- United States

- /

- Aerospace & Defense

- /

- NYSE:CW

Is Curtiss-Wright’s Recent Aerospace Expansion Justifying Its Rapid 64% Share Price Surge?

Reviewed by Bailey Pemberton

Are you watching Curtiss-Wright right now, unsure whether it is time to buy, hold, or trim your position? If so, you are not alone. This stock has been an undeniable powerhouse, gaining an impressive 64.3% over the last year, 244.9% over the past three years, and increasing more than 550% over five years. Just in the first seven days, it is up 2.1% and has rallied 8.9% over the past month. Those numbers certainly catch the eye of any investor looking for strong momentum and steady leadership in its sector.

Recent headlines continue to shine a positive light on Curtiss-Wright, with industry watchers pointing to its expansion into cutting-edge aerospace technologies and strong government contracting activities as reasons for continued confidence. This steady drumbeat of favorable news appears to support the perception that risk for shareholders has diminished somewhat and may help explain the significant rise in share price. However, as share prices climb, the question of valuation becomes more important than ever.

Curtiss-Wright’s current value score is 0 out of 6, suggesting it is not undervalued by any major metric in our standard framework. While the growth story is exciting and recent news paints a picture of opportunity, valuation matters. So, let us break down the different ways investors typically evaluate a stock like Curtiss-Wright. Continue reading to learn about an even more effective way to cut through all the noise later in the article.

Curtiss-Wright scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Curtiss-Wright Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s true value by projecting all expected future cash flows and “discounting” them back to today’s dollars. In Curtiss-Wright's case, this involves extrapolating its free cash flow (FCF) and then calculating what that stream is worth in today's terms.

Curtiss-Wright currently generates $518.0 Million in free cash flow annually. Analyst projections expect FCF to steadily grow and reach $700.8 Million by 2029. While forecasts out to 2029 come from industry analysts, projections out to 2035 are extended using modest growth rates to provide a full 10-year view.

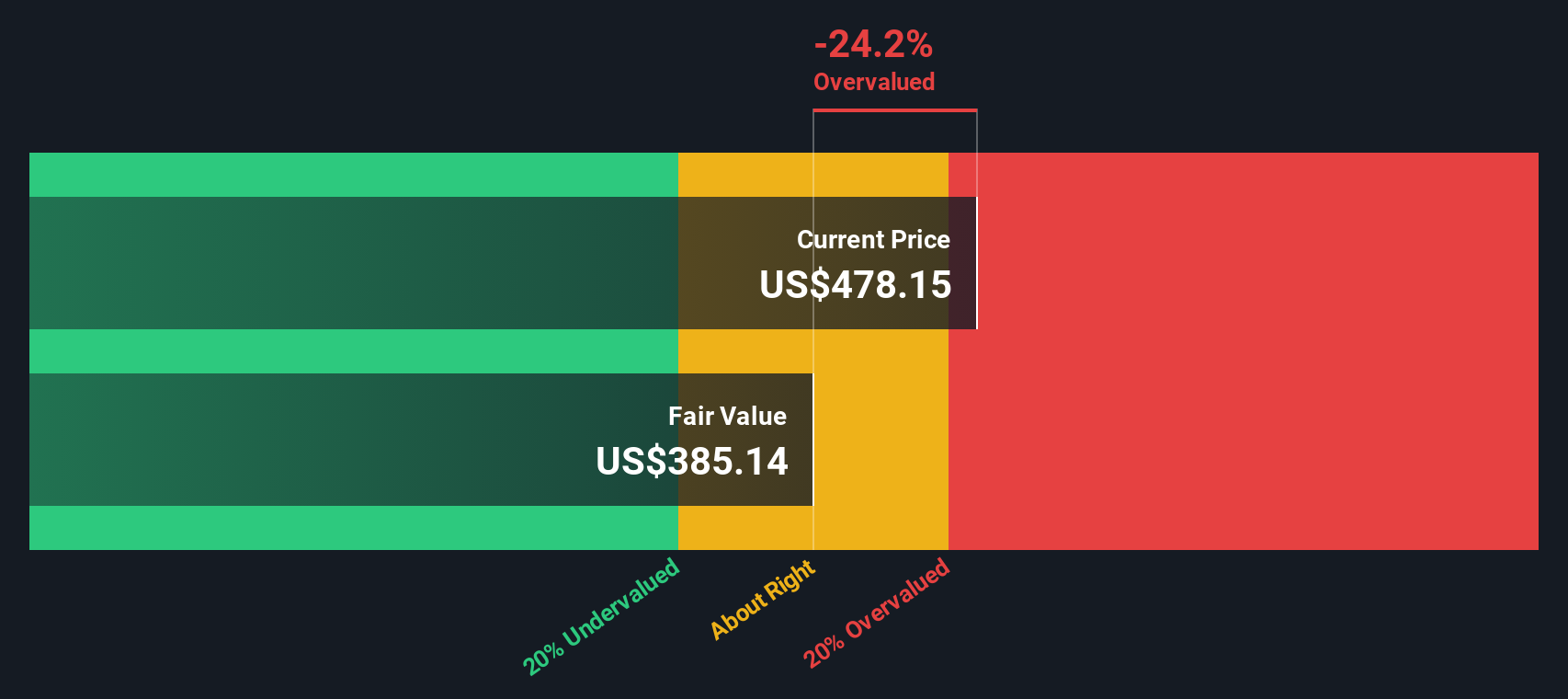

Taking all of these future cash flows into account, the DCF model calculates Curtiss-Wright's intrinsic value at $378.87 per share. This is based on the 2 Stage Free Cash Flow to Equity framework, which is widely accepted for its balance of rigor and practical realism.

When comparing the intrinsic value to the current share price, the model indicates Curtiss-Wright is trading at a 51.3% premium. This suggests it is strongly overvalued using this approach.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Curtiss-Wright may be overvalued by 51.3%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Curtiss-Wright Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely accepted metric for valuing profitable companies like Curtiss-Wright, as it directly compares a company’s share price to its earnings. Investors use the PE ratio to quickly gauge how much they are paying for each dollar of a company’s profit. Higher growth expectations or lower risk can justify a higher PE ratio. Conversely, slower growth or higher uncertainty often results in a lower fair multiple.

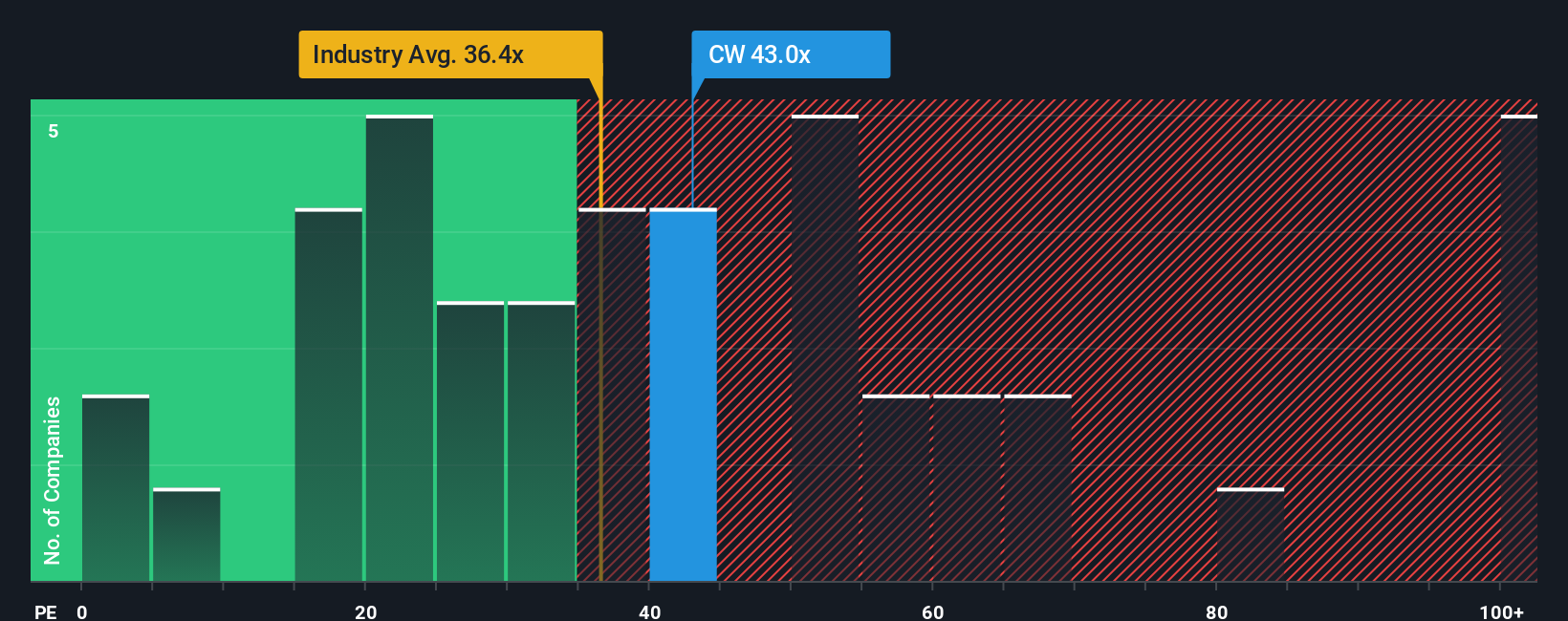

Curtiss-Wright currently trades at a PE ratio of 47.8x. This is noticeably higher than both the Aerospace & Defense industry average of 40.9x and the peer average of 40x. While these benchmarks provide a broad sense of market sentiment, they do not take into account Curtiss-Wright’s unique mix of growth potential, profitability, and risk.

Simply Wall St’s Fair Ratio addresses this gap. The Fair Ratio, calculated at 25.8x for Curtiss-Wright, adjusts for factors such as the company’s expected earnings growth, industry outlook, profit margins, market cap, and risk profile. Unlike basic peer or industry comparisons, the Fair Ratio offers a nuanced benchmark tailored to the company’s specific fundamentals and future prospects.

Compared to its Fair Ratio of 25.8x, Curtiss-Wright’s current multiple of 47.8x is significantly higher, suggesting the stock may be overvalued on this metric as well.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Curtiss-Wright Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives are a simple and transformative approach to investing. With Narratives, you connect your view of a company’s story—its opportunities, risks, and future prospects—directly to financial forecasts. These forecasts then drive a fair value estimate for the stock.

Unlike traditional methods that rely solely on formulas or ratios, Narratives allow you to anchor your beliefs about revenue growth, profit margins, or market trends into a living forecast. On Simply Wall St’s platform, Narratives are easily accessible via the Community page, which is used by millions of investors. This setup allows anyone to create, view, or debate different perspectives about Curtiss-Wright’s future.

Narratives show you in real time if your story, built on your assumptions, suggests a stock is undervalued or overvalued because the fair value is always compared to the latest share price. As new earnings, contract wins, or sector news reach the market, Narratives update automatically, so your investment view stays current.

For Curtiss-Wright, some investors might build a Narrative forecasting high double-digit growth and assign a fair value close to the latest bullish analyst price target of $572. Others may take a more cautious stance, projecting slower growth and a fair value near $457. This demonstrates how different perspectives can lead to different investment decisions.

Do you think there's more to the story for Curtiss-Wright? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CW

Curtiss-Wright

Provides engineered products, solutions, and services mainly to aerospace and defense, commercial power, process, and industrial markets worldwide.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives