- United States

- /

- Electrical

- /

- NYSE:EMR

Emerson Electric (EMR): Evaluating Valuation as Firm Expands Role in Texas Solar Infrastructure

Reviewed by Simply Wall St

Emerson Electric is at the center of a new project in Texas, where its Ovation Green platform has been chosen for supervisory control and asset management at Mitsui’s 110MW Three W Solar site. This deployment reinforces Emerson’s expanding footprint in renewable energy infrastructure.

See our latest analysis for Emerson Electric.

Emerson Electric’s recent involvement at Mitsui's Three W Solar site adds another win to a year marked by innovative projects and steady performance. Despite a modest 1-year total shareholder return of 0.6%, the company’s 5-year total return stands at an impressive 80%, suggesting solid long-term growth momentum as it expands its footprint in renewables.

If Emerson’s push into next-generation energy networks caught your attention, it is a timely moment to see what else is available. Discover fast growing stocks with high insider ownership

With shares showing only modest gains this year, but trading well below analyst targets and at a discount to intrinsic value, the question for investors is clear: is Emerson Electric an undervalued opportunity, or is the market fully pricing in future growth?

Most Popular Narrative: 12.5% Undervalued

Emerson Electric’s consensus fair value stands at $150.84, suggesting a healthy margin from the last close of $131.94 and pointing to continued optimism for growth in the automation and infrastructure markets. The latest narrative frames the company's transformation and operating strength within a dynamic, AI-driven industrial context.

The company's transformation toward a pure-play automation leader, emphasizing innovation, commercialization of new products, and operational excellence, continues to yield improved profitability (for example, margin expansion and higher free cash flow) and positions Emerson to capitalize on long-term modernization and infrastructure trends.

What is driving such an ambitious fair value target? The most popular narrative is built on rapidly rising revenues, margin gains, and a bold view on recurring cash flows that could shift investor perceptions. Could a surge in sector-leading financials be just getting started? The details might surprise you. Do not miss the quantifiable thesis powering this price.

Result: Fair Value of $150.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, exposure to currency swings and weaker demand in key industrial markets could still unsettle Emerson’s positive outlook and challenge the sustainability of recent gains.

Find out about the key risks to this Emerson Electric narrative.

Another View: What If the Market Is Right?

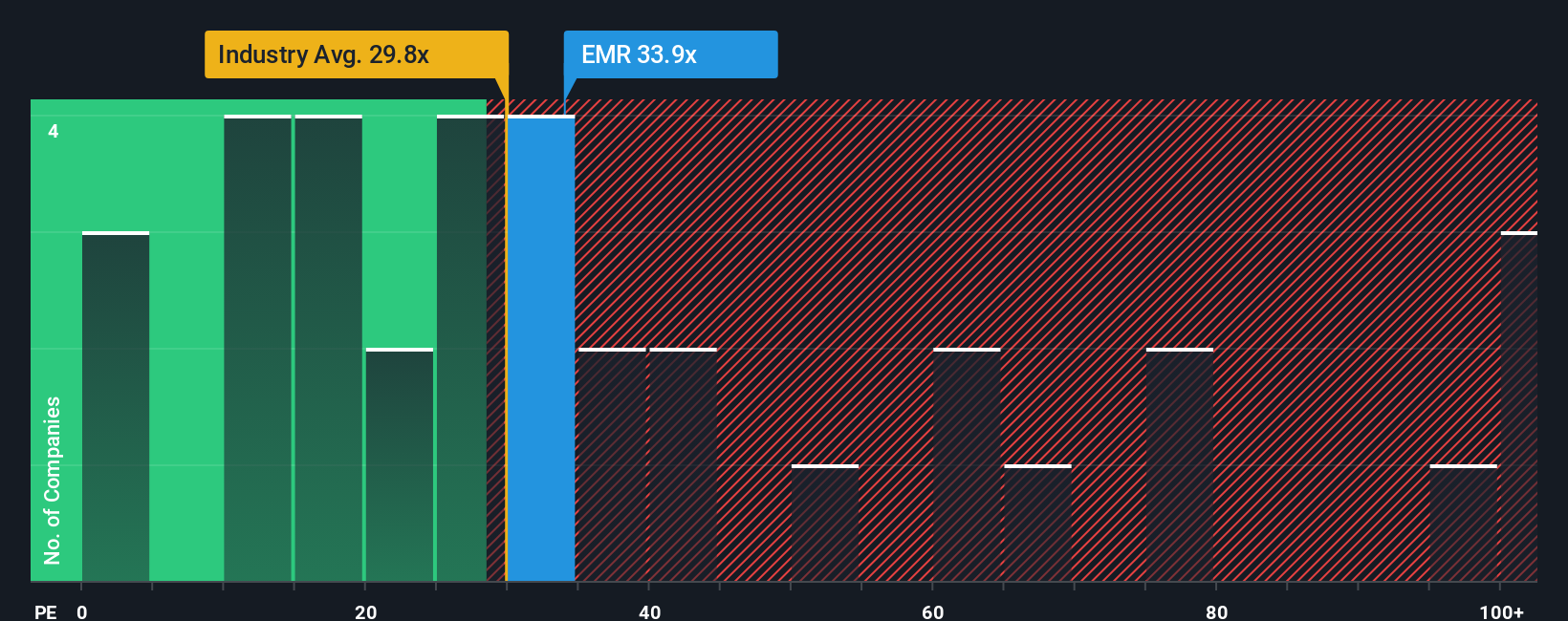

While some see clear value ahead, a look through the lens of the price-to-earnings ratio offers a more cautious picture. Emerson trades at 32.4 times earnings, which is above both the US Electrical industry average of 30.7 and the estimated fair ratio of 31.8, but remains cheaper than the sector peer average of 45.3. This gap could signal valuation risk if optimism fades. Could investors be discounting potential headwinds, or is value hiding in plain sight?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Emerson Electric Narrative

If you are not convinced by these perspectives or want to dive deeper with your own analysis, you can build a unique view using our tools in just minutes. Do it your way

A great starting point for your Emerson Electric research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not miss this opportunity to uncover exceptional opportunities beyond Emerson Electric by using these powerful tools on Simply Wall Street. Bold trends and undervalued gems might slip away if you hesitate.

- Capture potential for high rewards with these 3565 penny stocks with strong financials, which features companies with solid financials and room for significant growth.

- Target your portfolio for the future by harnessing these 25 AI penny stocks to stay ahead in the evolving field of artificial intelligence innovation.

- Enhance your search for market bargains with these 928 undervalued stocks based on cash flows, helping you find quality stocks trading below intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emerson Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EMR

Emerson Electric

A technology and software company, provides various solutions in the Americas, Asia, the Middle East, Africa, and Europe.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026