- United States

- /

- Construction

- /

- NYSE:EME

EMCOR Group (EME) Is Up 5.6% After U.K. Divestiture and S&P Index Additions—Has Its Investment Case Shifted?

Reviewed by Sasha Jovanovic

- In late September 2025, EMCOR Group, Inc. announced the sale of its U.K. building services unit and was added to the S&P 500 Equal Weighted and S&P Global 1200 indices, while exiting the Russell Small Cap Composite Growth and Value Indexes.

- This sharpened U.S. focus, which includes fresh capital for domestic expansion, positions EMCOR to benefit from ongoing infrastructure and energy-related industry trends.

- To assess what these changes mean, we'll look at how EMCOR's U.K. divestiture and index additions may influence its investment outlook.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

EMCOR Group Investment Narrative Recap

For investors considering EMCOR Group, the central belief is that the company can convert a sharpened U.S. focus and growing infrastructure demand into sustained earnings and revenue growth. The recent sale of its U.K. business and its addition to major indices may help support near-term momentum by concentrating resources at home, but these moves do not materially alter the most pressing catalyst, infrastructure expansion, or the company’s greatest risk, which remains cost pressure from persistent labor shortages.

Among recent developments, EMCOR’s Q2 2025 earnings report stands out, with both revenue and net income showing year-over-year growth. This result underscores the near-term catalyst of strong demand for domestic construction and retrofit projects, particularly as the company pivots further toward high-margin U.S. activities.

In contrast, investors should be aware of ongoing labor market constraints and rising wage costs that could compress margins if...

Read the full narrative on EMCOR Group (it's free!)

EMCOR Group's outlook anticipates $20.6 billion in revenue and $1.4 billion in earnings by 2028. This scenario is based on a 9.7% annual revenue growth rate and a $300 million increase in earnings from the current $1.1 billion.

Uncover how EMCOR Group's forecasts yield a $681.67 fair value, a 3% upside to its current price.

Exploring Other Perspectives

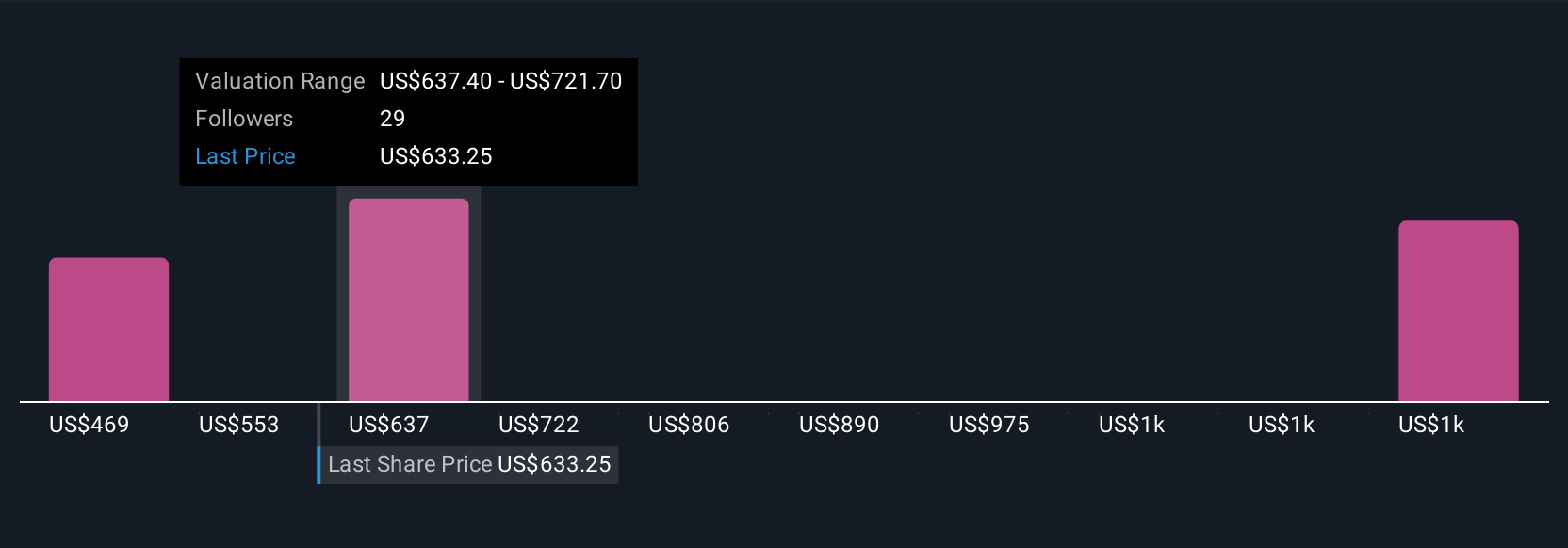

Fair value estimates from six Simply Wall St Community members range widely, from US$468.79 to US$1,310.09 per share. While many expect earnings growth to continue, persistent labor shortages remain a concern for future margins and profitability. Explore how these diverse viewpoints could affect your assessment of EMCOR's performance.

Explore 6 other fair value estimates on EMCOR Group - why the stock might be worth as much as 98% more than the current price!

Build Your Own EMCOR Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EMCOR Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free EMCOR Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EMCOR Group's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EMCOR Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EME

EMCOR Group

Provides electrical and mechanical construction and facilities, building, and industrial services in the United States and the United Kingdom.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives