- United States

- /

- Electrical

- /

- NYSE:EMR

Emerson Electric (NYSE:EMR) Exits Russell 1000 Defensive and Value-Defensive Indexes

Reviewed by Simply Wall St

Emerson Electric (NYSE:EMR) was removed from the Russell 1000 Defensive and Value-Defensive Indexes on June 30, 2025, a change that might affect its visibility and perceived stability. During the quarter, Emerson also affirmed a cash dividend and reported mixed earnings, with higher sales yet lower year-on-year net income. The company launched innovative initiatives like Project Beyond and advanced its AI portfolio, while engaging in share buybacks. The S&P 500 and Nasdaq showed strong performance with new highs, suggesting Emerson’s 21% price increase aligns with broader market trends despite its index removals.

Emerson Electric has 2 weaknesses we think you should know about.

The removal of Emerson Electric (NYSE:EMR) from the Russell 1000 Defensive and Value-Defensive Indexes might impact its visibility and perceived stability, potentially affecting investor sentiment and market positioning. However, despite this development and some negative earnings growth, Emerson's share price rose 21% this quarter, keeping pace with broader market trends. This aligns with a 137.66% total return over the five-year period, highlighting the company's long-term consistency. Over the past year, however, the company's return exceeded the US market's increase of 13.7% yet lagged behind the US Electrical industry's return of 34%.

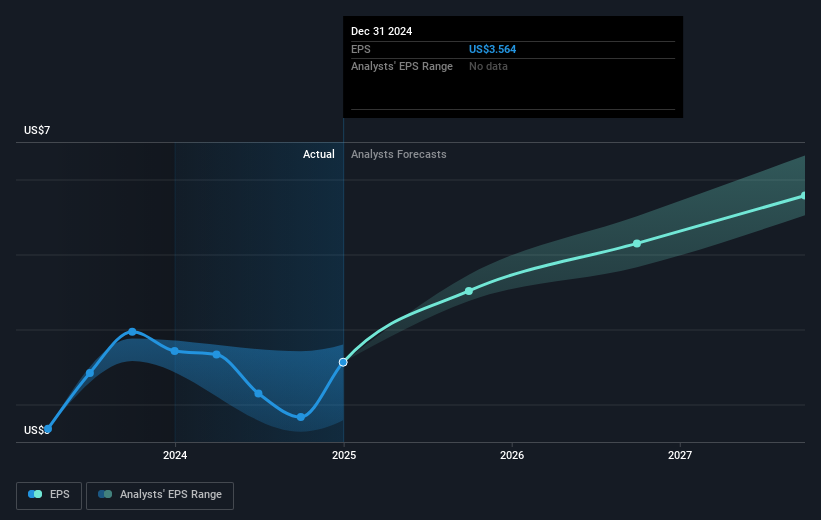

Emerson's integration of AspenTech and initiatives like Project Beyond could gradually enhance operational efficiency and profitability. Revenue forecasts suggest a moderate annual growth of 4.8%, while analysts anticipate earnings to reach US$3.2 billion by 2028. The company's capacity to offset approximately US$245 million in potential gross tariff impacts stands as a crucial factor that could support these projections. However, challenges like tariff pressures and an uncertain recovery in certain key markets could moderate progress. The current share price of US$107.27 indicates an 18.3% potential climb towards the consensus price target of US$131.32, reflecting both market confidence and calculated risks in Emerson's future financial outlook.

Learn about Emerson Electric's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emerson Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EMR

Emerson Electric

A technology and software company, provides various solutions in the Americas, Asia, the Middle East, Africa, and Europe.

Established dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives