- United States

- /

- Electrical

- /

- NYSE:EMR

How Emerson’s Latest Renewable and Mining Wins Could Shape the EMR Investment Case

Reviewed by Sasha Jovanovic

- Earlier this week, EKO Instruments USA announced the installation of advanced weather stations featuring MS-80SH Pyranometers, which integrate with Emerson’s Ovation Green solar solutions, at Mitsui & Co.’s 110MW Three W Solar project in Texas, while Emerson also revealed its automation technology will be central to South32’s Hermosa mine in Arizona.

- These wins highlight Emerson’s role in embedding high-efficiency control and data systems for major renewable energy and critical mineral projects across North America.

- We'll examine how Emerson’s expanding presence in large-scale solar and mining automation projects could strengthen its investment narrative going forward.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Emerson Electric Investment Narrative Recap

To be a shareholder in Emerson Electric, you need confidence in the company’s ongoing transformation into a pure-play automation leader, built on growing demand for advanced software and recurring revenue streams. This week’s wins in large-scale solar and mining automation reinforce that narrative, but are unlikely to materially change the near-term catalyst: accelerated adoption of digital automation across energy and critical minerals, while the biggest risk remains margin pressure from tariffs and foreign exchange volatility.

The Hermosa mine contract is especially relevant as it spotlights Emerson’s automation portfolio being used to enable the next generation of mining operations, connecting directly to current growth drivers in electrification and industrial efficiency. Such project wins support high-quality backlog and recurring software revenues, which could help offset the cyclical nature and timing risk of capital investment cycles in core markets.

However, investors should also pay attention to ongoing risks around margin pressure in Emerson’s Intelligent Devices segment that could...

Read the full narrative on Emerson Electric (it's free!)

Emerson Electric’s outlook forecasts $21.3 billion in revenue and $3.3 billion in earnings by 2028. Achieving this would require annual revenue growth of 6.2% and a $1.1 billion increase in earnings from the current $2.2 billion.

Uncover how Emerson Electric's forecasts yield a $150.84 fair value, a 15% upside to its current price.

Exploring Other Perspectives

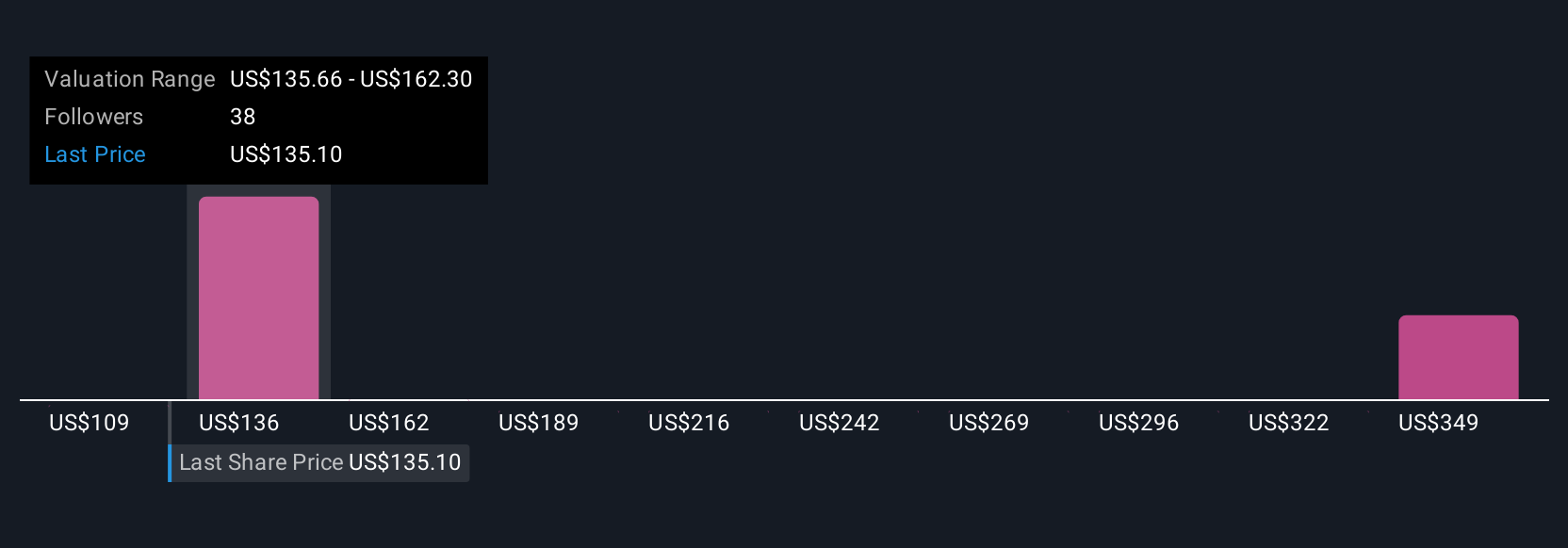

The Simply Wall St Community’s five fair value estimates for Emerson Electric range widely from US$109.01 to US$230.25 per share. While some see deep value, others anticipate more limited upside, reflecting both the company’s strong automation growth catalysts and concerns about market cyclicality. Explore how your own outlook compares to these diverse analyses.

Explore 5 other fair value estimates on Emerson Electric - why the stock might be worth 17% less than the current price!

Build Your Own Emerson Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Emerson Electric research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Emerson Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Emerson Electric's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emerson Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EMR

Emerson Electric

A technology and software company, provides various solutions in the Americas, Asia, the Middle East, Africa, and Europe.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.