- United States

- /

- Electrical

- /

- NYSE:ENS

Has EnerSys Rally in 2025 Run Ahead of Its Fundamentals?

Reviewed by Bailey Pemberton

- If you are wondering whether EnerSys is still a smart buy after its big run or if the value has already been priced in, you are not alone. This article is going to unpack exactly that.

- The stock has climbed 2.6% over the last week, 19.0% in the past month, and is now up 59.1% year to date, with a 55.0% gain over the past year highlighting how quickly sentiment has shifted.

- Recent market attention has centered on EnerSys as investors focus more on energy storage, grid reliability, and industrial decarbonization themes, which generally support companies providing advanced battery solutions. At the same time, the broader clean tech space has been volatile, reminding investors that strong narratives do not always translate into steady share prices.

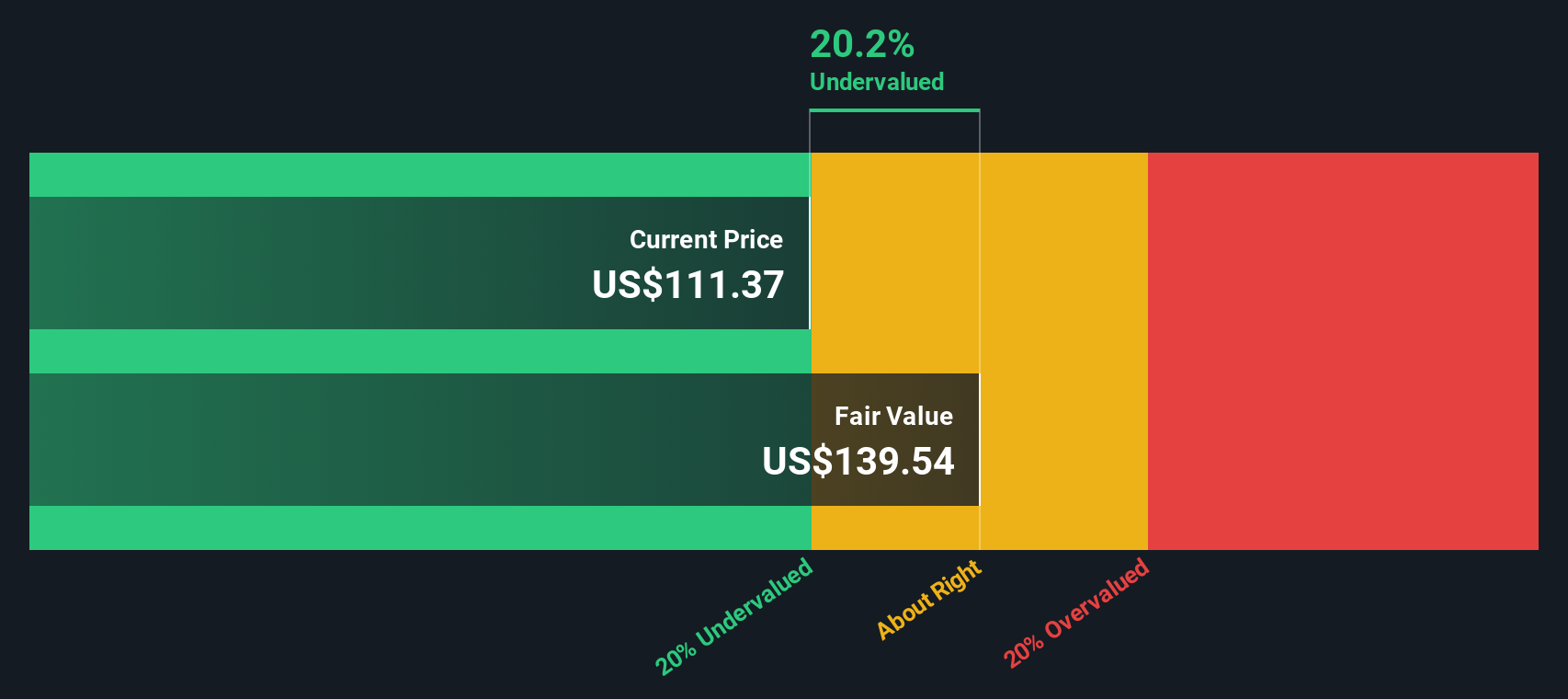

- On our valuation checks, EnerSys scores a 3 out of 6, suggesting it may be undervalued on some metrics but not obviously cheap across the board. We will walk through the key valuation approaches next and, by the end, also look at a more nuanced way to think about its fair value.

Approach 1: EnerSys Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company is worth by projecting the cash it is expected to generate in the future and then discounting those cash flows back to today in $ terms.

For EnerSys, the model uses a 2 Stage Free Cash Flow to Equity approach. The company generated about $329.7 Million in free cash flow over the last twelve months. Analysts provide detailed forecasts for the next few years, including an estimate of $261.9 Million by 2027. Simply Wall St then extrapolates this further, with projections gradually normalizing over the following decade as growth tapers off.

When these projected cash flows are discounted back, the intrinsic value for EnerSys comes out at roughly $58.18 per share. Compared with the current share price, the model implies the stock is 151.8% overvalued. This suggests that investors are paying well above what the long term cash flow profile would justify.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests EnerSys may be overvalued by 151.8%. Discover 908 undervalued stocks or create your own screener to find better value opportunities.

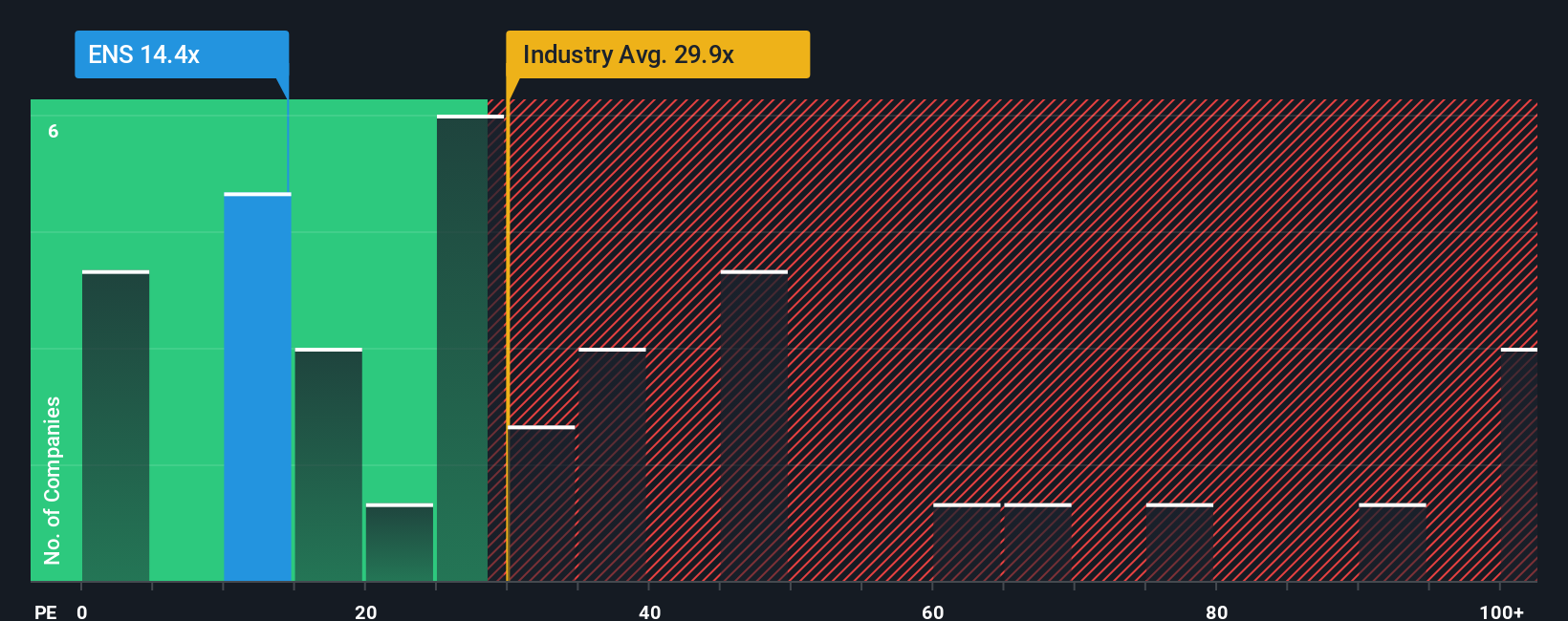

Approach 2: EnerSys Price vs Earnings

For a consistently profitable business like EnerSys, the Price to Earnings, or PE, ratio is a useful way to gauge how much investors are paying for each dollar of current earnings. In general, faster growing and lower risk companies deserve a higher PE multiple, while slower growing or riskier names tend to trade on lower multiples.

EnerSys currently trades on a PE of about 16.0x, which is well below both the Electrical industry average of around 31.2x and the broader peer group average near 36.8x. At first glance, that discount might suggest the stock is cheap, but headline comparisons can be misleading without adjusting for its specific growth profile and risk factors.

Simply Wall St addresses this by using a proprietary Fair Ratio. This estimates what PE multiple EnerSys should trade on, given its earnings growth outlook, profitability, industry, size, and risk characteristics. For EnerSys, the Fair Ratio is 24.6x. This means the company arguably deserves a higher multiple than the market is currently assigning. Because the actual PE of 16.0x sits meaningfully below this Fair Ratio, the shares look attractively priced on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

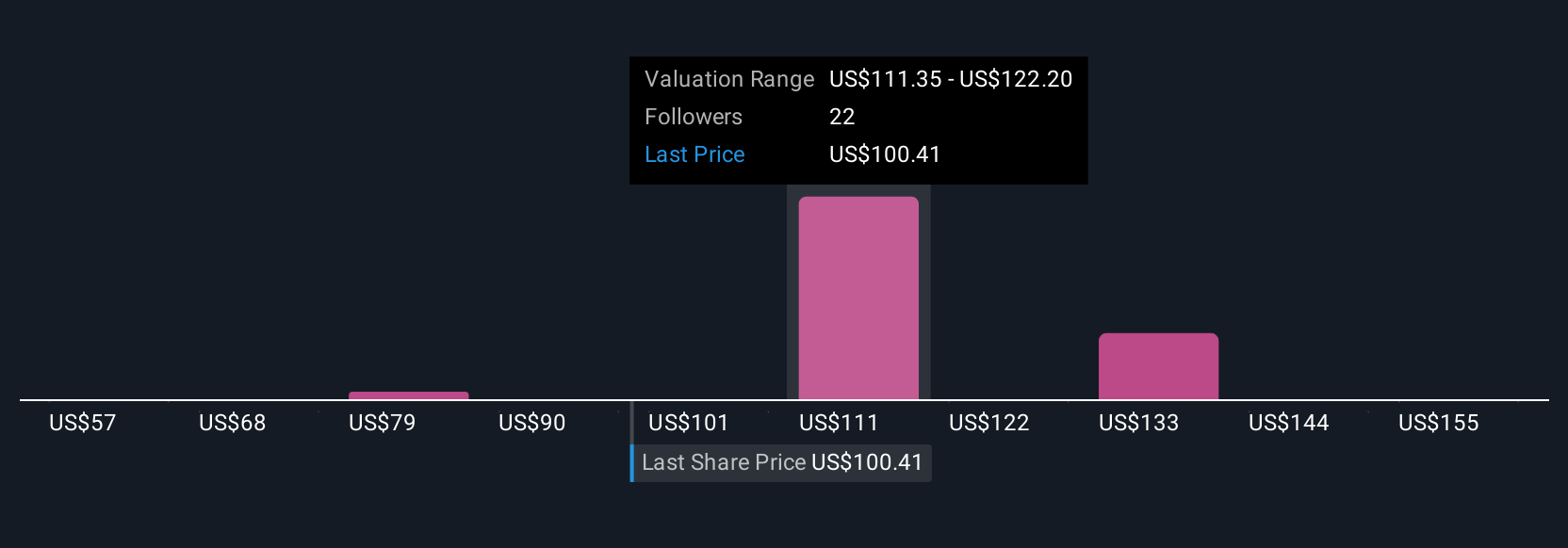

Upgrade Your Decision Making: Choose your EnerSys Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. This is a simple framework on Simply Wall St’s Community page where you write the story you believe about a company, translate that story into assumptions for future revenue, earnings, and margins, and automatically link it to a financial forecast and a fair value. You then get a clear buy or sell signal by comparing that fair value to today’s price. The whole Narrative updates dynamically as new news or earnings arrive. One investor might build a bullish EnerSys Narrative around data center demand, margin expansion, and a fair value near the higher community estimate. Another might focus on trade risks, slow organic growth, and a fair value closer to the lowest estimate. Both can see, in one place, how their different stories, numbers, and fair values stack up against the current share price.

Do you think there's more to the story for EnerSys? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EnerSys might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ENS

EnerSys

Engages in the provision of stored energy solutions for industrial applications worldwide.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026