- United States

- /

- Aerospace & Defense

- /

- NYSE:CW

Curtiss-Wright (CW): Is the Current Valuation Justified After Recent Share Price Cooling?

Reviewed by Simply Wall St

See our latest analysis for Curtiss-Wright.

This week’s dip comes after Curtiss-Wright delivered an exceptional run earlier in the year, with momentum steadily cooling off from sharp gains. While the 1-day and 7-day share price returns have slipped, the stock still boasts a robust year-to-date price return of 55.45%. Long-term investors have seen outsized total shareholder returns, including 51.52% over the past year and more than tripling their investment over five years.

If Curtiss-Wright’s recent moves have you wondering what else is out there, this might be the right moment to explore See the full list for free.

But after a year of strong returns and a solid business trajectory, is Curtiss-Wright still trading below its true worth, or have investors already accounted for all the upside? Could a real buying opportunity remain, or is future growth fully priced in?

Most Popular Narrative: 4.1% Undervalued

With Curtiss-Wright closing at $546.16 and the most widely followed narrative assigning fair value at $569.50, the stock stands out just below its projected worth. This slim gap raises questions about what is fueling the optimism behind the latest fair value call.

Rising defense spending and nuclear sector growth are driving sustained long-term revenue and margin expansion, with strong international demand and a robust order pipeline. The company's focus on advanced technologies, disciplined capital allocation, and expanded shareholder returns positions it for profitable growth and potential market undervaluation.

Want to know what assumptions ignite this bullish view? A blend of global tailwinds, aggressive margin plans, and bold forward earnings shape the story. Get the inside scoop on the numbers and see what might surprise the market next.

Result: Fair Value of $569.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on major defense and nuclear contracts, along with rapid shifts toward software solutions, could disrupt Curtiss-Wright’s growth outlook ahead.

Find out about the key risks to this Curtiss-Wright narrative.

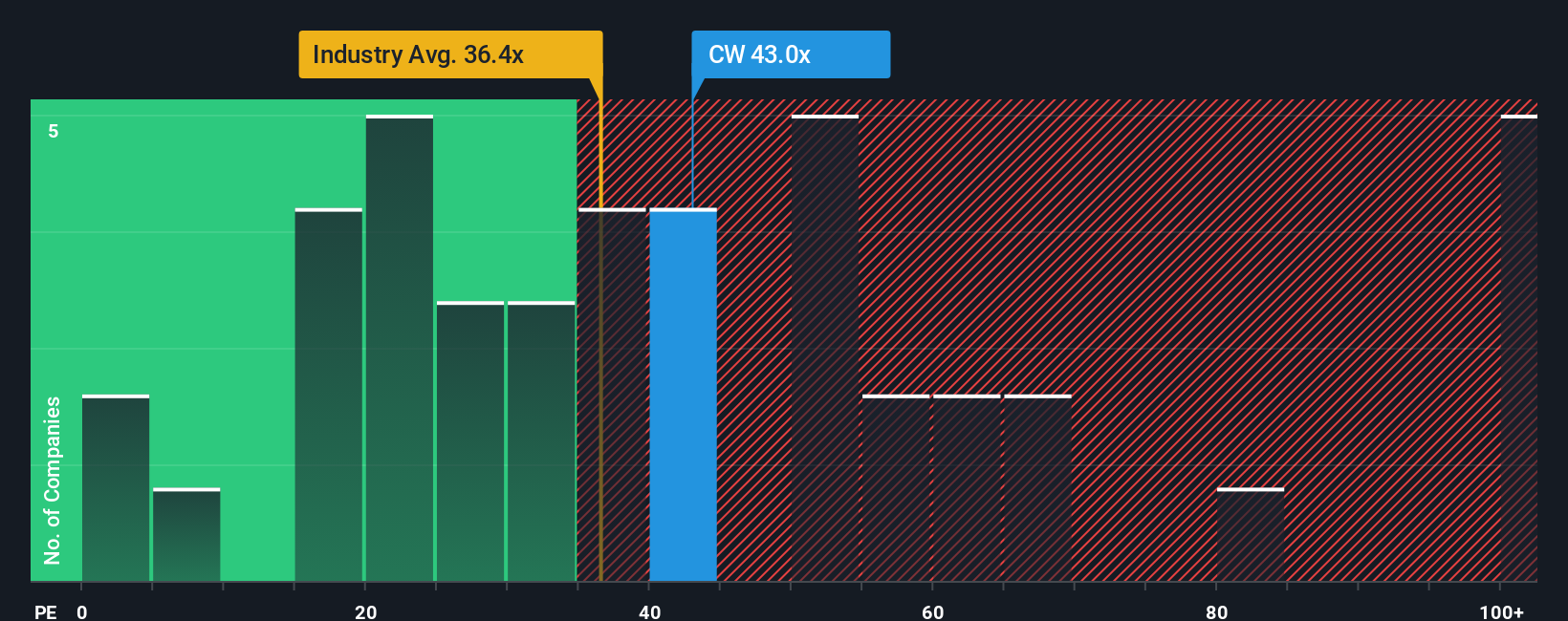

Another View: High Multiple Signals Caution

Looking beyond fair value estimates, the market’s pricing tells a different story. Curtiss-Wright is currently trading at a price-to-earnings ratio of 43.3x. This is well above both the US Aerospace & Defense industry average of 38.7x and its peer average of 37.5x. It also sits far above the fair ratio of 27.2x, which the market could eventually revert to. This premium means investors are taking on more valuation risk at current levels. So is the market betting too much on the company’s potential?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Curtiss-Wright Narrative

If the current story doesn't reflect your perspective, or you're eager to run the numbers yourself, you can craft your own in just a few minutes using Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Curtiss-Wright.

Looking for More Investment Ideas?

Don't miss your next winning move. Simply Wall Street's powerful screener uncovers standout investment opportunities across fast-moving markets, helping you stay ahead of the crowd.

- Earn passive income by scanning these 15 dividend stocks with yields > 3% boasting attractive yields greater than 3%, perfectly suited for income-focused portfolios.

- Target companies driving breakthroughs in artificial intelligence by exploring these 27 AI penny stocks and position yourself at the forefront of innovation.

- Capitalize on value by tracking these 868 undervalued stocks based on cash flows that offer growth potential based on cash flows, giving you an edge the market may overlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CW

Curtiss-Wright

Provides engineered products, solutions, and services mainly to aerospace and defense, commercial power, process, and industrial markets worldwide.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives