- United States

- /

- Machinery

- /

- NYSE:ESAB

ESAB (NYSE:ESAB) Valuation: Is There More Upside After Recent Share Price Stability?

Reviewed by Kshitija Bhandaru

ESAB (NYSE:ESAB) shares saw a mild uptick in trading today, sparking interest among investors curious about what might be driving the stock's movement. The company has a steady track record, but today's activity is notable.

See our latest analysis for ESAB.

While ESAB's share price was fairly stable today, momentum has cooled compared to earlier in the year. Still, investors who held over the past twelve months enjoyed a 10.9% 1-year total shareholder return, reflecting the company’s resilience even as short-term sentiment fades.

If you’re curious to see which other fast-growing companies could be catching momentum, now is a perfect moment to broaden your radar and discover fast growing stocks with high insider ownership

But does ESAB’s current share price reflect its true value, or could there be untapped potential for further gains? Investors now face a key question: Is this a buying opportunity, or is future growth already priced in?

Most Popular Narrative: 16.8% Undervalued

Compared to ESAB’s last close price of $112.52, the most followed narrative estimates fair value at $135.3, signaling a notable gap between current market sentiment and analyst projections.

ESAB is positioned to benefit from rising global infrastructure investment and energy project activity, particularly in high-growth markets like Asia-Pacific and the Middle East. Recent wins and acquisitions in these regions are supporting robust volume growth and higher EBITDA margins, indicating stronger future revenue and earnings potential as these long-term demand drivers persist.

Want to know what power moves and bold international strategies are shaping this valuation? This narrative’s secret sauce involves ambitious growth hurdles and margin improvements that set a high bar for price projections. The key metrics behind this fair value may surprise you. See why optimists are so confident in ESAB’s next chapter.

Result: Fair Value of $135.3 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent trade tensions and cyclical downturns in industrial demand could challenge ESAB’s growth. These factors could potentially dampen its path to higher valuations.

Find out about the key risks to this ESAB narrative.

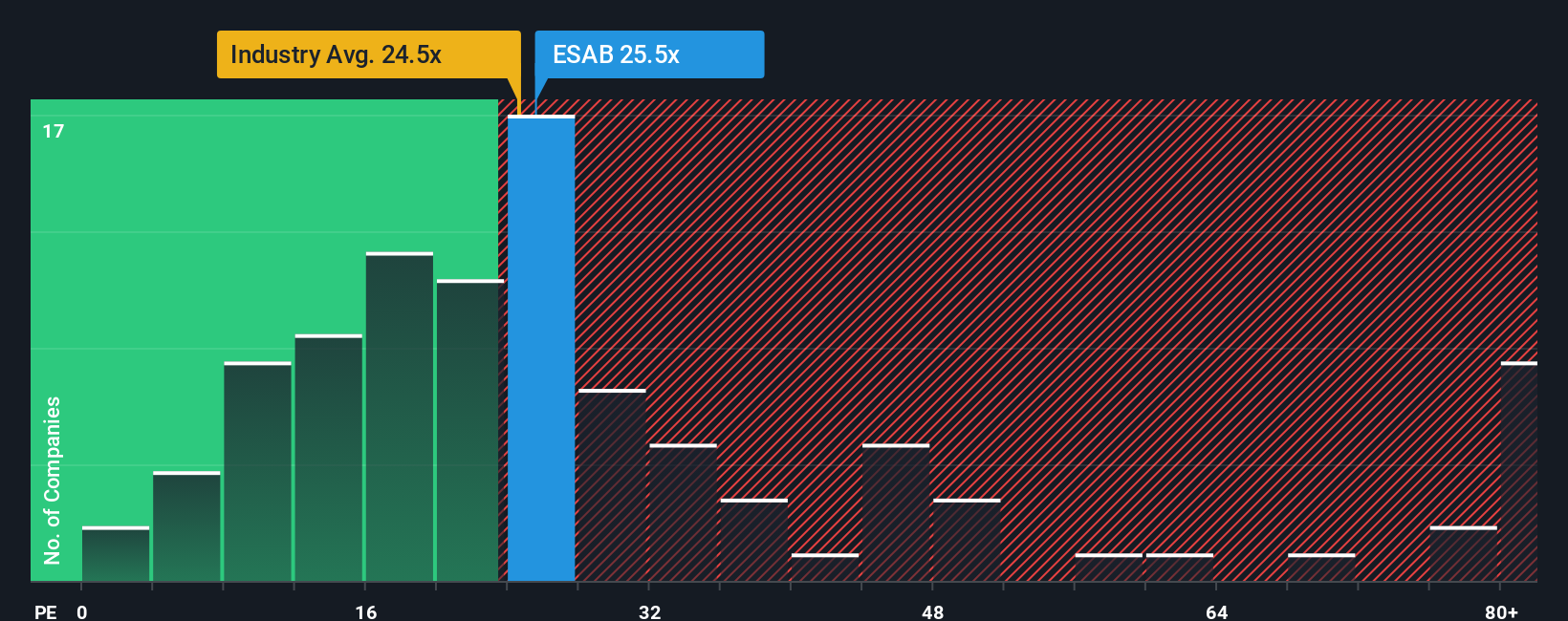

Another View: Multiples Tell a Different Story

While the analyst consensus points to ESAB being undervalued, a look at its price-to-earnings ratio presents a less optimistic picture. ESAB trades at 24.4x earnings, making it pricier than both the US Machinery industry average (24.1x) and its peer group (22.5x). This means investors are paying more than average for the company’s expected growth, raising the bar for future performance.

Compared with its fair ratio of 25x, however, there may still be some room for upward movement if the market shifts toward that multiple. Which lens will prove more accurate: the hopeful growth forecasts or the blunt reality of current market pricing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ESAB Narrative

If you think there’s more to ESAB’s story, or you prefer to dig into the numbers yourself, it takes just a few minutes to craft your own perspective with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding ESAB.

Looking for More Investment Ideas?

Smart investors set themselves apart by staying ahead of major trends. Right now, there are remarkable opportunities beyond ESAB that you won’t want to miss out on.

- Earn reliable income and boost your portfolio by seizing opportunities among these 19 dividend stocks with yields > 3% offering attractive yields above 3%.

- Tap into market-transforming breakthroughs by targeting these 24 AI penny stocks that are harnessing artificial intelligence for explosive growth.

- Get ahead of the curve with these 78 cryptocurrency and blockchain stocks, which is driving innovation in blockchain, digital assets, and next-generation finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ESAB might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESAB

ESAB

Engages in the formulation, development, manufacture, and supply of consumable products and equipment for use in cutting, joining, automated welding, and gas control equipment.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives