- United States

- /

- Construction

- /

- NYSE:ECG

Here's Why Everus Construction Group (NYSE:ECG) Can Manage Its Debt Responsibly

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Everus Construction Group, Inc. (NYSE:ECG) makes use of debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

How Much Debt Does Everus Construction Group Carry?

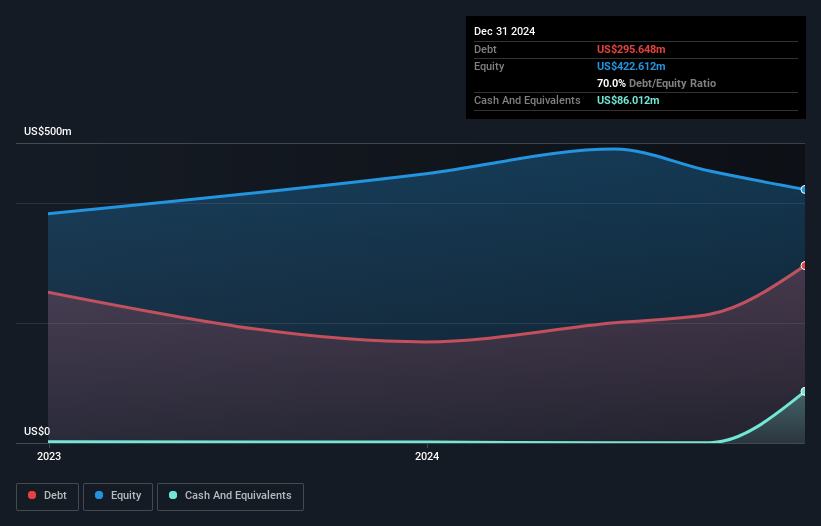

The image below, which you can click on for greater detail, shows that at December 2024 Everus Construction Group had debt of US$295.6m, up from US$168.5m in one year. On the flip side, it has US$86.0m in cash leading to net debt of about US$209.6m.

How Strong Is Everus Construction Group's Balance Sheet?

According to the last reported balance sheet, Everus Construction Group had liabilities of US$513.4m due within 12 months, and liabilities of US$352.5m due beyond 12 months. On the other hand, it had cash of US$86.0m and US$757.1m worth of receivables due within a year. So it has liabilities totalling US$22.8m more than its cash and near-term receivables, combined.

This state of affairs indicates that Everus Construction Group's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So while it's hard to imagine that the US$1.71b company is struggling for cash, we still think it's worth monitoring its balance sheet.

Check out our latest analysis for Everus Construction Group

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Everus Construction Group has a low net debt to EBITDA ratio of only 0.97. And its EBIT easily covers its interest expense, being 13.5 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. While Everus Construction Group doesn't seem to have gained much on the EBIT line, at least earnings remain stable for now. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Everus Construction Group can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. In the last three years, Everus Construction Group's free cash flow amounted to 35% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

Everus Construction Group's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But truth be told we feel its conversion of EBIT to free cash flow does undermine this impression a bit. Looking at all the aforementioned factors together, it strikes us that Everus Construction Group can handle its debt fairly comfortably. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 3 warning signs we've spotted with Everus Construction Group (including 1 which can't be ignored) .

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Everus Construction Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ECG

Everus Construction Group

Provides contracting services in the United States.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives