- United States

- /

- Construction

- /

- NYSE:CTRI

The Bull Case For Centuri Holdings (CTRI) Could Change Following Appointment of Ryan Palazzo as U.S. Gas President

Reviewed by Sasha Jovanovic

- Centuri Holdings, Inc. recently announced the appointment of Ryan Palazzo as President of U.S. Gas, entrusting him with leadership of a segment that contributes approximately half of the company’s total revenue.

- Palazzo’s three decades of leadership in pipeline and energy infrastructure, including recent success in driving revenue for major firms, positions Centuri to potentially strengthen its operational and growth initiatives in the U.S. gas market.

- We'll examine how Ryan Palazzo's extensive industry experience may influence Centuri Holdings' investment narrative going forward.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Centuri Holdings' Investment Narrative?

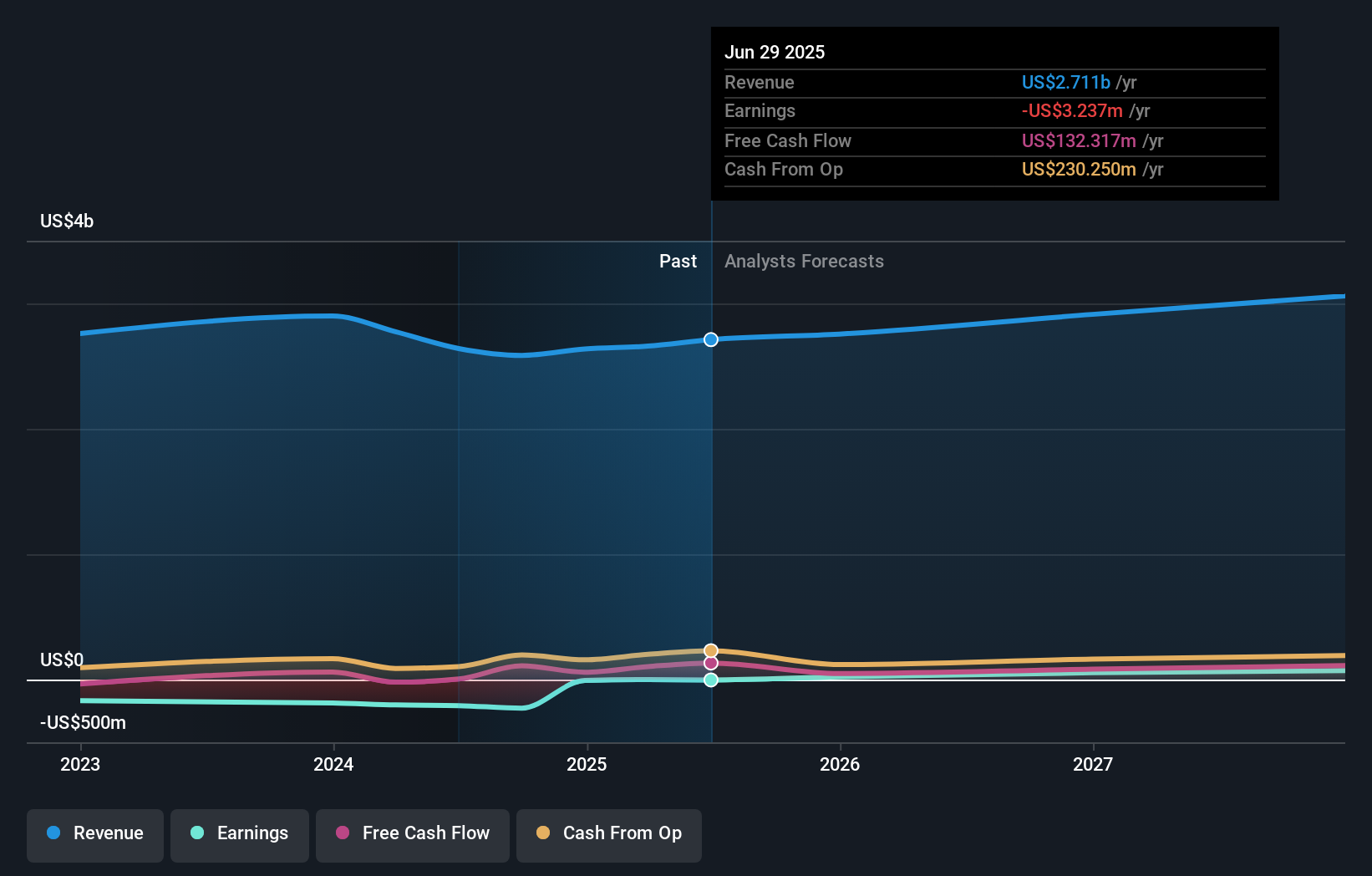

For Centuri Holdings, the investment story often hinges on belief in the company’s capacity to translate growing infrastructure contract wins into lasting profitability and margin improvements. The recent hiring of Ryan Palazzo as President of U.S. Gas could prove meaningful, given the U.S. Gas business represents about half of Centuri’s total revenue and is central to near-term growth catalysts like major project awards and service agreements. Palazzo’s deep sector experience may help address the company’s relatively new management team risk, potentially strengthening operational execution just as the business is scaling up. However, the risks linked to limited management tenure and persistent unprofitability remain close to the surface. If Palazzo’s appointment helps accelerate operational gains, it could meaningfully impact the risk profile and catalysts going forward, especially as investors weigh recent contract momentum against continued losses. But investors should watch closely if management turnover disrupts execution or customer relationships.

Centuri Holdings' shares are on the way up, but they could be overextended by 17%. Uncover the fair value now.Exploring Other Perspectives

Explore 3 other fair value estimates on Centuri Holdings - why the stock might be worth less than half the current price!

Build Your Own Centuri Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Centuri Holdings research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Centuri Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Centuri Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTRI

Centuri Holdings

Operates as a utility infrastructure services company in North America.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives