- United States

- /

- Electrical

- /

- NYSE:ENS

Could Improved U.S.-China Sentiment Change Revenue Trajectory for EnerSys (ENS)?

Reviewed by Sasha Jovanovic

- EnerSys recently announced it will release its second quarter fiscal 2026 financial results for the period ended September 28, 2025, after the market close on November 5, 2025, and host a conference call the following day to review the results.

- In the past week, EnerSys shares moved along with several industrial and technology peers, mainly attributed to improved investor sentiment after President Trump's statements on U.S.-China relations.

- We'll now explore how rising optimism over U.S.-China relations could influence EnerSys's revenue and earnings growth prospects.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

EnerSys Investment Narrative Recap

EnerSys shareholders typically focus on the company's exposure to the global energy transition and digital infrastructure, with near-term revenue and margin growth often tied to industrial demand recovery and improving global trade sentiment. The recent boost in investor confidence following remarks on U.S.-China relations may help sentiment, but the real near-term catalyst remains the upcoming Q2 earnings release, while tariff and policy uncertainty still stands as the central risk. These external headlines appear unlikely to materially shift the core risks and catalysts reflected in EnerSys's operating performance outlook.

Among recent announcements, EnerSys's plan to release Q2 fiscal 2026 results shortly is the most relevant to current investor focus. Upcoming financial results have added importance, as they will provide an updated view on whether stronger sentiment and easing global trade tensions are translating into higher sales or profit margins, especially for segments affected by tariff risks or customer hesitation.

However, it’s important to note that continued uncertainty around global trade policy and tariffs continues to pose a significant risk that investors should be aware of...

Read the full narrative on EnerSys (it's free!)

EnerSys' narrative projects $3.9 billion revenue and $394.7 million earnings by 2028. This requires 1.9% yearly revenue growth and a $43.6 million earnings increase from $351.1 million.

Uncover how EnerSys' forecasts yield a $120.00 fair value, a 3% downside to its current price.

Exploring Other Perspectives

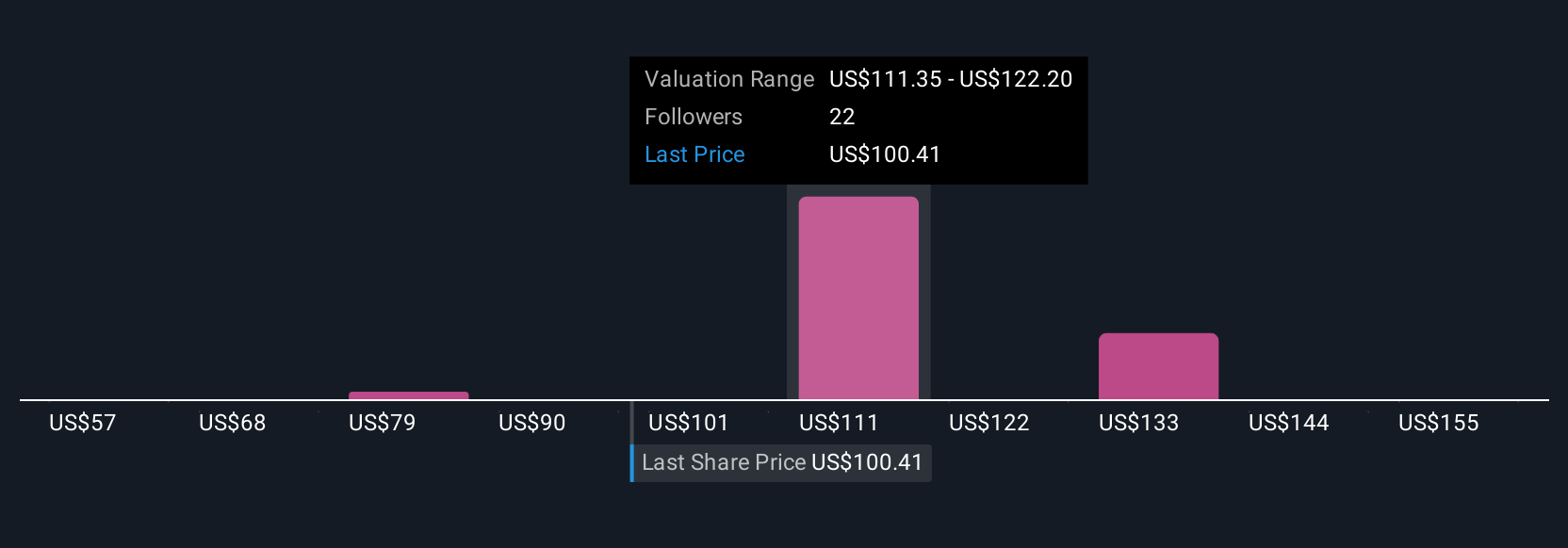

Eight Simply Wall St Community members set EnerSys fair value anywhere from US$57.11 to US$183.15 per share. Tariff risks and policy shifts remain a major point of debate for anyone assessing the company’s long-term earnings power.

Explore 8 other fair value estimates on EnerSys - why the stock might be worth less than half the current price!

Build Your Own EnerSys Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EnerSys research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free EnerSys research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EnerSys' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EnerSys might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ENS

EnerSys

Engages in the provision of stored energy solutions for industrial applications worldwide.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives