- United States

- /

- Machinery

- /

- NYSE:ESAB

ESAB (NYSE:ESAB): Assessing Valuation Following $1.4 Billion Credit Refinancing and Recent Analyst Optimism

Reviewed by Kshitija Bhandaru

ESAB (NYSE:ESAB) just announced it has refinanced its credit facilities, securing a $350 million term loan along with a $1.05 billion revolving credit facility. Both arrangements are designed to support ongoing corporate and working capital needs.

See our latest analysis for ESAB.

ESAB’s shares have shown renewed momentum lately, with a 5% gain over the past week and an 11% share price return in the past month. While the total shareholder return over the past year sits at just over 7%, the company’s three-year total return stands out at more than 240%. This suggests that longer-term investors continue to be rewarded despite some recent volatility. The recent refinancing news and strong analyst optimism appear to be building confidence among investors that ESAB can keep delivering on growth and stability.

If you’re curious about what other companies are gaining traction right now, consider expanding your search and discover fast growing stocks with high insider ownership

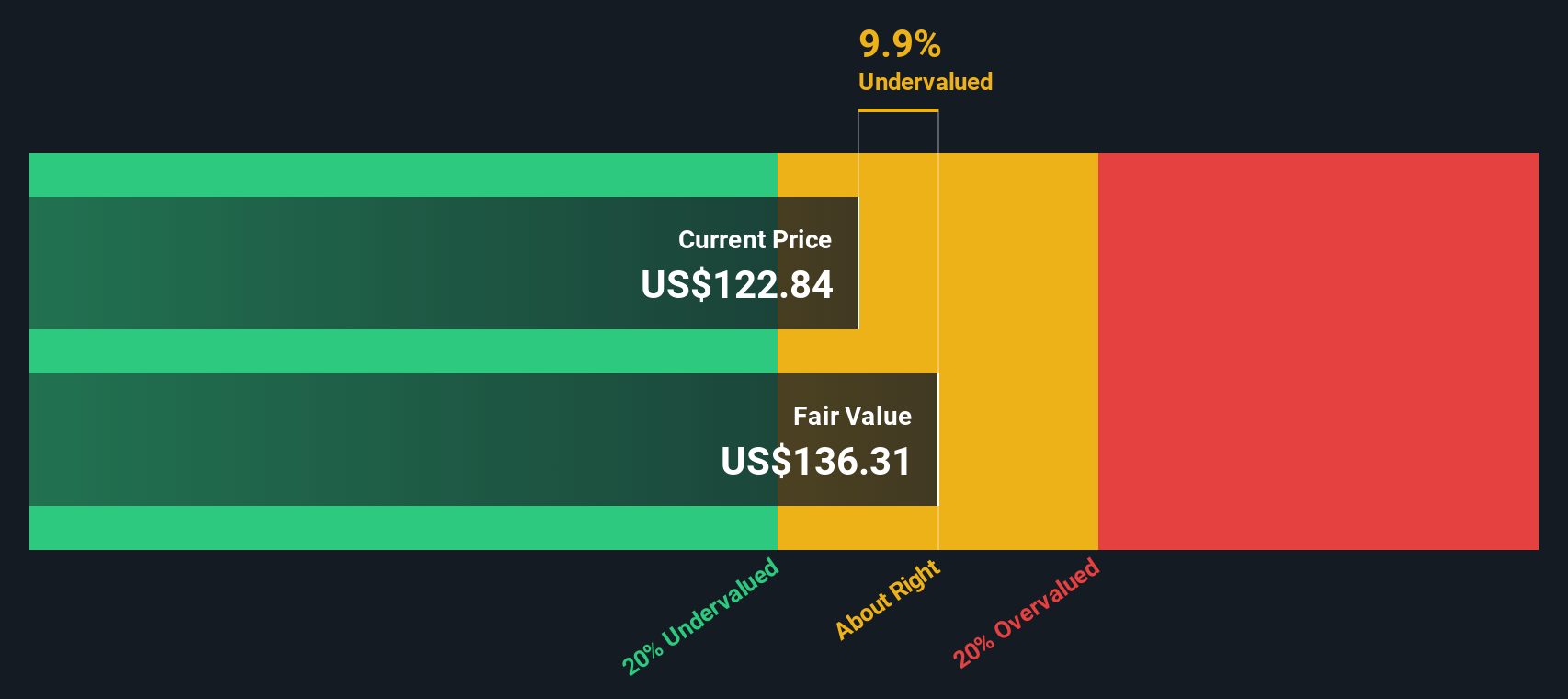

With ESAB’s stock approaching new highs and analysts projecting further upside, investors now face a pivotal question: Is there untapped value left to capture, or is the market already factoring in the company’s next wave of growth?

Most Popular Narrative: 11.8% Undervalued

With ESAB’s fair value pegged at $138.10 by the most widely tracked narrative, the current close of $121.87 suggests plenty of optimism remains about the path ahead. Market watchers are eyeing not just cyclical recovery, but also the company's focused push into faster-growing regions.

ESAB is positioned to benefit from rising global infrastructure investment and energy project activity, particularly in high-growth markets like Asia-Pacific and the Middle East. Recent wins and acquisitions in these regions are supporting robust volume growth and higher EBITDA margins, indicating stronger future revenue and earnings potential as these long-term demand drivers persist.

Want to know the numbers driving this narrative’s bullish tilt? The foundation is a projected multi-year transformation that brings margin growth and revenue expansion together. Intrigued which growth levers are expected to stay strong as competitors struggle? The full narrative unpacks the bold projections that could rewrite ESAB’s trajectory.

Result: Fair Value of $138.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing tariff uncertainties in the Americas and exposure to volatile emerging markets could quickly put ESAB’s bullish growth story to the test.

Find out about the key risks to this ESAB narrative.

Another View: Taking the Market’s Temperature

While some believe ESAB is undervalued, our DCF model takes a different angle. It still sees ESAB trading below fair value at $135.97, but the margin is tighter. Does this add conviction to the bullish case, or introduce more questions about growth expectations?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own ESAB Narrative

If you see things differently or want to dig deeper into the numbers, crafting your own narrative takes less than three minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding ESAB.

Looking for more investment ideas?

Don’t let opportunity pass you by. Expand your reach and power up your portfolio with carefully selected stocks using the Simply Wall Street Screener.

- Amplify your yield potential by targeting companies paying attractive returns within these 18 dividend stocks with yields > 3%.

- Uncover hidden value and get ahead of market moves with these 877 undervalued stocks based on cash flows focused on stocks trading below their intrinsic worth.

- Seize new frontiers in technology by checking out these 26 quantum computing stocks at the cutting edge of quantum computing innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ESAB might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESAB

ESAB

Engages in the formulation, development, manufacture, and supply of consumable products and equipment for use in cutting, joining, automated welding, and gas control equipment.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives