- United States

- /

- Construction

- /

- NYSE:DY

Will Gallagher’s Board Appointment Deepen Dycom’s (DY) Competitive Edge in Technology Operations?

Reviewed by Sasha Jovanovic

- Dycom Industries, Inc. recently appointed Phillip R. Gallagher, CEO of Avnet, Inc., to its Board of Directors, effective October 7, 2025, aiming to enhance board expertise with his extensive background in global technology distribution and operations.

- This addition is anticipated to provide the company with enhanced industry insight and operational knowledge, which aligns with Dycom's ongoing focus on strengthening its strategy and long-term value creation.

- We'll explore how Gallagher's appointment to the board could influence Dycom's long-term outlook and support its growth-focused investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Dycom Industries Investment Narrative Recap

To be a Dycom Industries shareholder, you need to believe in the multi-year fiber and data center buildout cycle, with growing infrastructure investment from major telecom and hyperscaler customers. The recent appointment of Phillip R. Gallagher to the board brings new operational and industry experience, but does not materially alter the near-term catalysts or mitigate Dycom’s largest risk: significant customer concentration, particularly reliance on AT&T and Lumen for a sizeable share of revenue.

Among recent announcements, Dycom’s Q2 earnings stood out, showing robust growth in both revenue and profit. This performance underscores the near-term catalyst of higher capital spending from telecom clients, supporting backlog expansion even as investors monitor the pace of fiber project rollouts and the long-term demand outlook.

In contrast, investors should be aware that heavy reliance on a limited group of customers could expose Dycom to earnings swings if spending priorities shift or major contracts are lost...

Read the full narrative on Dycom Industries (it's free!)

Dycom Industries' outlook anticipates $6.6 billion in revenue and $424.6 million in earnings by 2028. This projection is based on a 9.7% annual revenue growth rate and an increase in earnings of $163.6 million from the current $261.0 million level.

Uncover how Dycom Industries' forecasts yield a $297.89 fair value, in line with its current price.

Exploring Other Perspectives

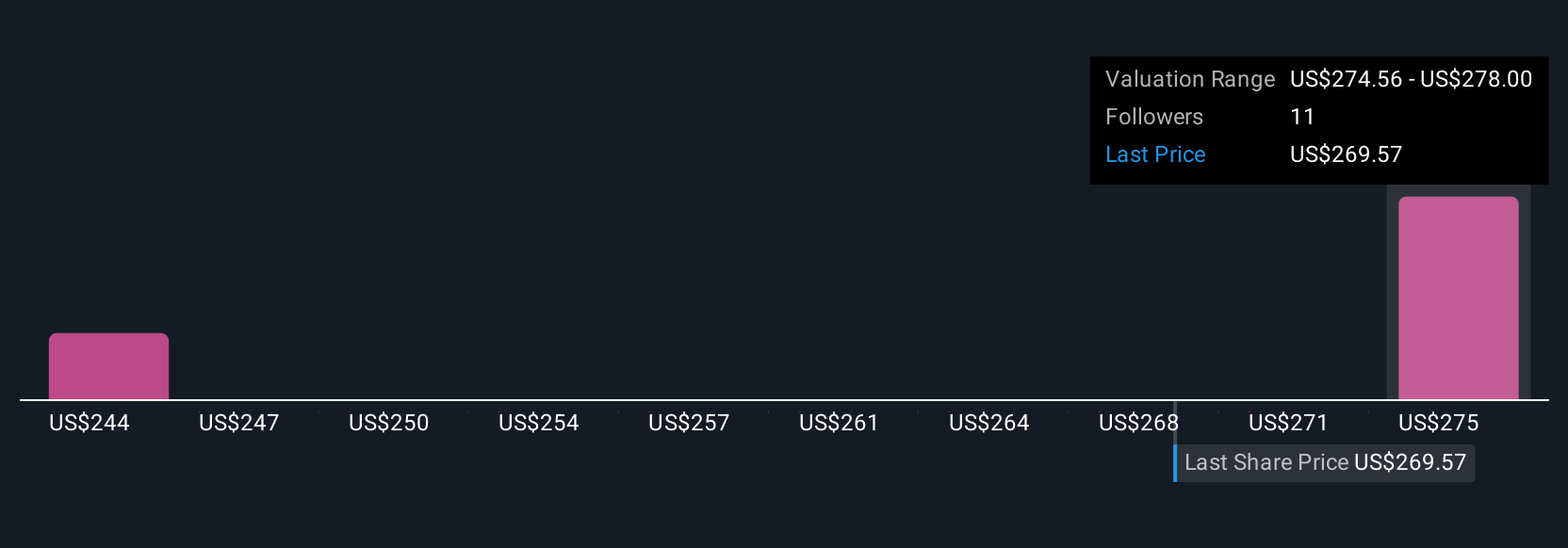

Fair value estimates from the Simply Wall St Community, based on two independent forecasts, span from US$208 to US$298 per share. While broader industry tailwinds drive optimism, persistent revenue concentration risk remains a central consideration for those weighing Dycom’s long-term performance. Explore the range of perspectives to inform your own view.

Explore 2 other fair value estimates on Dycom Industries - why the stock might be worth as much as $297.89!

Build Your Own Dycom Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dycom Industries research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dycom Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dycom Industries' overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DY

Dycom Industries

Provides specialty contracting services to the telecommunications infrastructure and utility industries in the United States.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives