- United States

- /

- Construction

- /

- NYSE:EME

Is It Too Late to Consider EMCOR Group After Record Five Year Returns?

Reviewed by Bailey Pemberton

Thinking about what to do with EMCOR Group’s stock? You’re not alone. With both seasoned investors and newcomers keeping a close eye on this name, it makes sense to want a bit more certainty before making a move. After all, the numbers have been nothing short of impressive. Over just the past week, EMCOR has crept up by 0.9%, but the real show-stopper has been the long-term climb: 50.2% year-to-date and an eye-popping 892.9% over the past five years. That kind of track record does not happen in a vacuum, and some of that momentum reflects a wider trend of growing confidence in solid infrastructure and facilities services providers like EMCOR, especially as markets look for stability and growth beyond tech giants.

Of course, with any stock that’s run this far, the big question for most of us is: is it still undervalued, or is it time to think twice before hitting the buy button? On most conventional metrics, EMCOR looks compelling. In fact, on a six-point value check, the company scores a five, meaning it passes five out of six undervaluation criteria. That is no small feat in today’s market. If you want a more detailed, valuation-focused take before you decide, you are in the right place. Up next, we will dig deep into how EMCOR stacks up by different valuation approaches, and I’ll share what might be the best way to really understand where its value lies.

Approach 1: EMCOR Group Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true worth by forecasting its future cash flows and discounting them back to their present value. For EMCOR Group, this method starts with the company's latest twelve months' Free Cash Flow, which stands at $1.21 Billion. Analysts forecast robust growth, projecting Free Cash Flow to rise to $2.76 Billion by 2029. Although analyst estimates directly inform only the next five years of projections, further outlooks are extrapolated based on trends by Simply Wall St and extend a decade out.

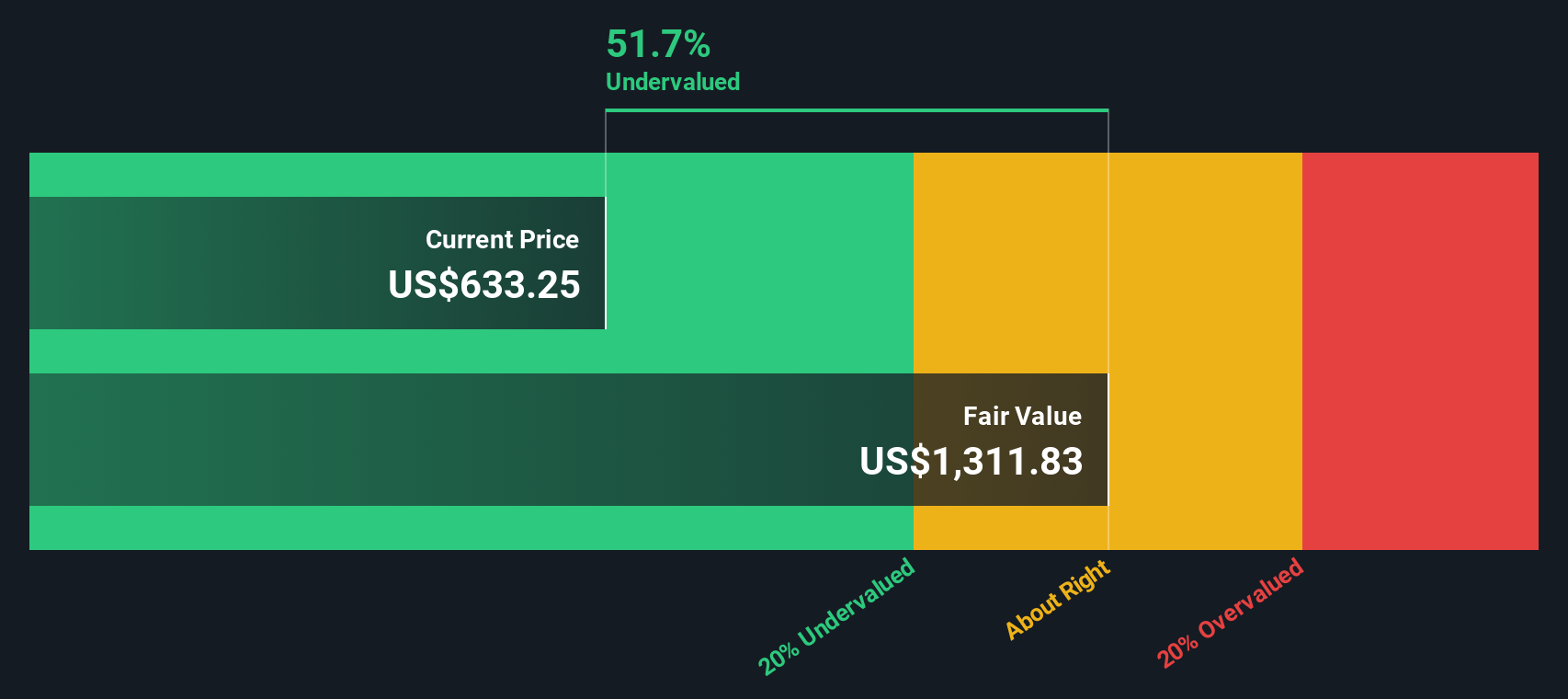

Using this forward-looking approach, the DCF model calculates the intrinsic value of EMCOR Group at $1,312 per share. This figure is significantly above the current share price, indicating the stock is about 47.6% undervalued. Such a substantial implied discount suggests that, based on forecasted cash generation, EMCOR Group's shares may offer attractive value at today’s prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests EMCOR Group is undervalued by 47.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: EMCOR Group Price vs Earnings

The Price-to-Earnings (PE) ratio is often the go-to metric for valuing healthy, profitable companies like EMCOR Group. It tells us how much investors are willing to pay for every dollar of earnings, making it especially relevant when a company generates consistent profits. Growth prospects and risk play a major role in what counts as a “normal” or fair PE ratio. Fast-growing companies or those in stable industries tend to command higher multiples, while those with more risk or slower earnings growth often trade at lower ratios.

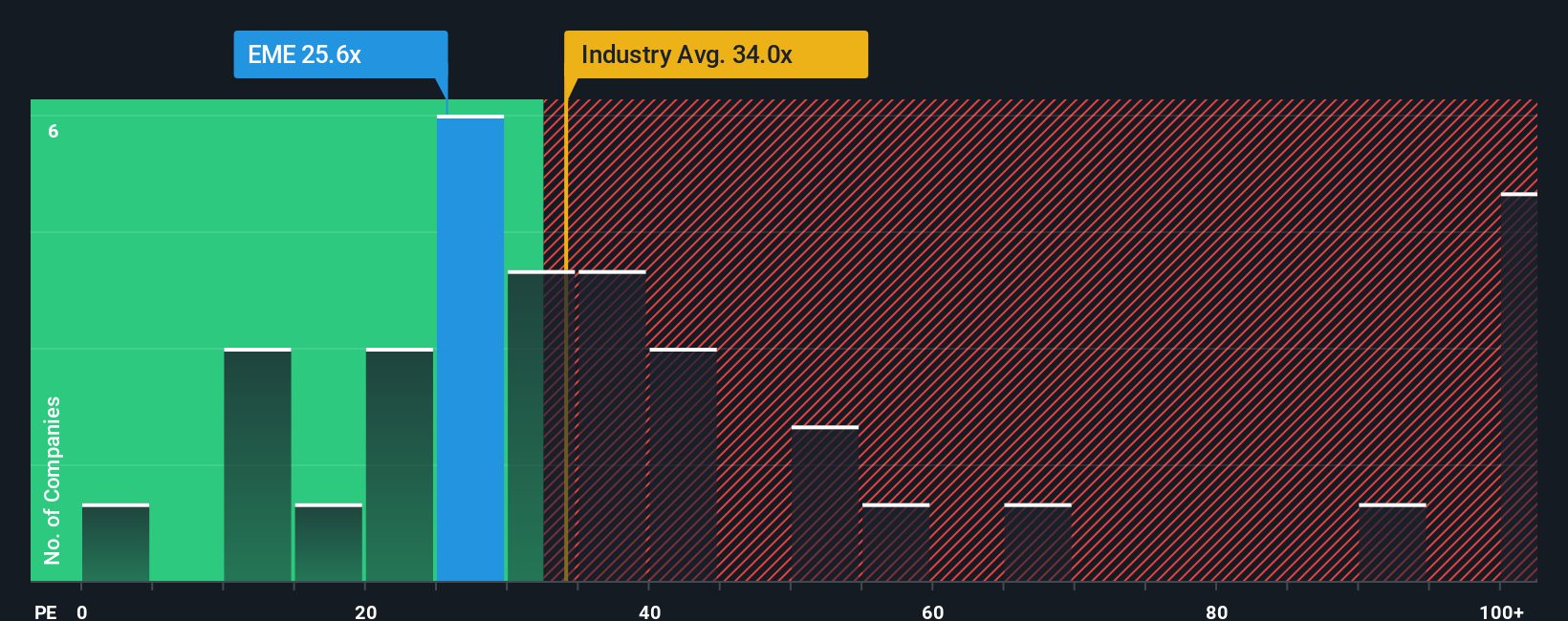

Currently, EMCOR trades at a PE ratio of 27.83x. For context, the average PE in the construction industry sits higher at 36.46x, and peer companies average an even loftier 48.72x. This suggests EMCOR is valued more conservatively on this metric. Enter Simply Wall St's “Fair Ratio,” which for EMCOR is calculated at 28.65x. This forward-looking figure considers not just historical earnings or peer comparisons, but also factors such as the company’s expected growth, industry position, profit margins, market size, and risk profile.

Unlike simple industry or peer averages, the Fair Ratio provides a tailored benchmark that better reflects EMCOR's unique strengths and challenges. Comparing EMCOR’s current PE of 27.83x to its Fair Ratio of 28.65x, the numbers are remarkably close, suggesting the market is pricing the stock almost exactly in line with what its fundamentals deserve.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your EMCOR Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a practical and insightful approach for making investment decisions that goes beyond just the numbers.

A Narrative is simply the story you believe about a company’s future, woven together with your own assumptions for things like fair value, future revenue growth, profit margins, and earnings. Rather than just relying on historic data or analyst averages, Narratives let you spell out the “why” behind your forecast, connecting the business's story and outlook directly to a fair value calculation.

On Simply Wall St’s Community page, millions of investors use Narratives to craft and share their perspectives, making it simple to see how different scenarios could play out and to identify when a stock might be undervalued or overvalued compared to your own expectations.

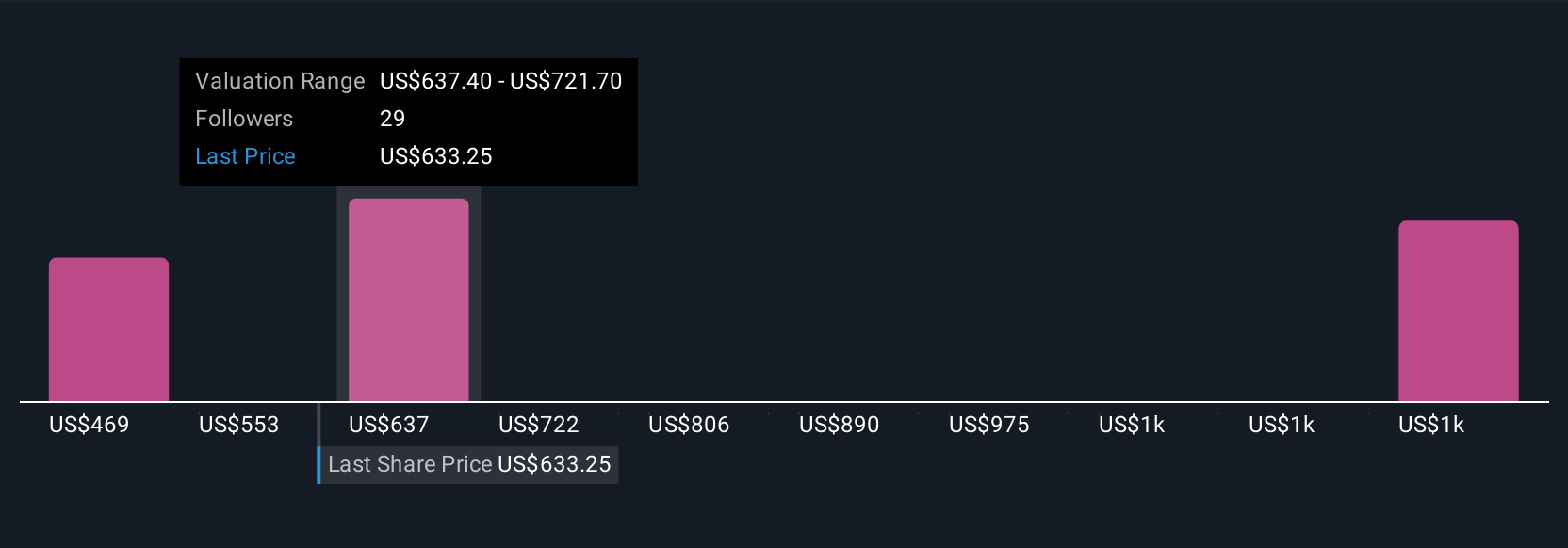

What makes Narratives powerful is their dynamic nature. They update automatically as new information or earnings are released, keeping your forecasts relevant and your decision making sharp. For example, one investor might build a Narrative for EMCOR Group using optimistic growth and margin assumptions, arriving at a fair value of $711.67 per share, while a more conservative investor could see fair value closer to $468.79, based on lower growth and different risks.

For EMCOR Group, we will make it easy for you with previews of two leading EMCOR Group Narratives:

- 🐂 EMCOR Group Bull Case

Fair Value: $711.67

Current Price is 3.43% above fair value

Revenue Growth Forecast: 9.8%

- Analyst consensus expects robust sector demand, digital integration, and sustainability trends to drive diversified revenue growth and margin expansion.

- Continued investment in talent, prefabrication, and strategic acquisitions positions EMCOR for greater efficiency and expanded market reach.

- Key risks include labor shortages, cyclical industry exposure, M&A integration, and limited focus on renewables. On average, analysts see shares as close to fairly valued.

- 🐻 EMCOR Group Bear Case

Fair Value: $468.79

Current Price is 46.6% above fair value

Revenue Growth Forecast: 9%

- Growth is expected from ongoing infrastructure projects, electrification trends, and data center expansion, but long-term assumptions are more conservative than consensus.

- Risks are heightened from industry cyclicality, rising labor costs, reliance on government spending, and supply chain pressures that could squeeze margins.

- This model values EMCOR below market, suggesting potential overvaluation at current prices despite strong fundamentals and positive industry drivers.

Do you think there's more to the story for EMCOR Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EMCOR Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EME

EMCOR Group

Provides electrical and mechanical construction and facilities, building, and industrial services in the United States and the United Kingdom.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives