- United States

- /

- Building

- /

- NYSE:FBIN

Fortune Brands’ Early Headquarters Expansion Might Change The Case For Investing In FBIN

Reviewed by Sasha Jovanovic

- In late September 2025, Fortune Brands Innovations, Inc. welcomed over 500 associates, including more than 400 new hires, to its newly opened Deerfield, Illinois headquarters, two years ahead of its regional job growth target, marking a significant expansion of its workforce and physical footprint.

- This move underscores the company’s commitment to fostering innovation and collaboration through investment in modern facilities and amenities designed to attract and retain top talent.

- We'll examine how this major headquarters and hiring expansion could influence Fortune Brands' future growth and operational momentum.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Fortune Brands Innovations Investment Narrative Recap

To be a shareholder in Fortune Brands Innovations, you need to believe in the company's ability to translate its ambitious expansion and investment in innovation into meaningful operational momentum, particularly in a slow housing market. The recent early completion of its hiring goal accelerates Fortune Brands' transformation initiatives, but given ongoing challenges in U.S. housing and modest near-term sales expectations, this expansion is not expected to substantially shift the key short-term catalyst: a sustained recovery in renovation demand; nor does it eliminate the ongoing risk from regional housing weakness.

Among recent company updates, the declaration of a regular $0.25 per share quarterly dividend stands out as most relevant, reaffirming Fortune Brands’ ongoing focus on shareholder returns in parallel with growth investments. This consistent payout may be viewed as a signal of management’s confidence, but it comes as profit margins and core business conditions remain under pressure. Contrasting the company's investment in talent and facilities, investors should be aware that risks tied to soft housing activity have not disappeared...

Read the full narrative on Fortune Brands Innovations (it's free!)

Fortune Brands Innovations is projected to reach $5.2 billion in revenue and $606.0 million in earnings by 2028. This outlook requires annual revenue growth of 4.9% and an earnings increase of $212.7 million from the current $393.3 million.

Uncover how Fortune Brands Innovations' forecasts yield a $66.94 fair value, a 29% upside to its current price.

Exploring Other Perspectives

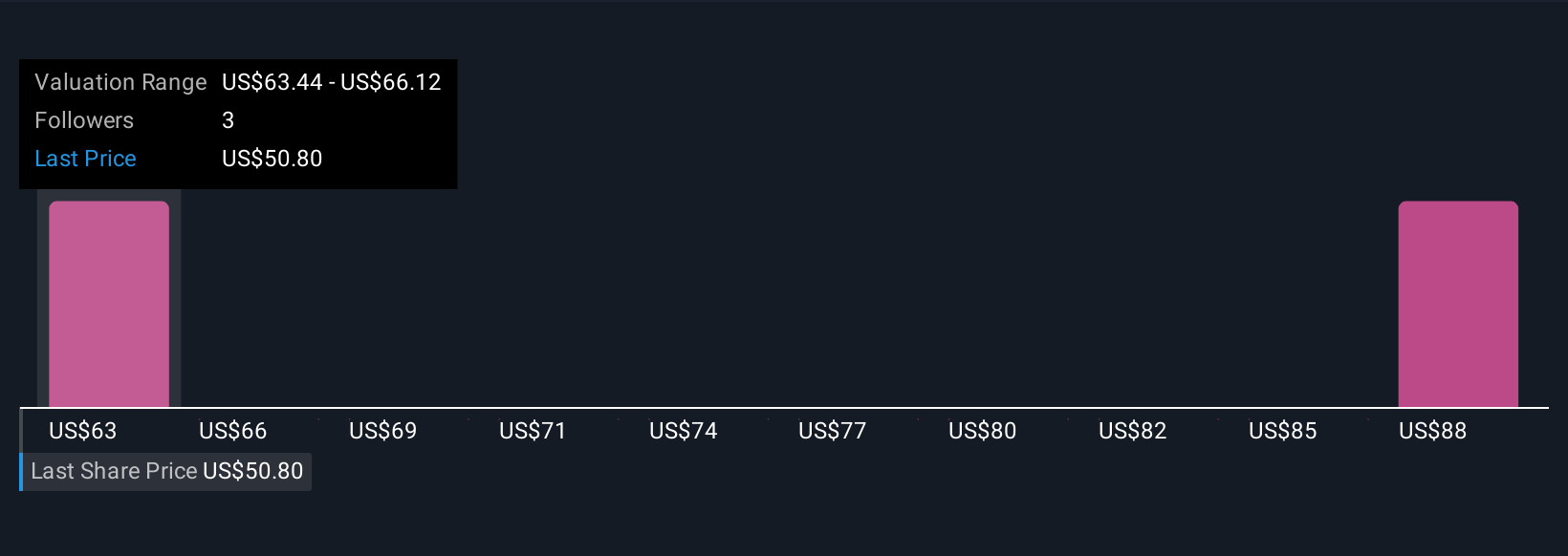

Simply Wall St Community members provided 4 fair value estimates for Fortune Brands Innovations, ranging from US$52.48 to US$87.14. While opinions vary greatly, much depends on whether broader renovation demand can overcome the company’s exposure to ongoing housing market risks.

Explore 4 other fair value estimates on Fortune Brands Innovations - why the stock might be worth as much as 68% more than the current price!

Build Your Own Fortune Brands Innovations Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fortune Brands Innovations research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Fortune Brands Innovations research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fortune Brands Innovations' overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FBIN

Fortune Brands Innovations

Engages in the provision of home and security products for residential home repair, remodeling, new construction, and security applications in the United States and internationally.

Very undervalued with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives