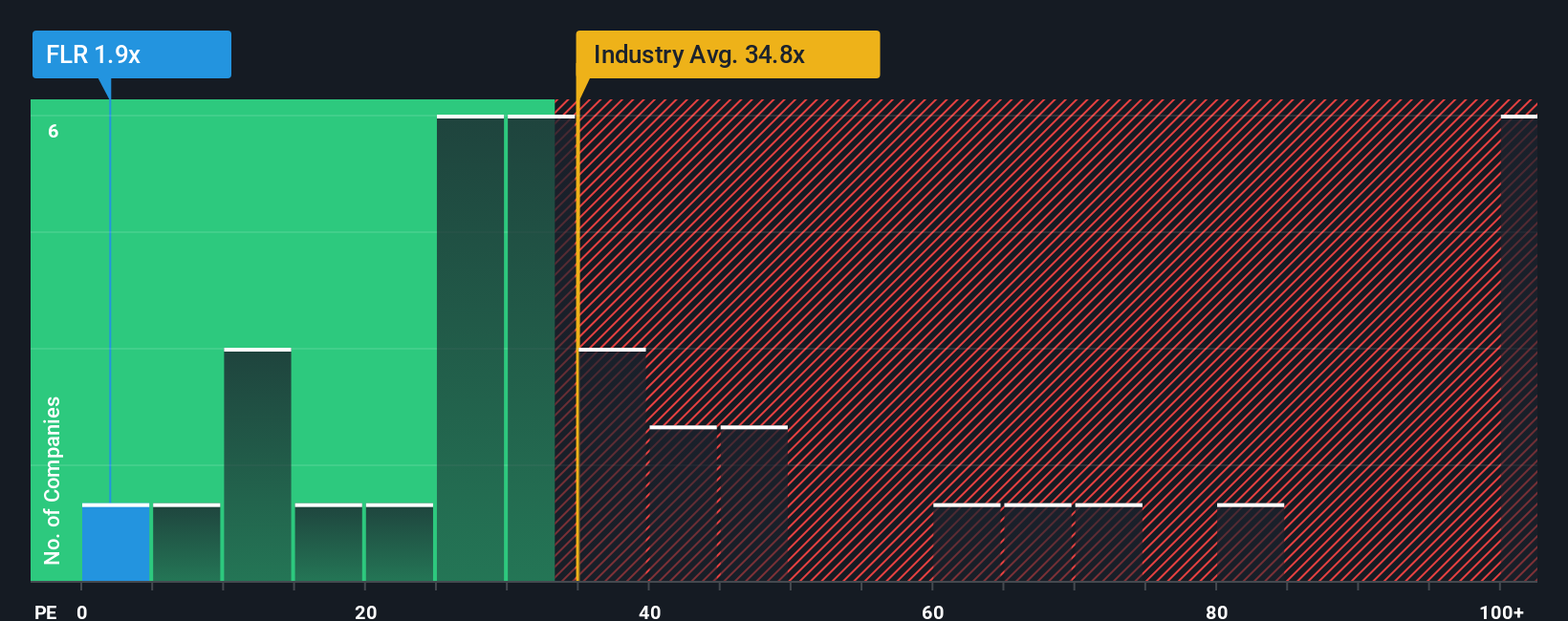

For a profitable business like Fluor, the price to earnings, or PE, ratio is a useful way to gauge how much investors are willing to pay for each dollar of current earnings. In general, faster growing and lower risk companies tend to trade on higher PE multiples, while slower growing or riskier names typically trade on lower ones.

Fluor currently trades on a PE of about 1.9x, which is dramatically below the Construction industry average of roughly 32.0x and also well under the peer group average of around 31.3x. On the surface, that large discount suggests the market is either heavily discounting Fluor’s earnings quality or factoring in substantial risk.

Simply Wall St’s proprietary Fair Ratio helps refine that picture. It estimates what PE multiple a company might trade on, based on its earnings growth outlook, risk profile, profitability, industry and size. Because it adjusts for these fundamentals, it can be more informative than a simple comparison with peers or the sector. For Fluor, the Fair Ratio comes out at about 5.2x, still well above the current 1.9x, which indicates the shares screen as meaningfully undervalued on an earnings basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1457 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Fluor Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Fluor’s story with a concrete forecast for its revenue, earnings and margins, and then translate that into a fair value you can compare to today’s share price. A Narrative on Simply Wall St’s Community page captures your perspective in numbers, turning your expectations about project wins, risks and capital allocation into a living valuation model that updates dynamically when new information like earnings, contracts or analyst revisions comes in. Narratives help you clarify whether your estimated fair value is above or below the market price, and by how much, so you can decide whether the gap is large enough to matter for your strategy. With Fluor for example, one investor might lean toward a bearish Narrative anchored around the lower analyst target near $40, while another builds a more optimistic Narrative closer to $57, and both can clearly see how their assumptions drive those very different fair values.

Do you think there's more to the story for Fluor? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FLR

Fluor

Provides engineering, procurement, and construction (EPC); fabrication and modularization; and project management services worldwide.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion