- United States

- /

- Construction

- /

- NYSE:EME

Subdued Growth No Barrier To EMCOR Group, Inc.'s (NYSE:EME) Price

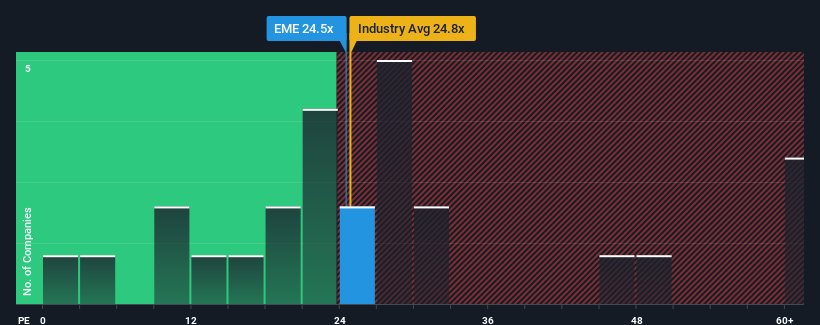

With a price-to-earnings (or "P/E") ratio of 24.5x EMCOR Group, Inc. (NYSE:EME) may be sending bearish signals at the moment, given that almost half of all companies in the United States have P/E ratios under 16x and even P/E's lower than 9x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

With its earnings growth in positive territory compared to the declining earnings of most other companies, EMCOR Group has been doing quite well of late. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for EMCOR Group

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, EMCOR Group would need to produce impressive growth in excess of the market.

If we review the last year of earnings growth, the company posted a terrific increase of 67%. The strong recent performance means it was also able to grow EPS by 491% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 8.4% as estimated by the dual analysts watching the company. That's shaping up to be materially lower than the 13% growth forecast for the broader market.

In light of this, it's alarming that EMCOR Group's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Bottom Line On EMCOR Group's P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that EMCOR Group currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You always need to take note of risks, for example - EMCOR Group has 1 warning sign we think you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if EMCOR Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:EME

EMCOR Group

Provides electrical and mechanical construction and facilities, building, and industrial services in the United States and the United Kingdom.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives