- United States

- /

- Construction

- /

- NYSE:FIX

Comfort Systems USA (NYSE:FIX) Expands Share Buyback Program With Additional 402,413 Shares

Reviewed by Simply Wall St

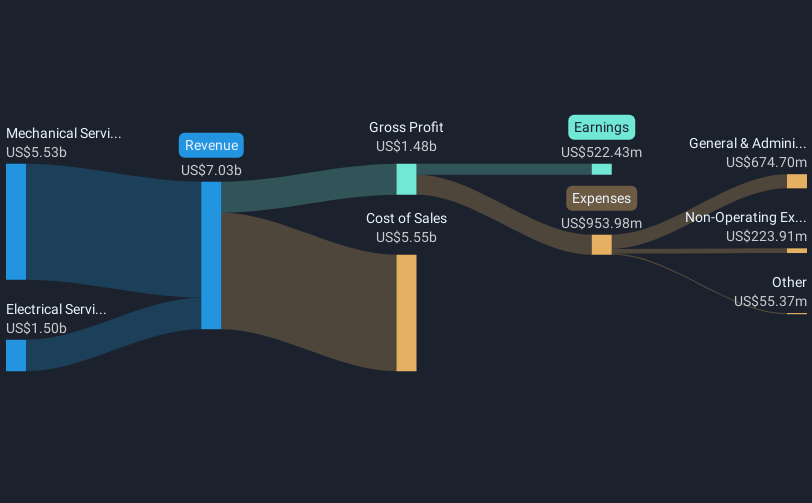

Comfort Systems USA (NYSE:FIX) saw a 36% share price increase over the last month, likely influenced by its enhanced buyback program announced in late May, reflecting confidence in its financial health. This move comes as the company reported strong first-quarter earnings, with sales climbing to $1,831 million and net income rising significantly year-over-year. These positive indicators seem to have countered the broader market's concerns, where major indices faced downturns due to revived trade worries, exemplifying Comfort Systems USA’s resilience amid external challenges.

We've identified 1 warning sign for Comfort Systems USA that you should be aware of.

The substantial 36% share price increase following Comfort Systems USA's enhanced buyback program and strong first-quarter earnings highlights investor confidence, possibly influencing future revenue and earnings forecasts. These developments suggest continued strength and potential margin improvements from the company's focus on acquisitions and advanced technology, despite prevailing economic uncertainties. Analysts' expectations for annual revenue growth of 7.4% and an increase in profit margins suggest optimism for sustained improvement, albeit tempered by challenges like supply chain costs and inflationary pressures.

Over the past five years, Comfort Systems USA achieved a very large total shareholder return of 1149.24%. This long-term performance significantly outpaced the broader US market and the US Construction industry, which saw returns of 10.5% and 21.3% over the last year, respectively. This indicates notable resilience and growth in the company's business model, driven by strong demand from industrial and tech sectors.

With shares currently trading at approximately US$428.97, below the consensus price target of US$500.67, there is potential for further share price appreciation based on analysts' projections. Future growth assumptions include reaching US$9.1 billion in revenue and $824.9 million in earnings by 2028. However, for the share price to fully align with these expectations, factors such as maintaining high backlog growth and effectively managing costs will be crucial. Such alignment would require the company to achieve a price-to-earnings ratio of 24.7 times future earnings, slightly above the current industry average.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIX

Comfort Systems USA

Provides mechanical and electrical installation, renovation, maintenance, repair, and replacement services for the mechanical and electrical services industry in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives