- United States

- /

- Machinery

- /

- NYSE:ESE

How New 2026 Sales Growth Guidance at ESCO Technologies (ESE) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- ESCO Technologies Inc. recently reported fourth quarter earnings, posting US$352.67 million in sales and US$218.65 million in net income, alongside new fiscal year 2026 guidance projecting consolidated net sales growth of 16% to 20% to approximately US$1.27 billion to US$1.31 billion.

- This outlook includes particularly strong anticipated growth in the Aerospace & Defense segment, supported by both organic expansion and Maritime revenue contributions, positioning the company for multi-segment progress in 2026.

- To assess the impact of this new guidance, we'll examine how the projected Aerospace & Defense growth shapes ESCO Technologies' investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

ESCO Technologies Investment Narrative Recap

To be a shareholder in ESCO Technologies, you need to believe in its ability to drive sustained growth across its multi-segment business, led by strength in Aerospace & Defense and supported by successful acquisition integration. The company’s new 2026 guidance elevates near-term expectations, but the largest catalyst remains the ramp in Aerospace & Defense, while the principal risk continues to be execution on the Maritime integration, which could influence net margins if synergies are delayed. The impact of this updated guidance appears material, affirming management’s confidence but adding visibility to both the catalyst and the risk at play.

Among recent announcements, the confirmation of 2026 sales growth projections, driven by 33% to 38% expected growth in Aerospace & Defense and substantial Maritime revenue, directly supports the near-term catalyst presented by the segment’s expansion. This guidance provides investment clarity but brings greater focus to the company’s capacity to manage added operational complexity while delivering on integration commitments.

However, investors should be aware that despite elevated topline projections, the ongoing challenge with Maritime integration and associated cost risks remains unresolved...

Read the full narrative on ESCO Technologies (it's free!)

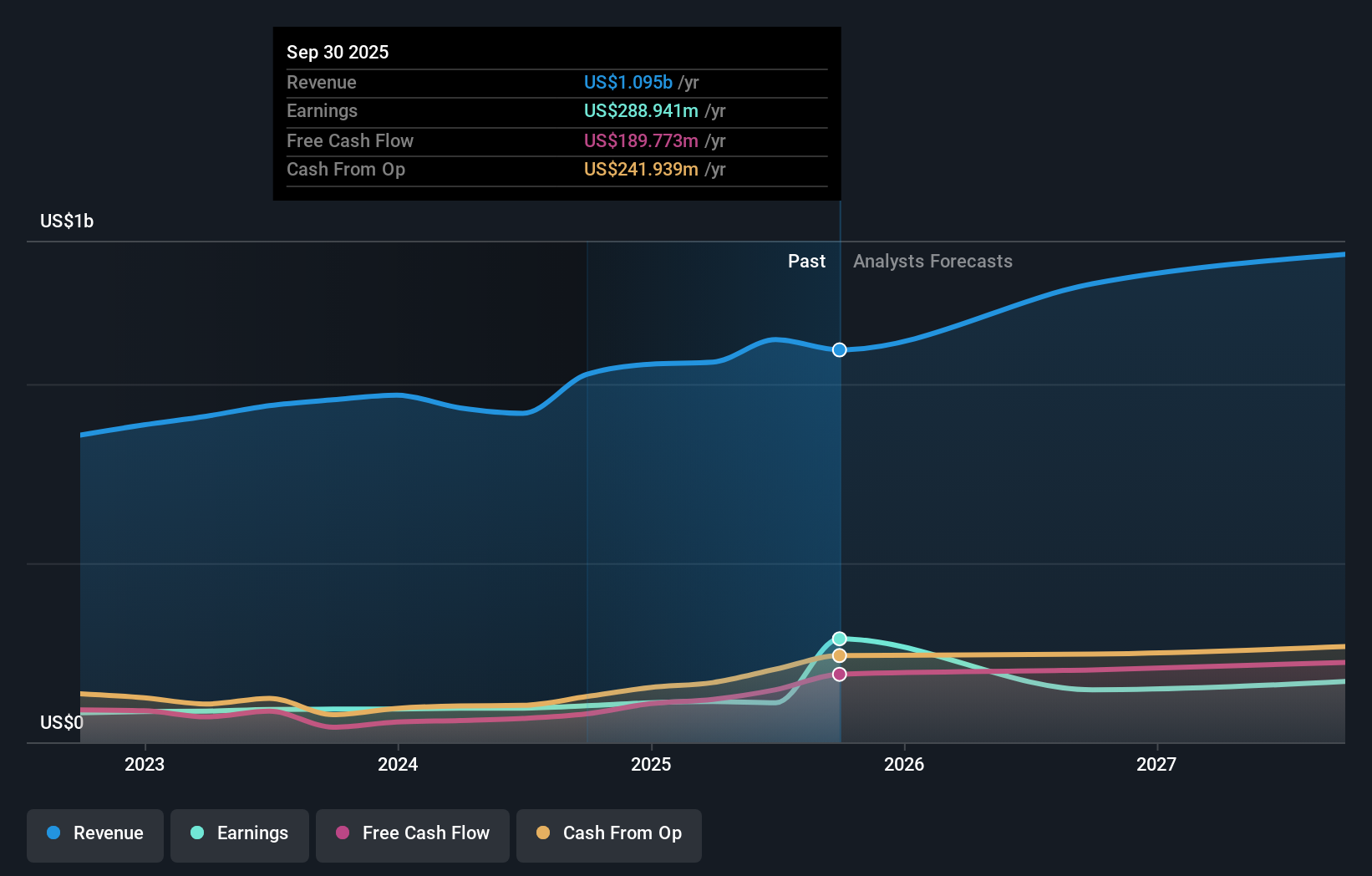

ESCO Technologies' outlook anticipates $1.5 billion in revenue and $199.7 million in earnings by 2028. This scenario assumes annual revenue growth of 10.7% and an $89.7 million increase in earnings from the current $110.0 million.

Uncover how ESCO Technologies' forecasts yield a $255.00 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members put ESCO Technologies’ fair value between US$168.83 and US$255, based on three separate projections. With Aerospace & Defense accounting for the majority of guidance upgrades, this wide range shows how much opinions can differ on what will drive future performance.

Explore 3 other fair value estimates on ESCO Technologies - why the stock might be worth as much as 20% more than the current price!

Build Your Own ESCO Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ESCO Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ESCO Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ESCO Technologies' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ESCO Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESE

ESCO Technologies

Provides engineered filtration and fluid control products, and integrated propulsion systems.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.