- United States

- /

- Electrical

- /

- NYSE:ENS

EnerSys (ENS): Evaluating Valuation Following Drop in Sales and Softer Demand Outlook

Reviewed by Simply Wall St

EnerSys (ENS) is currently navigating a challenging stretch, as the company faces a drop in unit sales and continued soft demand projected for the next year. These developments could impact its flexibility for future investments or shareholder returns.

See our latest analysis for EnerSys.

EnerSys has seen a surge in momentum lately, with its share price climbing nearly 30% over the past 90 days and delivering a robust 33% year-to-date share price return. Even with recent demand headwinds, the stock’s one-year total shareholder return sits at a healthy 25%. This reflects broad investor confidence in its long-term potential following a strong three-year run with total returns above 100%.

If EnerSys’ latest move has you thinking more broadly about growth, this is a great moment to explore fast growing stocks with high insider ownership.

The key question now is whether EnerSys’ recent share price momentum still leaves room for upside. Alternatively, the market may already be anticipating future growth and potential headwinds, which could leave limited opportunity for value-focused investors.

Most Popular Narrative: 2% Overvalued

EnerSys recently closed at $122.60, slightly above the most widely followed fair value estimate of $120.00. The narrative behind this valuation is closely linked to EnerSys' evolving market position, setting the stage for a deeper look at the forces at work.

Ongoing recovery in U.S. communications and robust growth in Data Center deployments, both driven by upgrades to broadband and expansion of digital infrastructure, are expected to fuel accelerating demand for EnerSys' energy storage solutions, supporting multi-year revenue growth.

Want to know what financial formula powers this price target? There is a bold forecast for margin expansion and profit growth beneath the headlines. Find out which assumptions analysts are banking on; the details might surprise you.

Result: Fair Value of $120.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent trade policy uncertainties and overreliance on acquisitions could undermine EnerSys’ growth outlook. This calls current margin expansion assumptions into question.

Find out about the key risks to this EnerSys narrative.

Another View: What About the DCF Model?

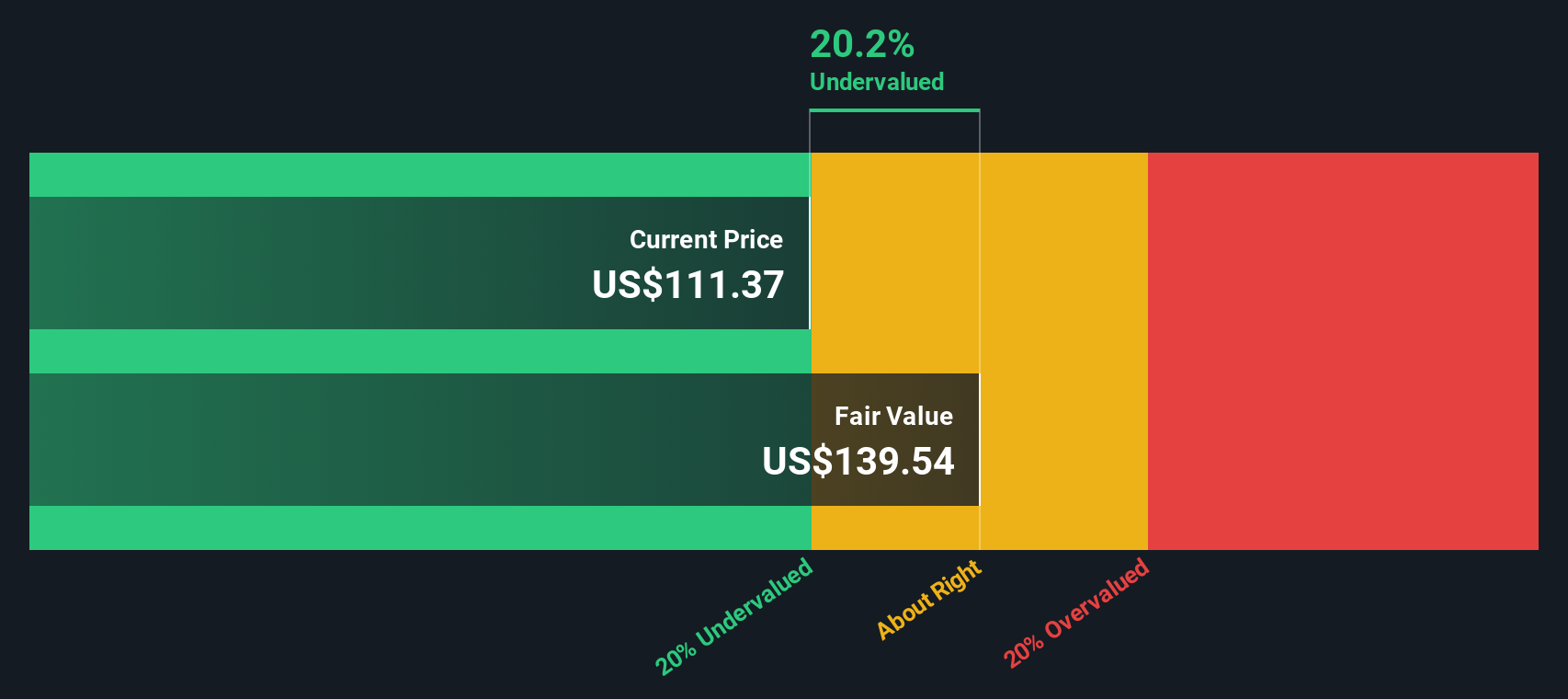

While the analyst-driven fair value relies on earnings forecasts and multiples, the SWS DCF model offers a different perspective. According to our DCF calculation, EnerSys is trading about 10% below its estimated fair value. This suggests the market might be undervaluing future cash flows. Which model will prove more accurate as events unfold?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own EnerSys Narrative

If you see things differently or want to follow your own approach, it's easy to craft your own view based on the data. Get started in just a few minutes with Do it your way.

A great starting point for your EnerSys research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't let today's best opportunities slip away. Take the next step and spot tomorrow’s winners using exclusive tools smart investors trust and use every day.

- Catch the next wave of high-potential technology by checking out these 24 AI penny stocks, which drive innovation in artificial intelligence and advanced automation.

- Boost your passive income with ease by exploring these 17 dividend stocks with yields > 3%, offering steady yields above 3% for income-focused portfolios.

- Stay ahead in the evolving digital landscape and see which companies are transforming finance with these 79 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EnerSys might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ENS

EnerSys

Engages in the provision of stored energy solutions for industrial applications worldwide.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives