- United States

- /

- Electrical

- /

- NYSE:EMR

The Bull Case For Emerson Electric (EMR) Could Change Following New Armexa OT Cybersecurity Partnership

Reviewed by Sasha Jovanovic

- In early December 2025, Emerson and Armexa announced a collaboration to provide DeltaV automation platform users with a global suite of operational technology cybersecurity services, including assessments, network intrusion detection deployments, and OT security for capital projects aligned with ISA/IEC 62443 standards.

- This move highlights how Emerson is broadening its automation offering into lifecycle OT cybersecurity, aiming to simplify vendor management and strengthen resilience for industrial customers across energy, LNG, chemicals, pharmaceuticals, utilities, and manufacturing.

- Now we'll explore how this OT cybersecurity collaboration, set against recent revenue and margin pressures, influences Emerson Electric's broader investment narrative.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Emerson Electric Investment Narrative Recap

To own Emerson Electric today, you need to believe in its shift toward higher value automation and software, even as near term revenue and margin pressures weigh on sentiment. The Armexa OT cybersecurity collaboration supports that story by deepening Emerson’s role in customers’ critical infrastructure, but it does not yet change the key short term catalyst, which remains evidence of margin improvement in automation, or the main risk of softer demand in core industrial end markets.

Among recent announcements, Emerson’s plan to return US$10,000,000,000 to shareholders through 2028, backed by a 5.2 percent dividend increase and an expanded buyback authorization, stands out alongside the Armexa news. Together, they frame a company trying to balance reinvestment in automation and cybersecurity with ongoing capital returns, which matters if margin pressure in its automation focused portfolio proves more persistent than expected.

Yet investors should also be aware that persistent margin pressure in automation could become more than a temporary setback if...

Read the full narrative on Emerson Electric (it's free!)

Emerson Electric’s narrative projects $21.3 billion revenue and $3.3 billion earnings by 2028.

Uncover how Emerson Electric's forecasts yield a $150.84 fair value, a 10% upside to its current price.

Exploring Other Perspectives

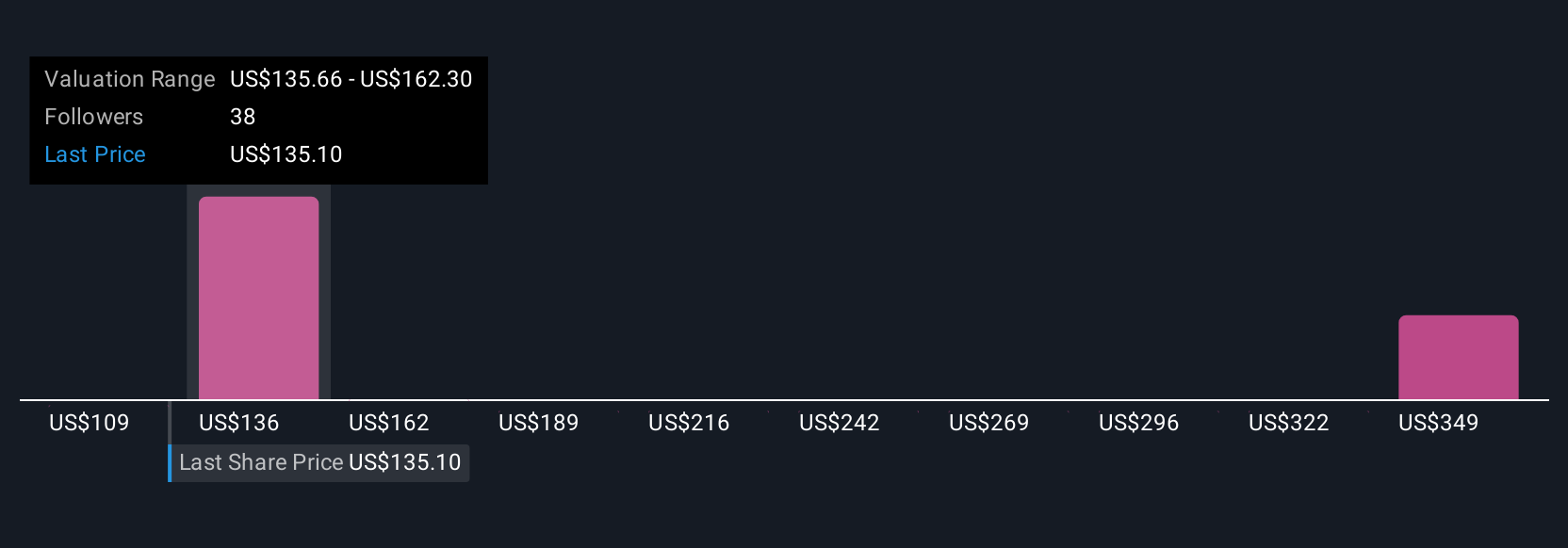

Five members of the Simply Wall St Community estimate Emerson’s fair value between about US$109 and US$230, showing very different expectations. You can weigh those against current concerns about automation margins and revenue softness in key end markets to consider how resilient the earnings story might be over time.

Explore 5 other fair value estimates on Emerson Electric - why the stock might be worth as much as 68% more than the current price!

Build Your Own Emerson Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Emerson Electric research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Emerson Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Emerson Electric's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emerson Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EMR

Emerson Electric

A technology and software company, provides various solutions in the Americas, Asia, the Middle East, Africa, and Europe.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026