- United States

- /

- Building

- /

- NYSE:FBIN

Is Fortune Brands Innovations a Bargain After a 36.6% Slide in 2024?

Reviewed by Bailey Pemberton

- Wondering if Fortune Brands Innovations is finally a bargain or just a value trap? You are not alone, and today we will cut through the noise to see if the stock really stacks up.

- The share price has been through a rocky patch, slipping 27% year to date and down 36.6% over the past year. However, it recently nudged up 1.2% over the last week, suggesting some fresh optimism or a reassessment of risk.

- Much of this action is happening alongside ongoing headlines around the company’s strategic investments and shifts in sector leadership. Fortune Brands continues to fine-tune its portfolio and allocate capital toward higher-growth opportunities. Market sentiment seems to have reacted sharply at times to these capital deployment moves, fueling a turbulent price journey.

- On paper, Fortune Brands Innovations impresses with a top valuation score of 6 out of 6, making it look undervalued across every metric we track. As we dig into the details, we will see how different valuation approaches stack up and why there is an even better way to judge its true worth coming up at the end of this article.

Approach 1: Fortune Brands Innovations Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by forecasting its future cash flows and discounting them back to today's dollars. This approach aims to determine what those future streams of money are worth right now, providing an objective measure of value based on expected company performance.

For Fortune Brands Innovations, the current Free Cash Flow stands at $344.08 million, and analysts project strong growth over the next decade. By 2027, Free Cash Flow is expected to reach approximately $612.47 million. Long-term projections, extrapolated to 2035, see this figure rising further to around $826.49 million before discounting. These numbers are calculated in $ millions, reflecting healthy operational cash generation and anticipated future expansion.

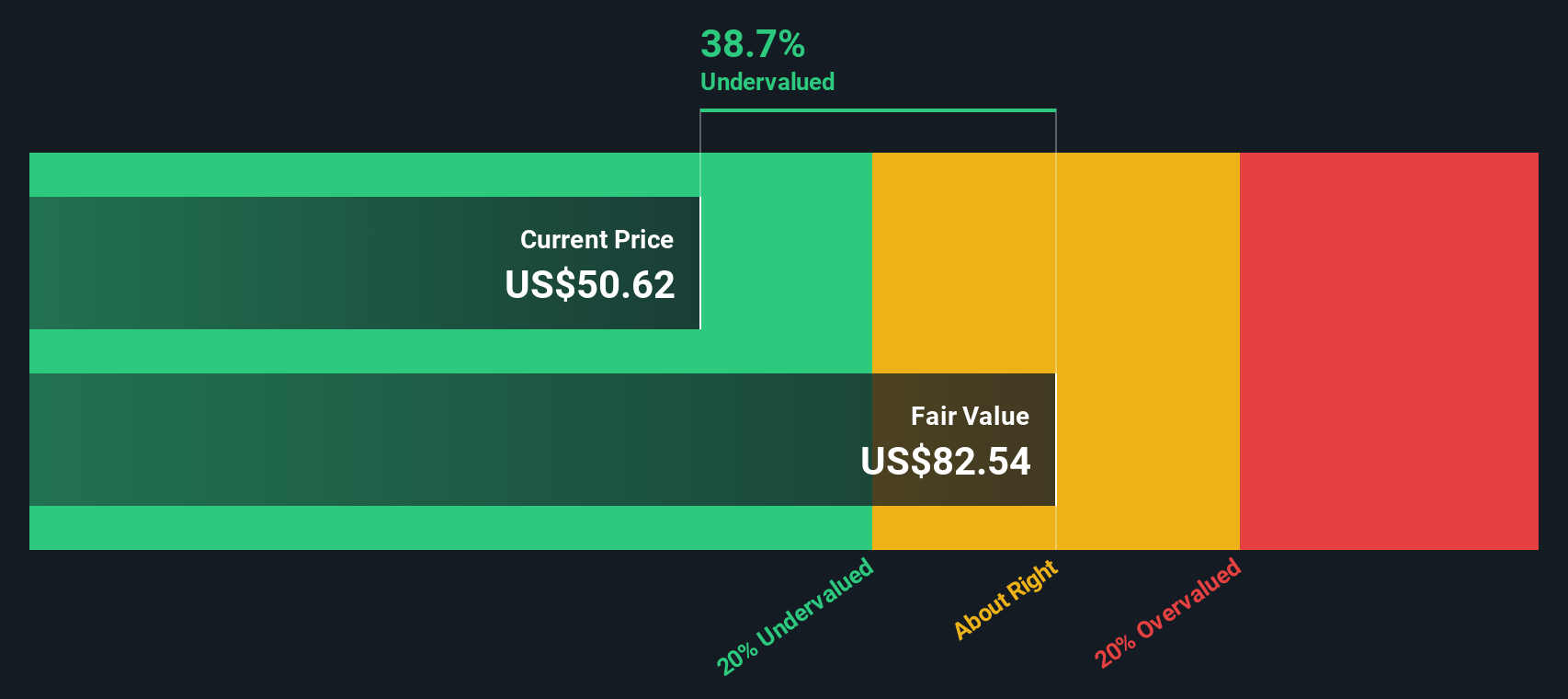

After discounting these projected streams back to present value using a 2 Stage Free Cash Flow to Equity model, the resulting intrinsic value per share comes out to $80.61. With the current share price trading at a 38.8% discount to this estimated fair value, Fortune Brands Innovations looks notably undervalued according to the DCF model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Fortune Brands Innovations is undervalued by 38.8%. Track this in your watchlist or portfolio, or discover 842 more undervalued stocks based on cash flows.

Approach 2: Fortune Brands Innovations Price vs Earnings

For established companies generating consistent profits, the Price-to-Earnings (PE) ratio is a widely used valuation tool. It tells investors how much they are paying for each dollar of earnings the company generates, making it especially useful when a firm's cash flows and profits are stable.

What makes a "fair" PE ratio, however, depends on expectations for the company’s future growth and the risks it faces. Companies growing faster or with fewer risks often justify a higher PE, while slower or riskier businesses are awarded lower multiples by the market.

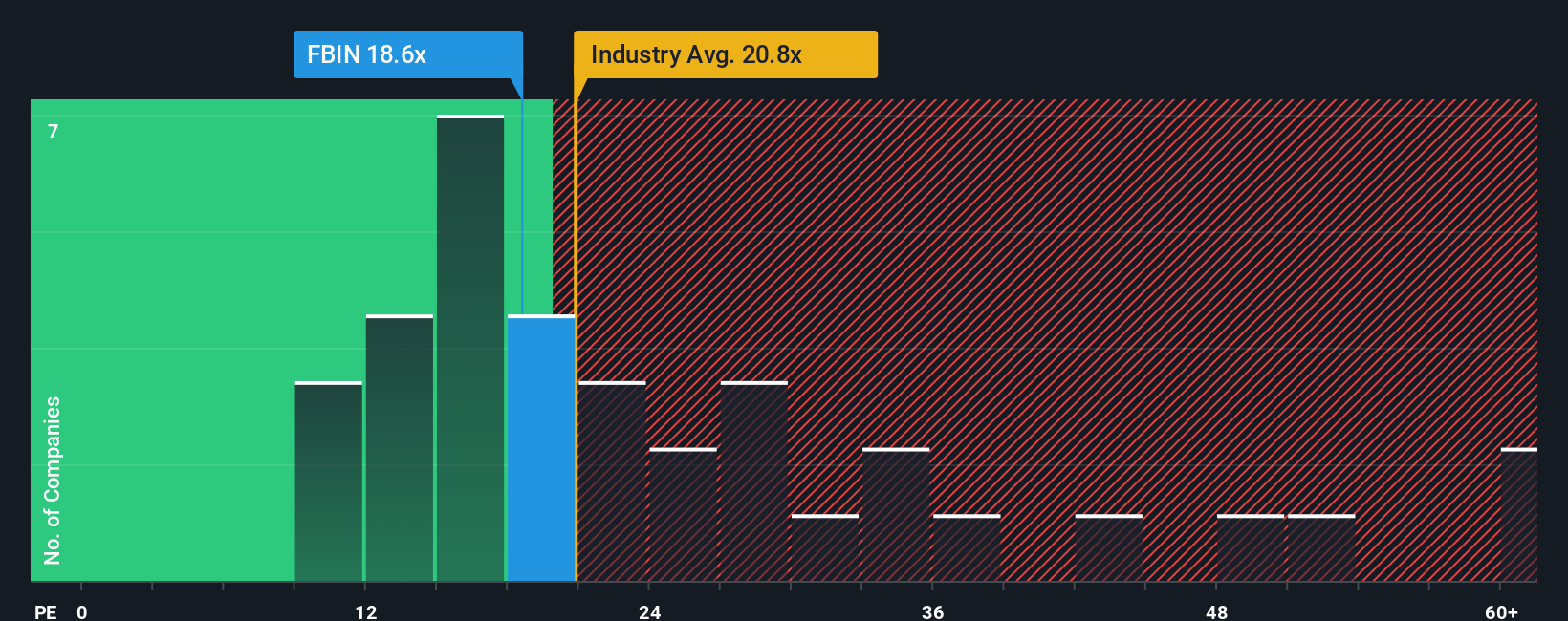

Currently, Fortune Brands Innovations trades on a PE ratio of 18.1x. To put that in context, this is slightly below the Building industry average of 19.5x and well below the average for its closest peers at 26.7x.

Simply Wall St provides its own "Fair Ratio," in this case 32.5x, which incorporates not just industry trends, but also the company’s unique earnings growth prospects, profit margins, market cap and business risks. The Fair Ratio goes further than simple peer or industry comparisons by tailoring the benchmark to Fortune Brands Innovations’ specific circumstances and delivering a more accurate indication of what the multiple should be given all the key factors investors care about.

With the company’s current 18.1x PE significantly lower than its Fair Ratio of 32.5x, the stock appears to be undervalued when taking growth, profitability and risk profile into account.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Fortune Brands Innovations Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, powerful investing tool that allows you to combine your personal view of a company—its story, future prospects, and business risks—with the financial assumptions and forecasts that matter most, such as expected revenue, profit margins, and valuation multiples.

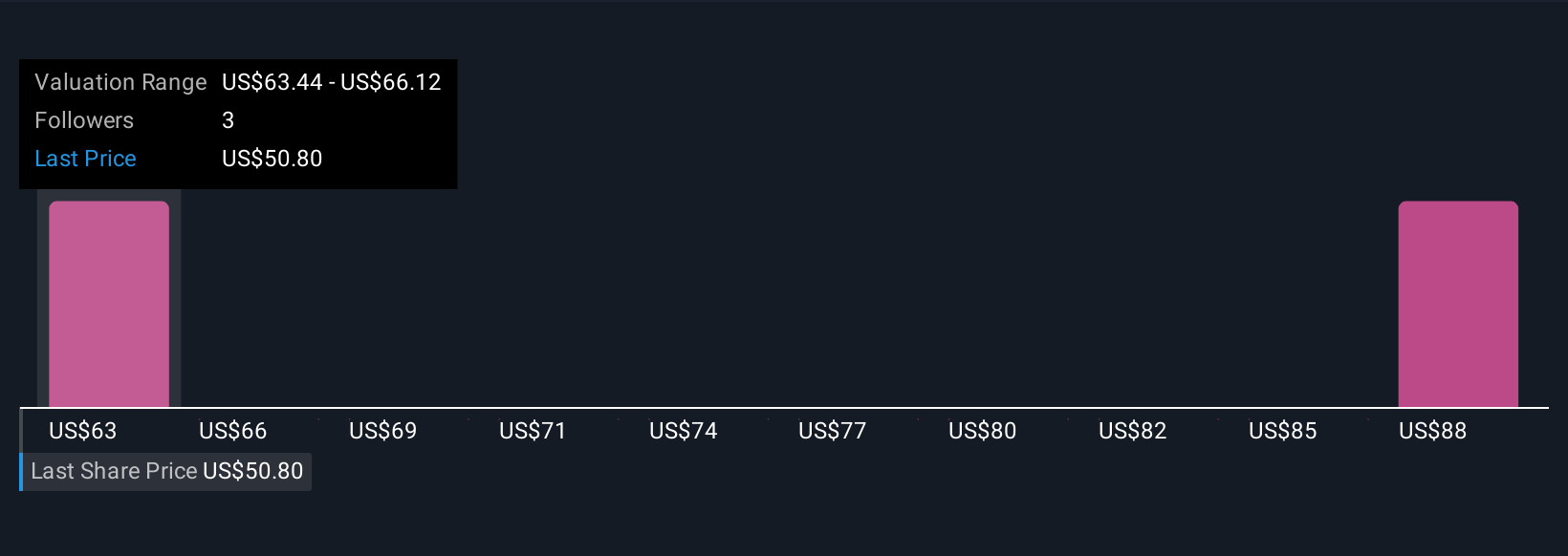

Rather than relying on static numbers or analyst consensus, Narratives connect a company's evolving story directly to what you believe its future could look like. This approach translates assumptions into a custom fair value and decision point. On Simply Wall St’s Community page, millions of investors use Narratives to quickly map out scenarios for companies like Fortune Brands Innovations, compare them to the current share price, and see whether their view signals a buying or selling opportunity.

What makes Narratives especially useful is their dynamic nature; they automatically update when new news, earnings reports, or company updates are published, so your thesis stays relevant. For example, some investors see Fortune Brands Innovations supported by digital innovation and margin expansion, projecting robust growth and a fair value as high as $83. Others focus on risks from housing market softness and tighter profit expectations, setting their fair value closer to $51. Narratives let you personalize your perspective, sense-check analyst outlooks, and make decisions with clarity and confidence.

Do you think there's more to the story for Fortune Brands Innovations? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FBIN

Fortune Brands Innovations

Engages in the provision of home and security products for residential home repair, remodeling, new construction, and security applications in the United States and internationally.

Very undervalued with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives