- United States

- /

- Electrical

- /

- NYSE:EMR

Has the Latest Acquisition Changed the Outlook for Emerson Electric Stock in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with your Emerson Electric stock? You are not alone. Investors everywhere are watching Emerson's journey, weighing up whether the recent price action hints at a new chapter of growth or signals caution. The stock closed recently at $130.11, and while it has slipped slightly over the past month, down 2.1%, Emerson has delivered an impressive 21.9% climb over the past year and a staggering 122.7% gain in five years. That resilience speaks to a story bigger than short-term jitters and suggests there could still be room for upside if you look at the big picture.

Recent headlines have been dominated by Emerson's strategic acquisition activity. The company's focus is shifting toward automation and digital solutions for industrial customers. These moves are reshaping how the market values Emerson, as investors weigh the long-term potential against perceived risks and evolving industry trends. Despite this transformation, our valuation scorecard finds Emerson is undervalued in 3 of the 6 key checks, earning it a value score of 3, which indicates there is some hidden value that might go unnoticed at first glance.

So, how does this all stack up when you assess the current price against various established methods of valuation? Let us break down the numbers and approaches, and later, explore an even better way to understand what Emerson is really worth in today's market.

Why Emerson Electric is lagging behind its peers

Approach 1: Emerson Electric Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future free cash flows and discounting those amounts back to today's dollars. For Emerson Electric, this approach uses recent and forecasted Free Cash Flow (FCF) data to gauge the company’s underlying worth beyond current market sentiment.

Emerson’s latest twelve-month Free Cash Flow stands at $2.76 Billion. Analyst estimates predict continued steady growth, with FCF expected to reach $9.67 Billion by 2029. Beyond that, longer-range projections, extrapolated using market assumptions, anticipate FCF surpassing $20 Billion by 2035. All figures are reported in US dollars and highlight considerable expansion over the coming decade.

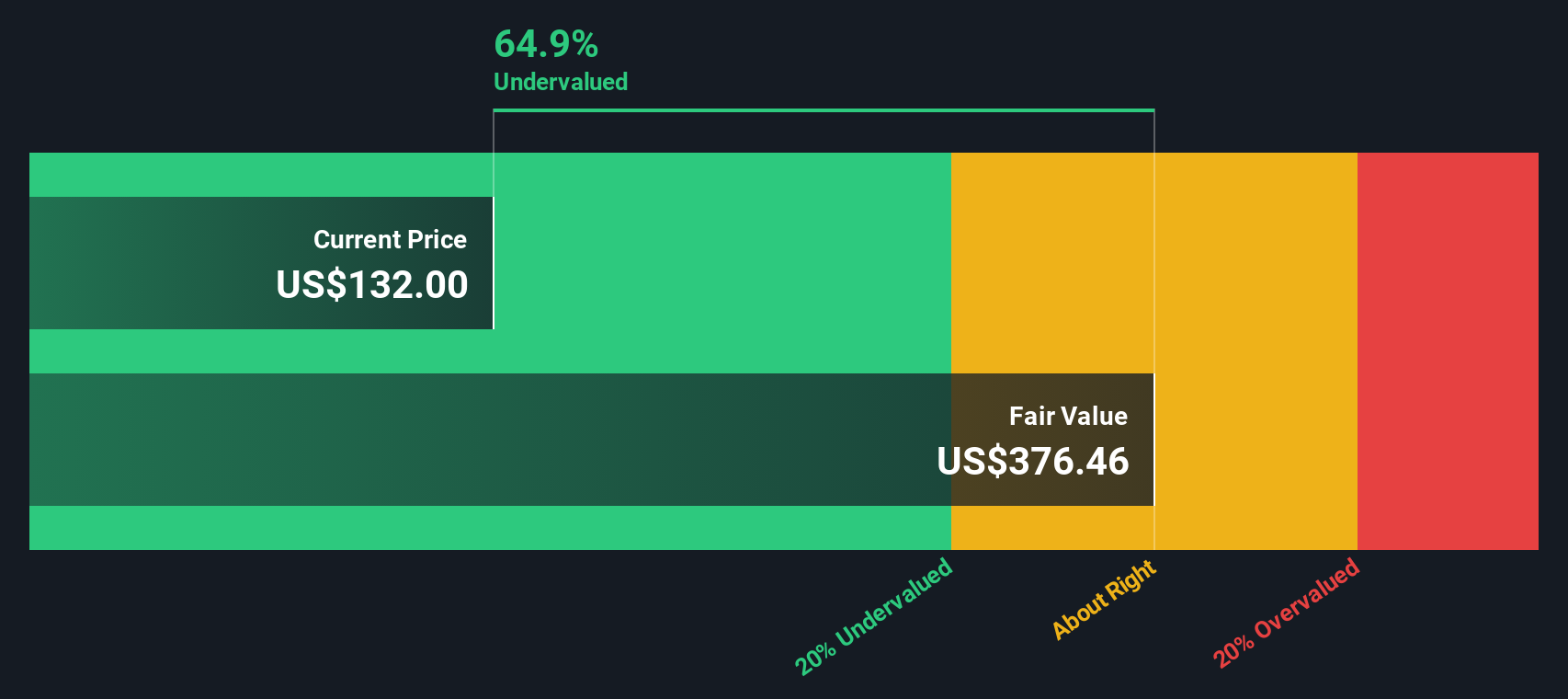

According to the DCF analysis, Emerson's intrinsic value per share is calculated at $357.04. This figure implies the stock is approximately 63.6% undervalued compared to its latest closing price of $130.11. In other words, the market may not be fully appreciating Emerson’s future cash-generating power based on current discounted projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Emerson Electric is undervalued by 63.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Emerson Electric Price vs Earnings

The Price-to-Earnings (PE) ratio is one of the most popular ways to value established, profitable companies like Emerson Electric, as it directly compares the company's share price to its earnings per share. This makes it a reliable measure for investors evaluating whether the stock price reflects the business's ability to generate profits.

When assessing what constitutes a "normal" or "fair" PE ratio, factors such as future growth prospects, industry stability, and company-specific risks come into play. Companies expected to deliver robust growth or facing lower risk often trade at higher PE ratios, while those with more uncertainty or slower growth command lower multiples.

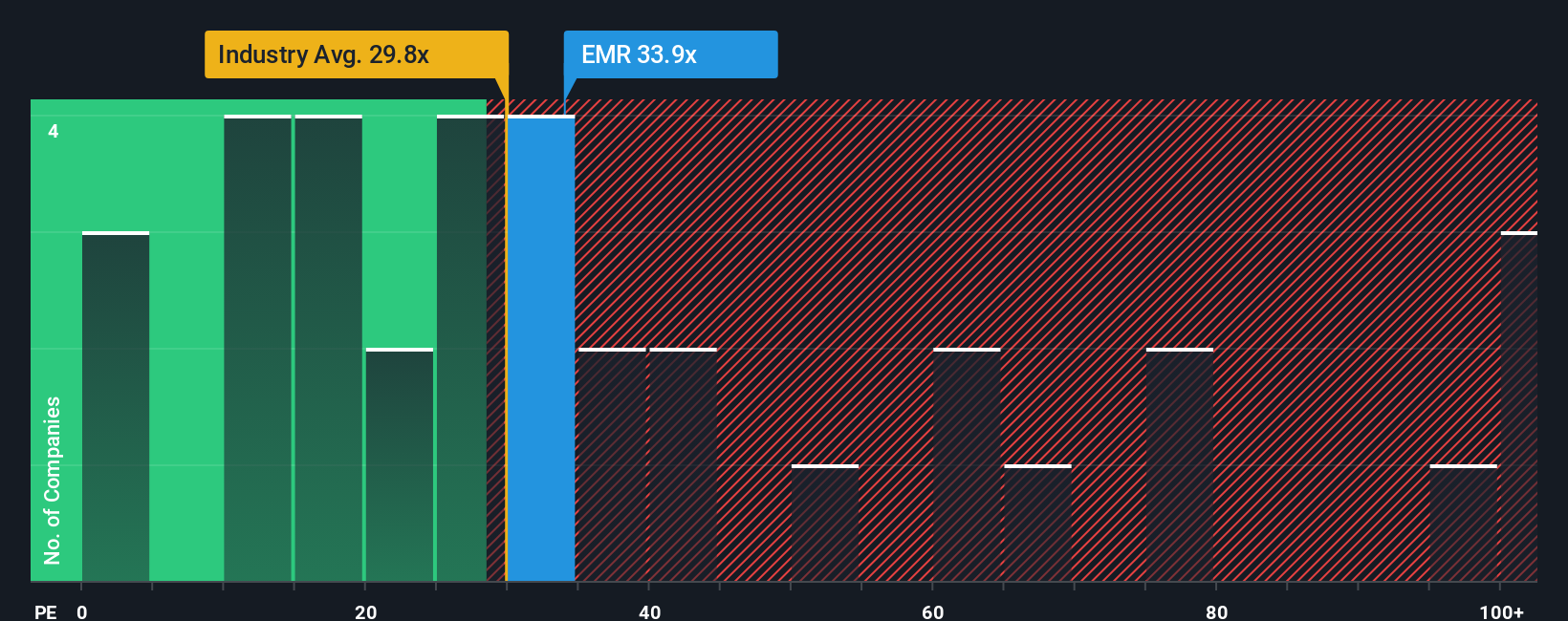

Emerson Electric is currently trading at a PE ratio of 33.16x. This is slightly above the Electrical industry average of 30.79x but sits well below the peer group mean of 46.75x. While these benchmark comparisons provide valuable context, they do not account for Emerson's unique growth trajectory, risk profile, or margins.

This is where Simply Wall St's "Fair Ratio" comes in. The Fair Ratio for Emerson, calculated at 31.60x, reflects a holistic view that factors in growth expectations, profit margins, sector trends, company size, and risk. Unlike basic peer or industry averages, the Fair Ratio is tailored to each business's fundamentals and provides a more nuanced valuation benchmark.

With Emerson trading at 33.16x, only a fraction above its Fair Ratio of 31.60x, the stock's valuation appears to be about right relative to what investors should expect given its growth and financial characteristics.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Emerson Electric Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a smarter tool for investors that connects the story you believe about Emerson Electric to your own forecasts and a resulting fair value.

A Narrative is simply your perspective on what is driving a company's future, from industry shifts and new technology to management actions, turned into actual financial assumptions, such as expected revenue growth, margins, or risk. These assumptions are then rolled into a fair value calculation.

Because Narratives join together the company’s real-world story and the numbers behind it, they make your investment decisions far more personal and informed. Narratives are easy to use and available to everyone on Simply Wall St’s Community page, where millions of investors shape and share their outlooks.

This means you can compare what you believe is Emerson’s fair value with the current market price and decide whether it is time to buy or sell. Narratives also update automatically when big news, earnings releases, or industry changes occur, keeping your view accurate and current without extra effort.

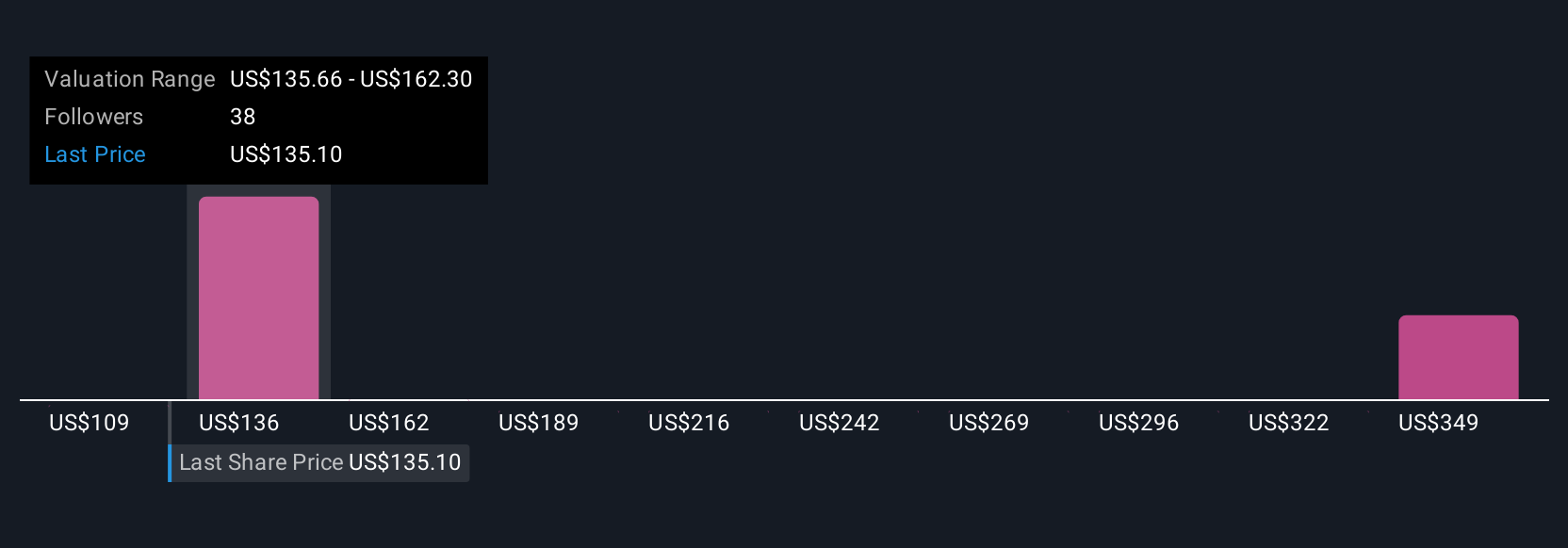

For example, when it comes to Emerson Electric, some investors see rapid digital automation and global AI adoption driving a fair value as high as $185 per share. More cautious observers believe potential integration risks and cyclical market exposure could mean a fair value nearer $111 per share. Narratives make it easy to explore both sides and craft your own informed judgement.

Do you think there's more to the story for Emerson Electric? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emerson Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EMR

Emerson Electric

A technology and software company, provides various solutions in the Americas, Asia, the Middle East, Africa, and Europe.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives