- United States

- /

- Trade Distributors

- /

- NYSE:DNOW

Did Analyst Upgrades and Sector Outperformance Just Shift DNOW's (DNOW) Investment Narrative?

Reviewed by Sasha Jovanovic

- Recently, DNOW earned a Zacks Rank of #2 and saw its full-year earnings estimate rise by 9.2% over the past 90 days, reflecting improved analyst sentiment and a stronger earnings outlook.

- This optimism has coincided with DNOW's outperformance of the Industrial Products sector in year-to-date returns, underscoring positive momentum relative to peers.

- Given this increase in consensus earnings estimates, we'll explore what these developments could mean for DNOW's investment narrative moving forward.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

DNOW Investment Narrative Recap

To be a shareholder in DNOW right now, you would need confidence in the company’s ability to grow earnings and cash flow amid the ongoing transformation of the energy sector, while staying competitive in industrial distribution. The recent Zacks Rank upgrade and consensus earnings revision highlight improved sentiment, but do not fundamentally shift the short-term catalysts or risks: DNOW remains sensitive to rig counts, customer activity, and pricing competition, so the core narrative holds steady for now.

Among the latest announcements, the reaffirmation of financial guidance for 2025 is the most relevant, underscoring management’s confidence despite sector volatility and recent fluctuations in sales. This ties back to the key catalyst of continued M&A and midstream market expansion, supporting potential earnings growth if industry conditions remain supportive.

However, it’s important to remember that while rising analyst expectations and sector outperformance are encouraging, persistent weakness in US rig counts could quickly undermine revenue, and this is something investors should be aware of as...

Read the full narrative on DNOW (it's free!)

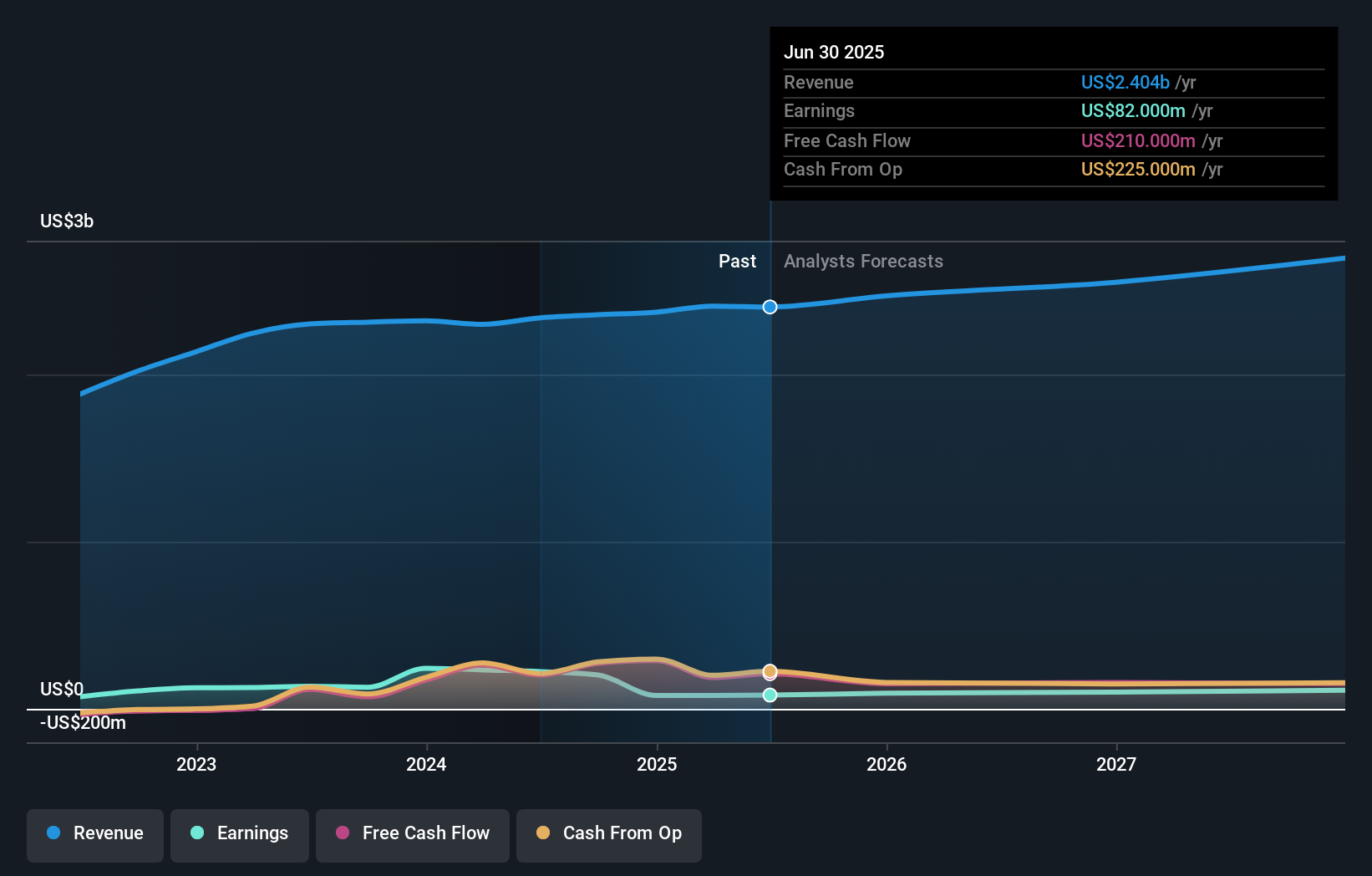

DNOW's outlook anticipates $2.5 billion in revenue and $61.4 million in earnings by 2027. This is based on a 2.5% annual revenue growth rate, but reflects a significant earnings decrease of $161.6 million from current earnings of $223.0 million.

Uncover how DNOW's forecasts yield a $17.00 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have published fair value estimates for DNOW ranging from US$17.00 to US$30.44, with 2 unique viewpoints. In light of analyst concerns about declining rig activity, these differences signal why it’s worth exploring multiple takes on DNOW’s outlook.

Explore 2 other fair value estimates on DNOW - why the stock might be worth just $17.00!

Build Your Own DNOW Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DNOW research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DNOW research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DNOW's overall financial health at a glance.

No Opportunity In DNOW?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DNOW

DNOW

Distributes downstream energy and industrial products for petroleum refining, chemical processing, LNG terminals, power generation, gas utilities, and customer on-site and off-site locations in the United States, Canada, the United Kingdom, Norway, Australia, the Netherlands, Singapore, and the Middle East.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives