- United States

- /

- Machinery

- /

- NYSE:DE

Is Deere’s Stock Price Attractive After Antitrust Inquiry Into Crop Suppliers?

Reviewed by Bailey Pemberton

Thinking about what to do with Deere stock? You are not alone. Whether you are watching from the sidelines or already in for the long haul, it is easy to see why Deere captures so much interest. In the past year alone, shares have climbed 13.8%, with a steady 9.6% gain year to date. That is impressive, but if you zoom out even further, the stock is up a massive 104.2% over five years. Yet, the ride has not always been smooth. Over the last month, shares have eased back 2.3%, even as they rose 2.7% in just the past week, reflecting how quickly Wall Street's mood can shift around this industrial heavyweight.

Several recent headlines have played into these shifts. News of antitrust investigations into crop suppliers may shape the field Deere sells into, while past impacts from tariffs and struggling U.S. farmers highlight the challenges the company faces from both global politics and local realities. Despite these crosswinds, the conversation increasingly circles around a central question: is Deere undervalued at current prices, especially with its most recent close at $458.5?

This is where it gets interesting. Deere earns a value score of 5 out of 6, meaning the stock checks the box for undervaluation in five key metrics. That is not just impressive on paper; it is a solid signal for investors looking for quality at a fair price. But before you make any decisions based on tradition or hunches, let us dig into which valuation methods matter most. Stay tuned, because we will wrap up with an even sharper way to look at valuation opportunities.

Approach 1: Deere Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true value by projecting its future cash flows and discounting them back to today’s dollars. In simple terms, it tries to answer: how much are all of Deere’s future profits worth right now?

Currently, Deere generates about $4.83 billion in Free Cash Flow (FCF) annually. Analysts predict strong growth in these cash flows, with projections reaching $12.04 billion by 2029. Over the next decade, additional estimates—some based on analyst input and others extrapolated by valuation models—show Deere’s annual cash flow rising steadily, surpassing $21.9 billion by 2035. All of these figures are calculated in US dollars, which provides a consistent basis for comparison.

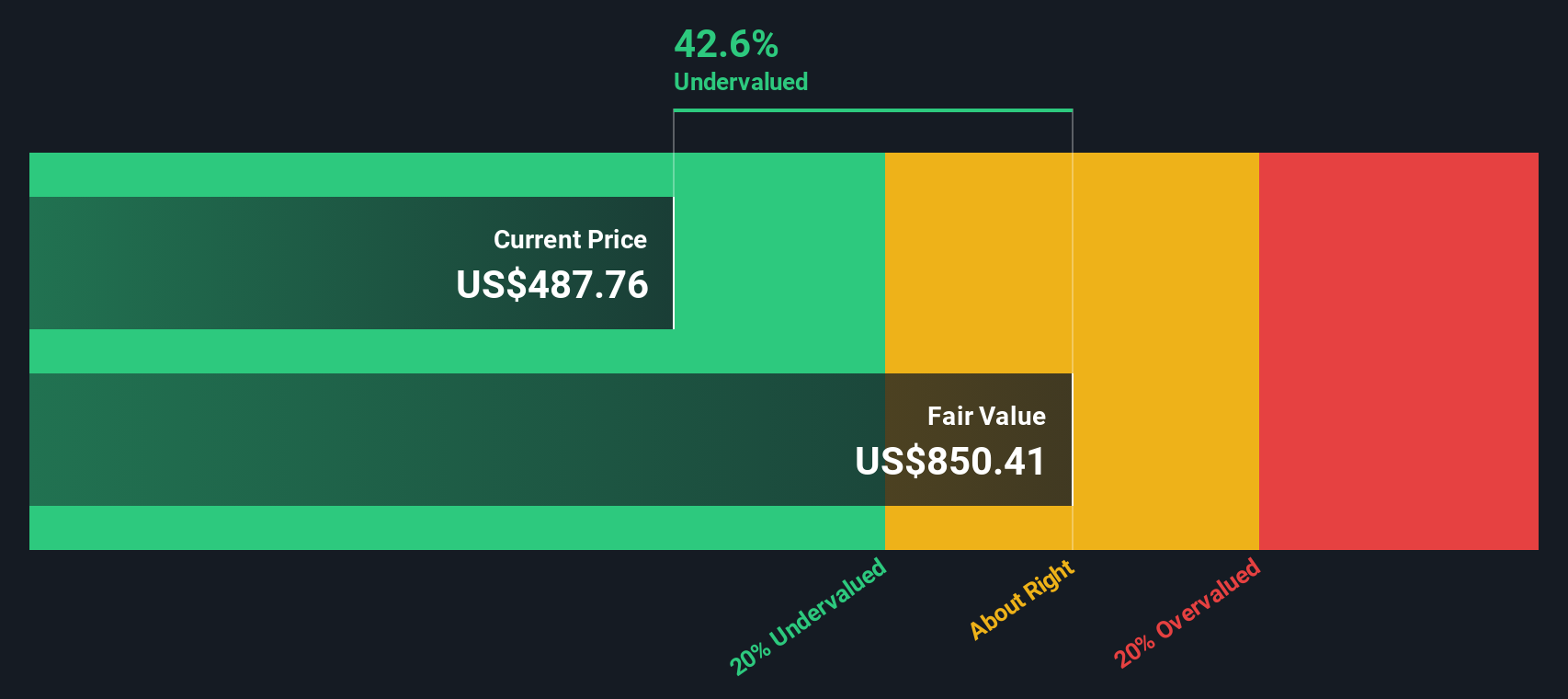

Based on this method, the estimated intrinsic value for Deere stock comes to $823.71 per share. With the stock trading at $458.50, this suggests the shares are trading at a 44.3% discount to their fair value. By this measure, Deere may offer a compelling opportunity for value-focused investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Deere is undervalued by 44.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Deere Price vs Earnings

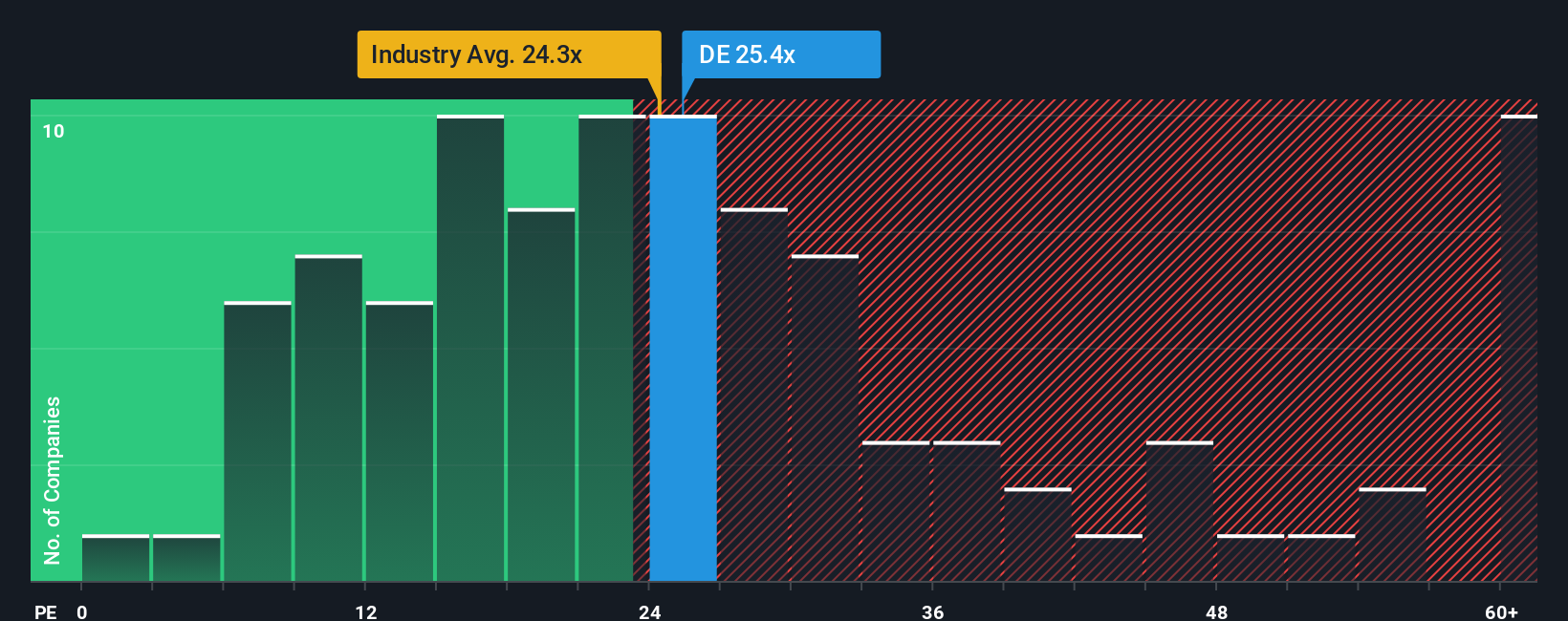

The Price-to-Earnings (PE) ratio is widely used for valuing profitable companies because it measures how much investors are willing to pay today for a dollar of current earnings. For established and consistently profitable businesses like Deere, the PE ratio offers a simple and effective way to gauge market expectations and overall sentiment.

What constitutes a “normal” or “fair” PE ratio depends largely on how quickly a company is expected to grow and the risks it faces. Higher expected growth or lower risk can justify paying a higher multiple, while slow growth or significant uncertainties usually mean a lower PE is warranted.

At present, Deere’s PE ratio is 23.8x. Comparing this to the Machinery industry average of 24.2x and major peers averaging 34.2x, Deere trades a little below both benchmarks. At first glance, this may suggest the market is taking a slightly more cautious stance with Deere compared to its rivals.

This is where Simply Wall St’s Fair Ratio comes in. The Fair Ratio for Deere is calculated at 33.6x and factors in a fuller picture beyond just what peers or industry averages reveal. It includes the company’s unique earning power, growth outlook, margins, risk profile, and size. Because the Fair Ratio takes these broader considerations into account, it provides a more personalized benchmark of what would be a reasonable PE for Deere specifically.

With Deere’s real PE at 23.8x compared to a Fair Ratio of 33.6x, there is a clear gap. This suggests the market may be undervaluing Deere’s earnings potential relative to its growth and risk-adjusted fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Deere Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative connects your perspective on a company, explaining why you think it will succeed or face headwinds, to your own financial forecast and estimates of fair value. Instead of just relying on ratios or models, you can tell the story behind your investment: what you believe about Deere’s future revenue, profits, and margins, and how those beliefs shape your opinion of whether it is undervalued or overvalued today.

Narratives tie together the big picture and the numbers, transforming investing from a numbers game into a more personalized and dynamic process. They are quick to create and update, and on Simply Wall St’s Community page, millions of investors use Narratives to share and compare their forecasts. Narratives are especially powerful because they automatically update with new market-moving information, such as earnings or important news, helping you stay on top of your assumptions without extra work.

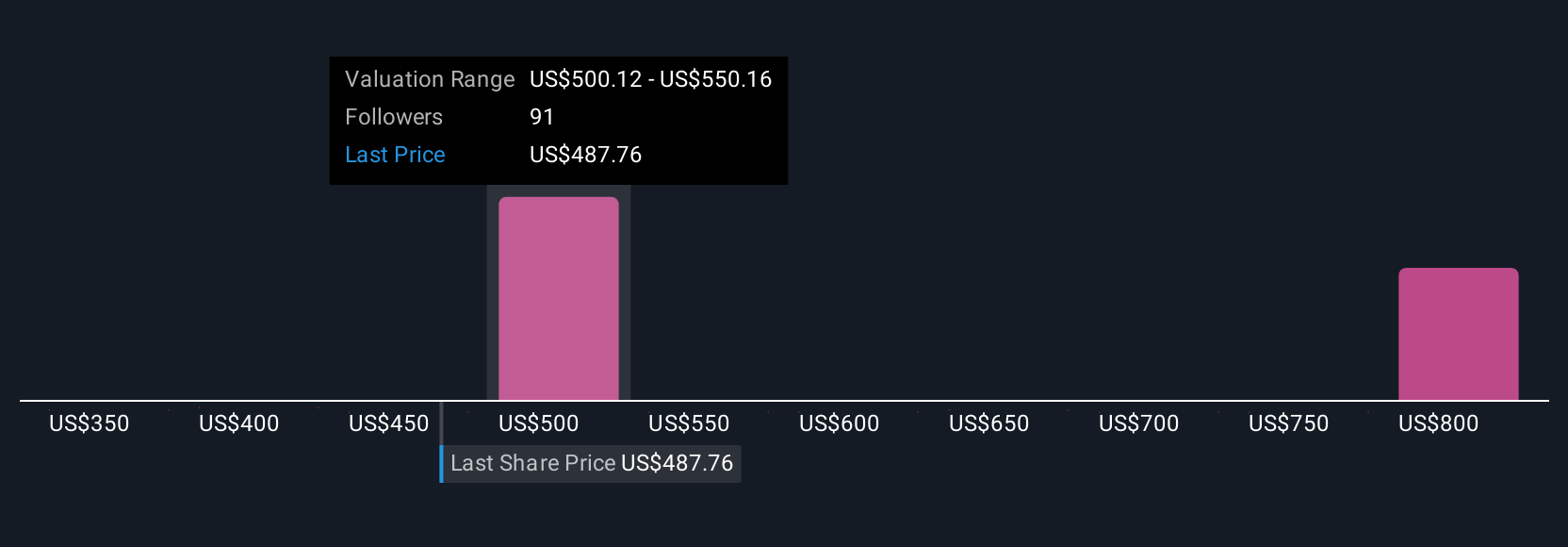

For example, two investors looking at Deere might arrive at very different price targets. One, believing in rapid automation growth and global expansion, could project a fair value of over $724. Another, cautious about tariffs and volatile farm demand, might see a fair value closer to $460. Narratives let you visualize these differing outlooks so you can make decisions based on a story and fair value estimate that fits your own reasoning.

Do you think there's more to the story for Deere? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DE

Deere

Engages in the manufacture and distribution of various equipment worldwide.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives