- United States

- /

- Machinery

- /

- NYSE:DCI

Donaldson Company (DCI): Assessing Valuation After One-Off Earnings Items Shift Underlying Profit Picture

Reviewed by Kshitija Bhandaru

Donaldson Company (DCI) recently reported earnings that looked softer on the surface. However, once one-off items are factored out, the underlying profit story appears much more upbeat for investors and shareholders.

See our latest analysis for Donaldson Company.

Despite the initial headline concerns around Donaldson Company's latest earnings, the stock itself has been telling a resilient story. Over the past year, the company delivered a 15.41% total shareholder return. The share price has rallied 23.42% year-to-date and steadily advanced 15.96% over the past 90 days. Momentum clearly seems to be building, likely reflecting investor optimism about the company's underlying profit growth and the prospect that one-off earnings items may not repeat.

If you're watching this momentum and looking for your next idea, broaden your investing horizons and discover fast growing stocks with high insider ownership

With earnings affected by one-off items and share price gains outpacing recent analyst targets, it is worth asking if Donaldson Company is now undervalued, or if the market is already pricing in future growth potential and upside.

Most Popular Narrative: Fairly Valued

Donaldson Company's latest close at $83.05 is nearly identical to the most widely followed narrative's fair value estimate of $80, suggesting little room for mispricing, at least according to analyst and market consensus. This sets the backdrop for a careful look at the core assumptions powering this valuation.

Global expansion of environmental regulations and emissions standards is increasing demand for advanced filtration across industrial and transportation sectors, positioning Donaldson to achieve record sales in both Industrial Solutions and Mobile Solutions, with a direct positive impact on revenue and earnings growth in FY26 and beyond.

Curious what financial leap powers these forecasts? The narrative hints at breakthrough growth for key segments and powerful gains in margins, yet relies on projections the market doesn’t usually apply to this kind of business. Want to know what assumptions unlock this valuation? Find out the ingredients behind the price.

Result: Fair Value of $80 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent delays in bioprocessing and heavy reliance on aftermarket sales could limit Donaldson Company's long-term revenue and margin expansion.

Find out about the key risks to this Donaldson Company narrative.

Another View: Discounted Cash Flow Perspective

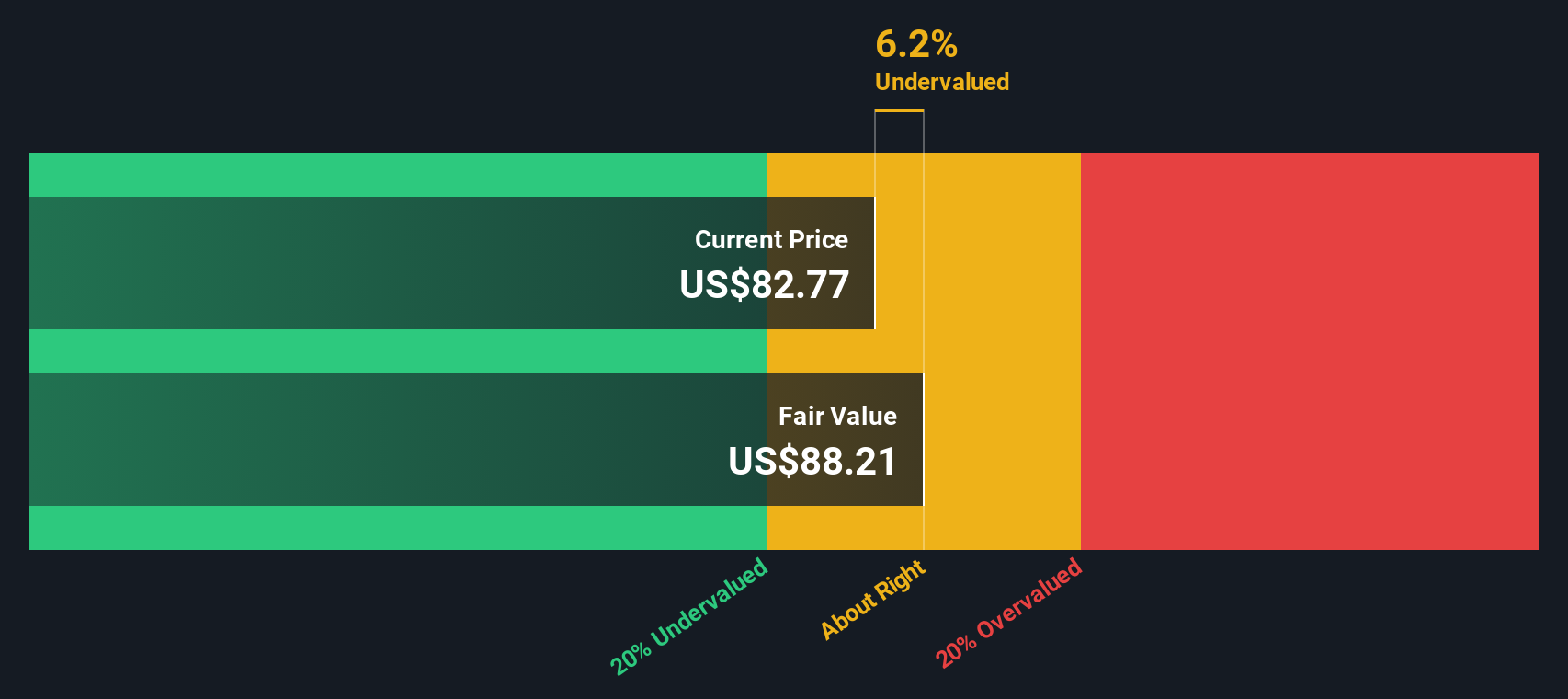

While the market and analyst consensus suggest Donaldson Company is fairly valued, our DCF model presents a different picture. Based on forecasted cash flows, the SWS DCF model currently values the stock at $88.71, which is about 6.4% above the present share price. Could this indicate untapped upside for investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Donaldson Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Donaldson Company Narrative

If you have a different perspective or want to dig into the numbers personally, it's quick and easy to craft your own view in just a few minutes, so why not Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Donaldson Company.

Looking for more investment ideas?

The market keeps moving. Seize the moment and arm yourself with timely, high-potential opportunities. Don’t let tomorrow’s winners pass you by.

- Zero in on future market leaders by scanning these 25 AI penny stocks. These companies are set to transform industries through artificial intelligence and automation.

- Maximize potential long-term gains as you evaluate these 888 undervalued stocks based on cash flows, which highlights under-the-radar opportunities based on solid cash flow fundamentals.

- Uncover exciting innovations with these 78 cryptocurrency and blockchain stocks, featuring companies pushing the boundaries in blockchain and cryptocurrency solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DCI

Donaldson Company

Manufactures and sells filtration systems and replacement parts worldwide.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives