- United States

- /

- Building

- /

- NYSE:FBIN

Does the Recent 15.5% Surge Signal Real Value in Fortune Brands Innovations?

Reviewed by Bailey Pemberton

- Curious whether Fortune Brands Innovations is trading at a bargain or potentially overpriced? You are in the right place for a clear-eyed look at what the numbers say about its true value.

- Despite a challenging backdrop, the stock bounced back with an impressive 15.5% gain over the last week, even though it is still down 32.7% compared to this time last year.

- Market sentiment lately has shifted on renewed attention to innovation in home and security solutions, a space Fortune Brands is known for. Headlines have highlighted their focus on strategic growth and portfolio streamlining, fueling speculation around what is driving these price moves.

- Fortune Brands Innovations currently notches a valuation score of 5 out of 6 across our key value checks, which is a strong showing compared to many peers. Let’s dig into what this score really means by exploring popular valuation methods. Plus, stick around for an even smarter way to assess value at the end of the article.

Approach 1: Fortune Brands Innovations Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future cash flows and discounting them back to today's value. This reflects what those future dollars are worth now, given the risks and time involved.

For Fortune Brands Innovations, the model uses a 2 Stage Free Cash Flow to Equity approach. The company generated $344.08 Million in Free Cash Flow (FCF) over the last twelve months. Analysts anticipate this will steadily grow, reaching $612.47 Million by the end of 2027. Longer-term, Simply Wall St extrapolates this growth rate, with projections putting FCF at $803.15 Million by 2035.

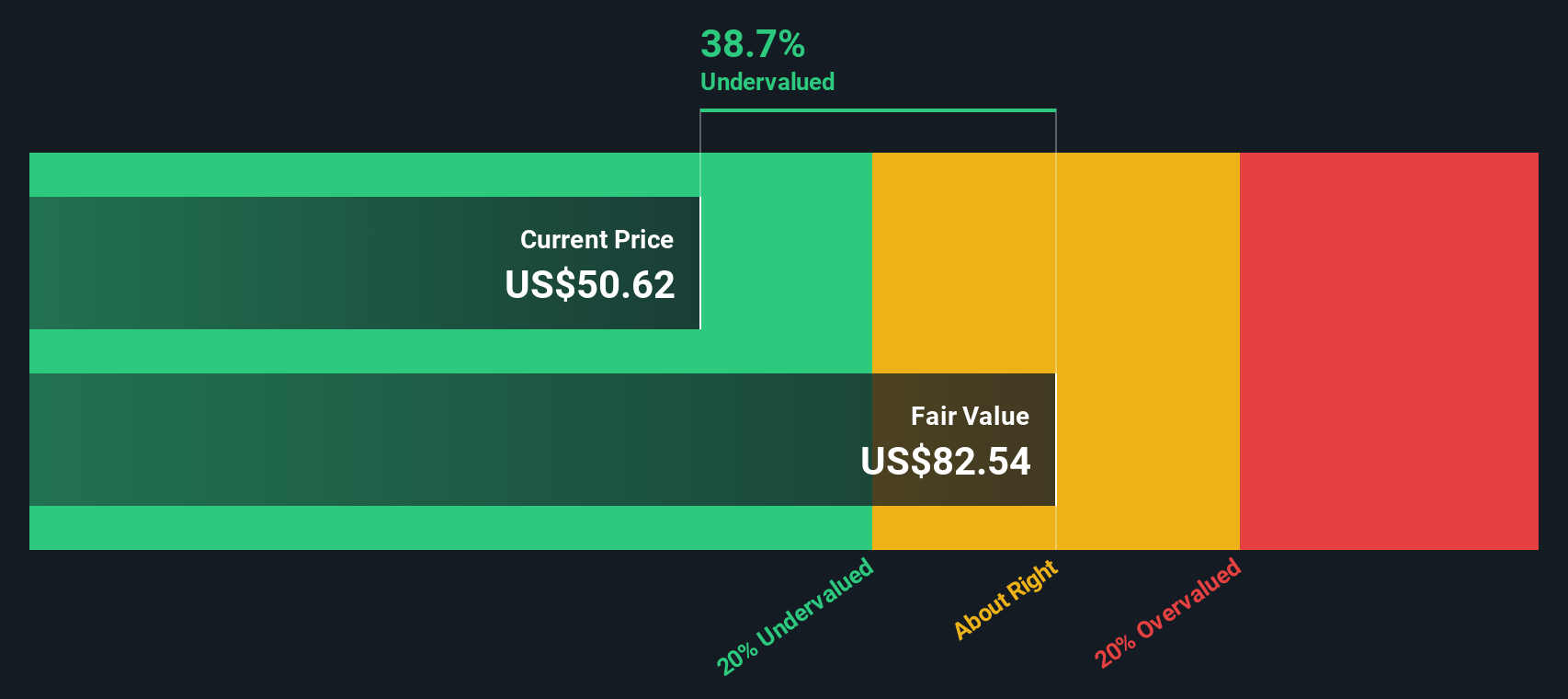

Taking all these cash flows into account, the DCF model computes an estimated intrinsic value of $79.28 per share. Compared to the current stock price, this suggests the shares are trading at a 35.0% discount. This could indicate the market may be underestimating the company’s future cash-generating power.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Fortune Brands Innovations is undervalued by 35.0%. Track this in your watchlist or portfolio, or discover 928 more undervalued stocks based on cash flows.

Approach 2: Fortune Brands Innovations Price vs Earnings (PE)

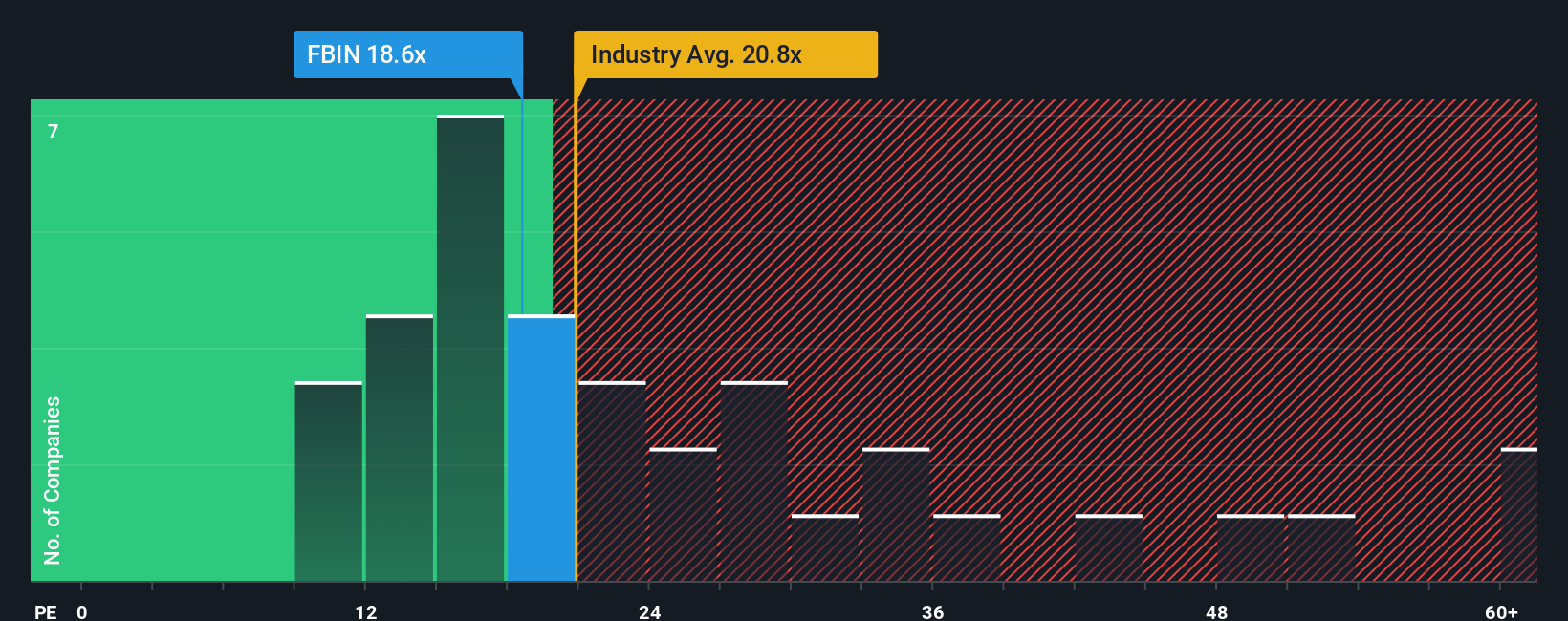

For profitable companies like Fortune Brands Innovations, the Price-to-Earnings (PE) ratio is one of the most widely used valuation metrics. The PE ratio tells investors how much they are paying for each dollar of a company’s earnings, making it a convenient way to compare profitability and expectations across businesses.

Growth expectations and risk play a key role in deciding what a “normal” or “fair” PE should look like. Typically, companies growing quickly or with lower risk can command higher PE ratios. In contrast, slower-growing or riskier companies tend to trade at lower multiples.

Right now, Fortune Brands Innovations trades at a PE of 18.9x. This is almost exactly in line with the Building industry average of 18.9x and sits well below the peer average of 30.5x. On the surface, this suggests the market might be taking a cautious but fair stance on the company’s prospects.

Simply Wall St goes further by calculating a proprietary “Fair Ratio” for each stock. The Fair Ratio is not just a simple industry comparison; it also considers critical factors such as Fortune Brands' earnings growth, profit margins, market cap, industry dynamics, and risk profile. This approach aims to reflect a more holistic judgement of what the market should pay for the company right now, rather than relying solely on market averages that may not capture its unique situation.

For Fortune Brands Innovations, the Fair Ratio comes in at 32.8x, which is significantly above the current PE of 18.9x. This indicates that, accounting for the business’s fundamentals and outlook, the shares are potentially undervalued relative to what would be justified given its growth and risk profile.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Fortune Brands Innovations Narrative

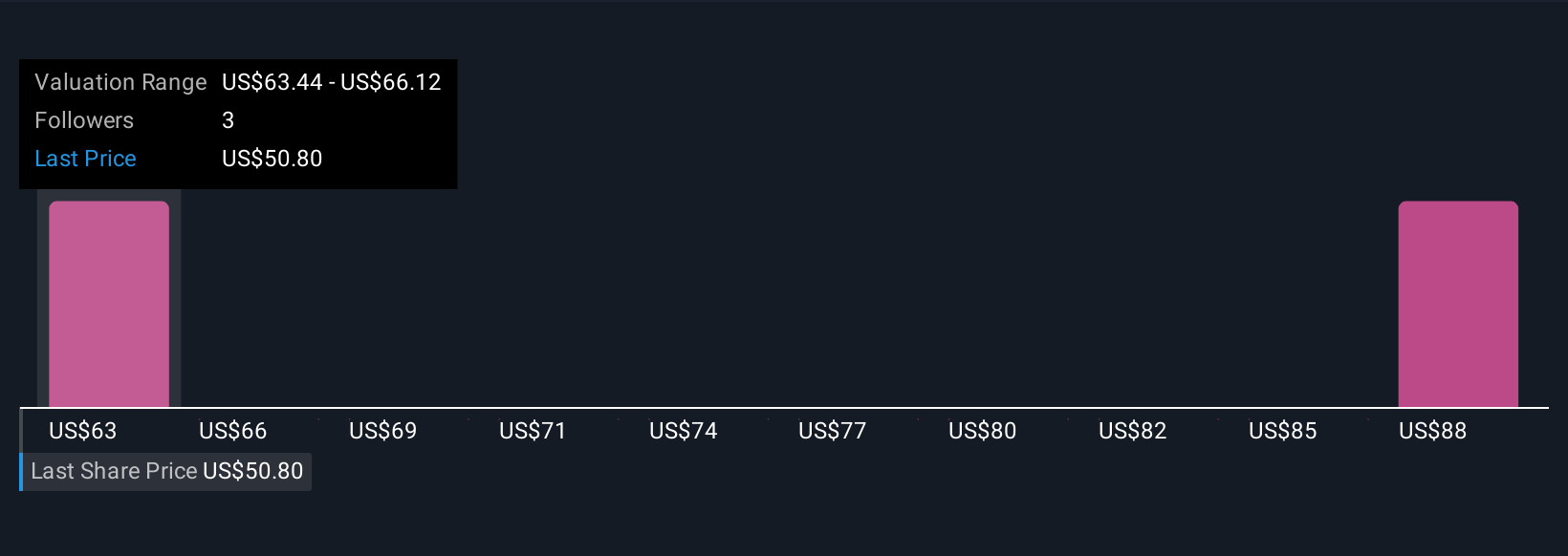

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are an innovative investment tool where you connect your story or perspective on a company, such as your views on its potential, risks, and market opportunities, to real financial forecasts and an estimated fair value.

A Narrative ties together what you believe about a business, your estimates of future revenue, earnings, and margins, and then calculates what the company could truly be worth. This approach goes beyond the numbers, letting each investor factor in their unique expectations and insights.

On Simply Wall St's platform, Narratives are easily accessible within the Community page, where millions of investors are already sharing and comparing perspectives. Narratives also update dynamically as new information like news or earnings releases become available, ensuring your view remains relevant and up to date.

By comparing each Narrative’s Fair Value with the current market price, investors can make smarter decisions on whether to buy or sell. For example, some investors currently see Fortune Brands Innovations as worth up to $83.00 per share if tech adoption accelerates and margins expand, while others believe the value could be as low as $51.00 if housing slows and costs rise. This demonstrates how Narratives reflect both optimism and caution, depending on your outlook.

Do you think there's more to the story for Fortune Brands Innovations? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FBIN

Fortune Brands Innovations

Engages in the provision of home and security products for residential home repair, remodeling, new construction, and security applications in the United States and internationally.

Undervalued with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success