- United States

- /

- Aerospace & Defense

- /

- NYSE:EVEX

Eve Holding (NYSE:EVEX): Assessing Valuation After Entry to the S&P Global BMI Index

Reviewed by Kshitija Bhandaru

If you own shares of Eve Holding (NYSE:EVEX), the recent addition of the company to the S&P Global BMI Index is worth paying attention to. Index inclusions often draw new interest as funds that track these benchmarks adjust their portfolios, bringing heightened trading volume and potentially greater liquidity for the stock. For current or potential investors, this event may be more than just procedural. It could influence how the market values Eve Holding going forward.

Looking at the bigger picture, Eve Holding’s one-year return stands at nearly 30%, which outpaces many peers. However, a year-to-date loss of 25% serves as a reminder that momentum has swung back and forth throughout 2024. Over the past three months, the share price has dipped by 27%, reversing earlier gains. These moves frame the company’s entry to the S&P Global BMI, and with other factors like revenue growth providing some backdrop, it is clear that the market is having an ongoing debate over Eve Holding’s future growth drivers.

With the index inclusion behind us and recent price swings still fresh, the question is whether the market is offering a chance to buy Eve Holding before the next growth phase or if everything is already reflected in its current valuation.

Price-to-Book of 103.7x: Is it justified?

On valuation, Eve Holding is trading at a price-to-book ratio of 103.7 times. This is significantly higher than both the US Aerospace & Defense industry average of 3.3 times and the peer average of 4.1 times. This suggests the market is applying a substantial premium to the company’s book value, raising questions about what justifies such a high figure.

The price-to-book ratio compares a company’s share price to the value of its net assets. In capital-intensive sectors like aerospace, it is a widely used metric to gauge whether a stock is undervalued or overvalued relative to its tangible assets. For an early-stage company such as Eve Holding, which has ambitious growth plans but little current revenue, a high ratio can indicate investor optimism about future expansion or, conversely, it may reflect speculative excess.

Given Eve Holding’s lack of profitability and minimal revenue, the premium implied by its price-to-book multiple appears difficult to justify based on fundamentals alone. Unless future business milestones are met or growth vastly outpaces industry norms, investors may eventually question the sustainability of this valuation.

Result: Fair Value of $4.00 (OVERVALUED)

See our latest analysis for Eve Holding.However, risks remain because Eve Holding’s lack of current revenue and ongoing net losses could spark renewed skepticism if future growth fails to materialize.

Find out about the key risks to this Eve Holding narrative.Another View: What Does the SWS DCF Model Say?

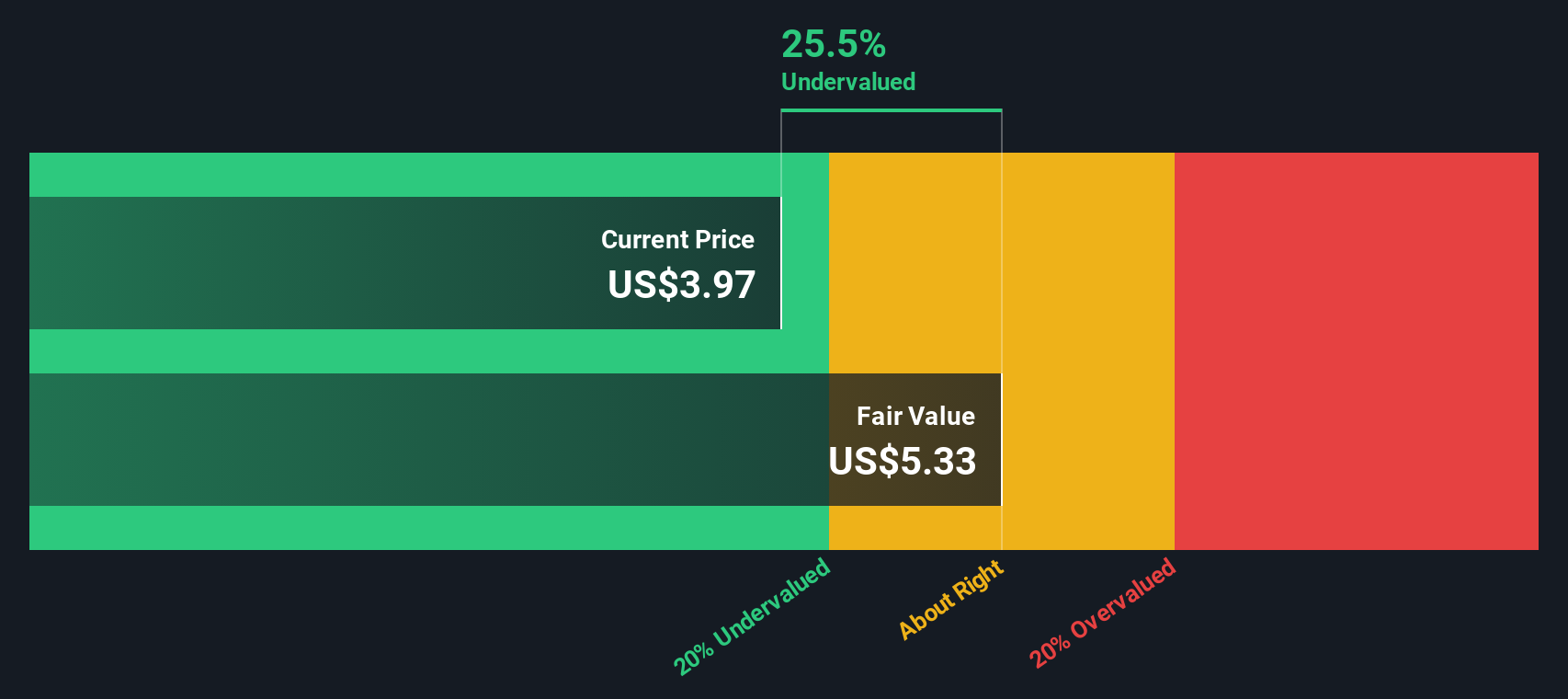

Looking beyond multiples, the SWS DCF model presents a different perspective for Eve Holding and suggests the shares may actually be trading below their estimated fair value. Could this method be identifying potential that others are missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Eve Holding Narrative

If you have a different viewpoint or want to see the data firsthand, you can craft your own analysis in just a few minutes. Do it your way

A great starting point for your Eve Holding research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why limit your options? The best opportunities often appear where you least expect them. Power up your next move with these exciting handpicked stock ideas below.

- Capitalize on the artificial intelligence boom and see which innovative companies are shaking up the sector through our AI penny stocks.

- Grow your portfolio’s income potential by checking out established businesses with lucrative cash payouts using our dividend stocks with yields > 3%.

- Find tomorrow’s bargains before the crowd does by targeting stocks trading below intrinsic value via our undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eve Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EVEX

Excellent balance sheet with slight risk.

Market Insights

Community Narratives