- United States

- /

- Electrical

- /

- NYSE:ENS

Is the EnerSys Stock Rally Justified After Battery Innovation Headlines?

Reviewed by Bailey Pemberton

- Ever wondered if EnerSys stock could be a hidden gem or if the current price leaves little value on the table? Here is a breakdown of where it stands and what savvy investors should know before making any moves.

- The stock has been on a roll lately, climbing 3.4% in the past week and notching a 14.4% gain over the last month. A year-to-date surge of 55.1% has captured the attention of growth watchers.

- News surrounding EnerSys has been filled with industry developments and innovation updates, which have helped fuel recent optimism. Headlines about battery technology advancements and expanding partnerships have prompted investors to reconsider what is possible for the company’s future trajectory.

- When it comes to value, EnerSys lands a 3 out of 6 on our valuation checks, suggesting there is more to the story than meets the eye. We will walk through how those numbers come together and look at why there may be a broader way to think about a stock’s fair value beyond just the usual metrics.

Approach 1: EnerSys Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates EnerSys's future cash flows over time and discounts them back to today’s dollars, providing investors with an indication of the company’s intrinsic value based on realistic expectations of its future performance.

For EnerSys, the current Free Cash Flow is $329.7 million, measured over the last twelve months. Analysts estimate the company’s annual Free Cash Flow will be $261.9 million by March 2027, with projections extending further and the model forecasting approximately $140.8 million in annual Free Cash Flow by 2035. Estimates beyond five years are projections based on logical trends, as most analysts provide forecasts only up to five years out.

Using these cash flows, the DCF model calculates an intrinsic value per share of $58.23. Currently, the stock trades well above this estimate, making it about 145.3% overvalued based on this approach. This significant premium may indicate that the market is factoring in strong future growth or other favorable developments that may not be reflected in conservative cash flow projections.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests EnerSys may be overvalued by 145.3%. Discover 922 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: EnerSys Price vs Earnings

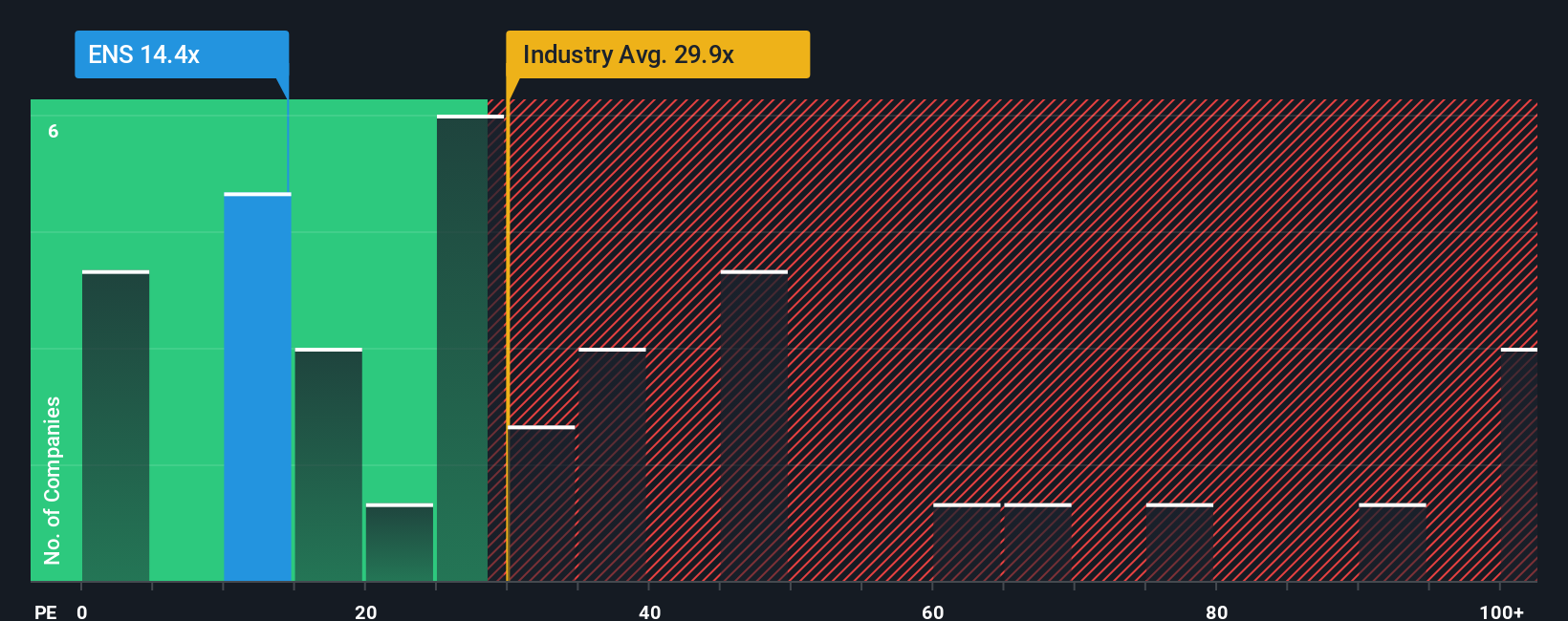

The Price-to-Earnings (PE) ratio is an essential metric for valuing profitable companies like EnerSys because it connects what investors are willing to pay for a company's earnings. A reasonable or "fair" PE ratio is shaped by expectations around growth and risk, with higher expected growth or lower risk often justifying a higher multiple.

Currently, EnerSys trades at a PE ratio of 15.6x. When compared to the electrical industry average of 30.8x and the average of similar peers at 35.5x, EnerSys appears to be priced more conservatively, suggesting lower market expectations or potentially lower risk. However, these benchmarks may not always capture the nuances of each individual company.

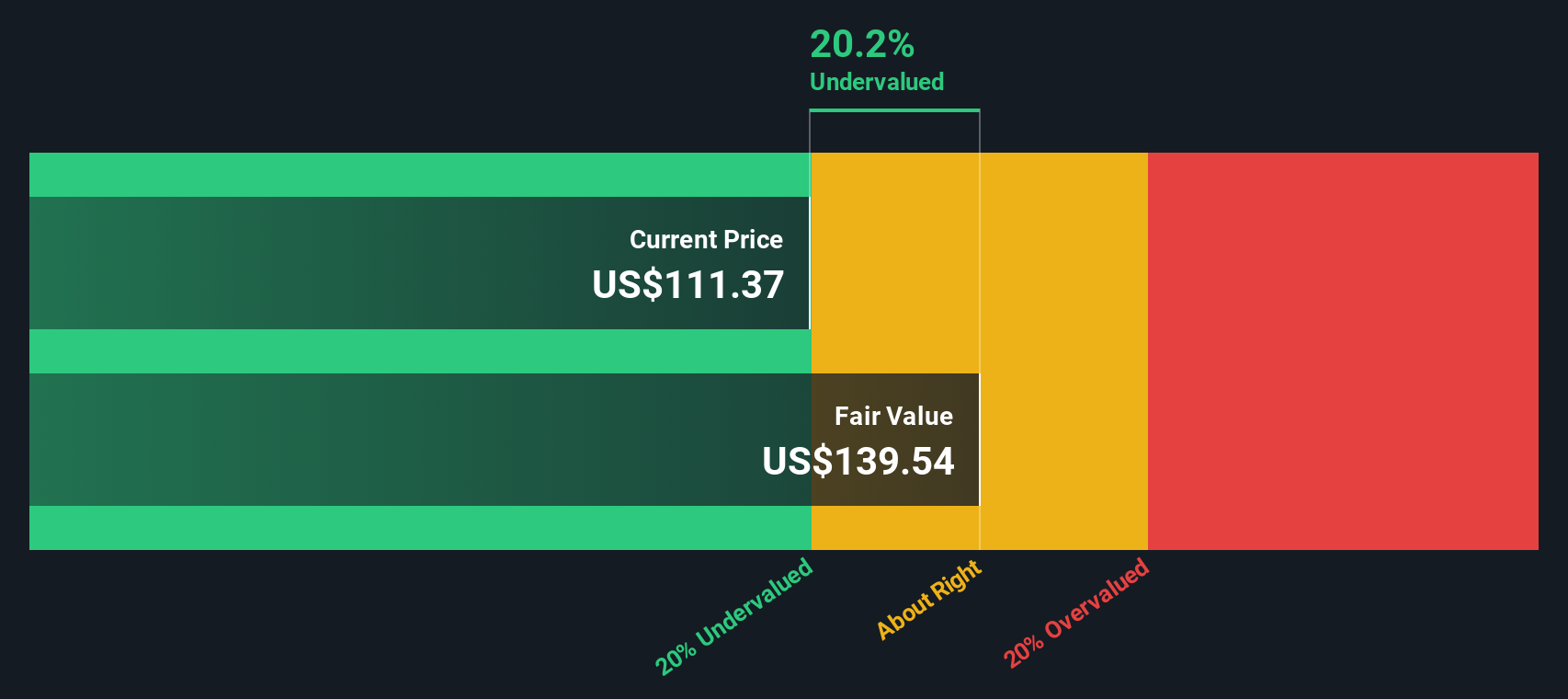

This is where Simply Wall St's "Fair Ratio" becomes valuable. The Fair Ratio of 24.6x for EnerSys is calculated by weighing factors beyond simple industry comparisons, such as projected earnings growth, risk profile, profit margin, and the company’s size. By relying on a tailored Fair Ratio, investors get a more holistic and arguably more precise assessment of intrinsic value.

Comparing the Fair Ratio (24.6x) to EnerSys's current PE (15.6x) reveals that the stock trades at a considerable discount. This suggests EnerSys is undervalued relative to what would typically be expected, presenting an opportunity for investors seeking value.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your EnerSys Narrative

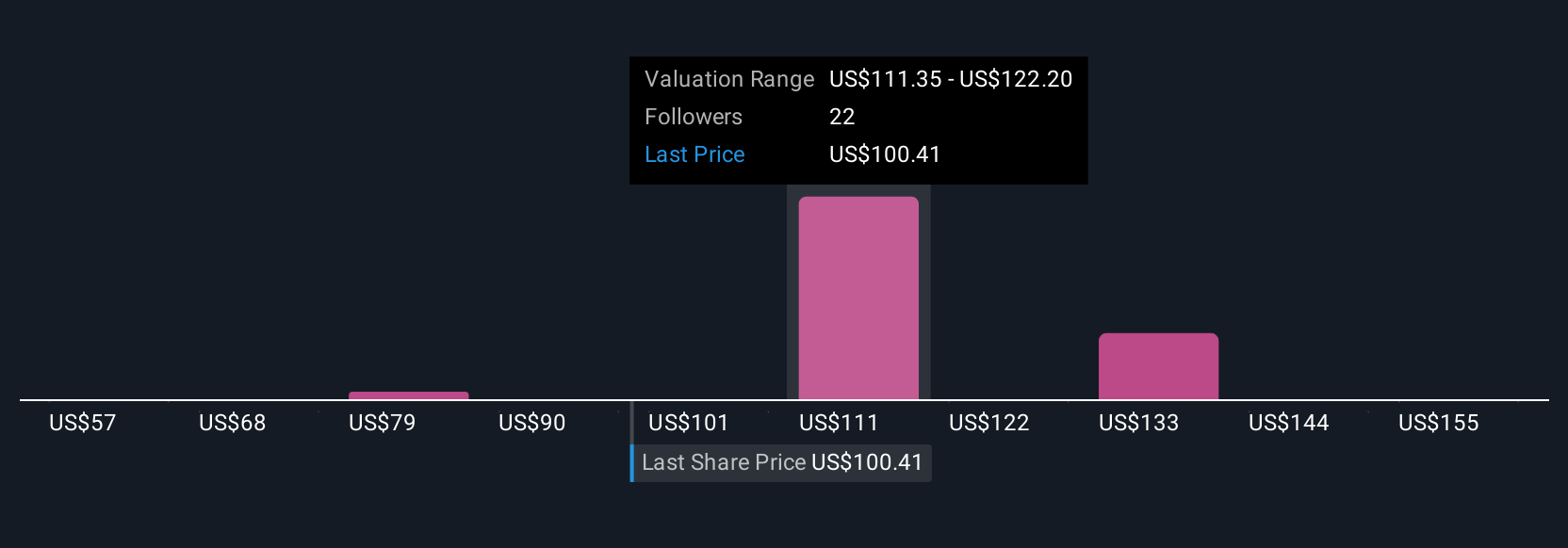

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a simple but powerful approach that lets you tell your own story behind EnerSys's numbers by combining your perspective on future revenue, earnings, and margins with a fair value estimate.

Unlike static models, a Narrative connects the dots from a company's story through to a detailed financial forecast, then translates that into a fair value per share. Narratives are easy to access on Simply Wall St's Community page, where millions of investors share their real-time outlooks; you can explore or create your own to reflect your unique view on EnerSys and instantly see what it means for the stock's valuation.

By comparing the Fair Value your Narrative produces to the current market price, you can confidently decide whether to buy, hold, or sell. Dynamic updates automatically reflect new news, earnings releases, or other crucial information. For example, some investors might have an optimistic Narrative with a fair value of $144 based on robust margin expansion and a strong outlook for digital infrastructure. Others might take a more cautious view, highlighting risks from slow organic growth or delayed projects, resulting in a much lower fair value.

Do you think there's more to the story for EnerSys? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EnerSys might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ENS

EnerSys

Engages in the provision of stored energy solutions for industrial applications worldwide.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.