- United States

- /

- Construction

- /

- NYSE:CTRI

Should Investors Reassess Centuri Holdings After Recent Share Price Dip in 2025?

Reviewed by Bailey Pemberton

If you have been eyeing Centuri Holdings, you are not alone. The stock is getting attention from investors wondering whether now is the right time to act, or if it’s better to wait for clearer signals. Over the past year, Centuri has delivered a return of 29.1%, which is enough to catch any serious investor’s attention. The year-to-date gain sits at 5.7%, which is solid progress by most standards, even though the last week brought a slight decline of 2.5% and the past month saw a 6.0% dip. These recent bumps have come alongside shifting sentiment in the utility services sector, especially as infrastructure spending trends and regulatory discussions make waves across the industry. While these market developments have not caused dramatic swings, they are shaping perceptions of both risk and potential reward.

But is Centuri Holdings actually undervalued right now, or have recent gains already priced in most of the upside? To cut through the noise, we turn to a rigorous valuation scorecard. Out of 6 key checks, Centuri scores a 3, meaning it’s undervalued in half of the areas that typically matter most to analysts and long-term investors.

Let’s dig deeper into those valuation approaches, see where Centuri shines and where questions remain, and ultimately explore a smarter way to think about what this company is really worth.

Why Centuri Holdings is lagging behind its peers

Approach 1: Centuri Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s fair value by projecting its future cash flows and then discounting them back to today’s value using an appropriate rate. This provides a snapshot of what the business is fundamentally worth, based not on hype, but on anticipated cash generation power.

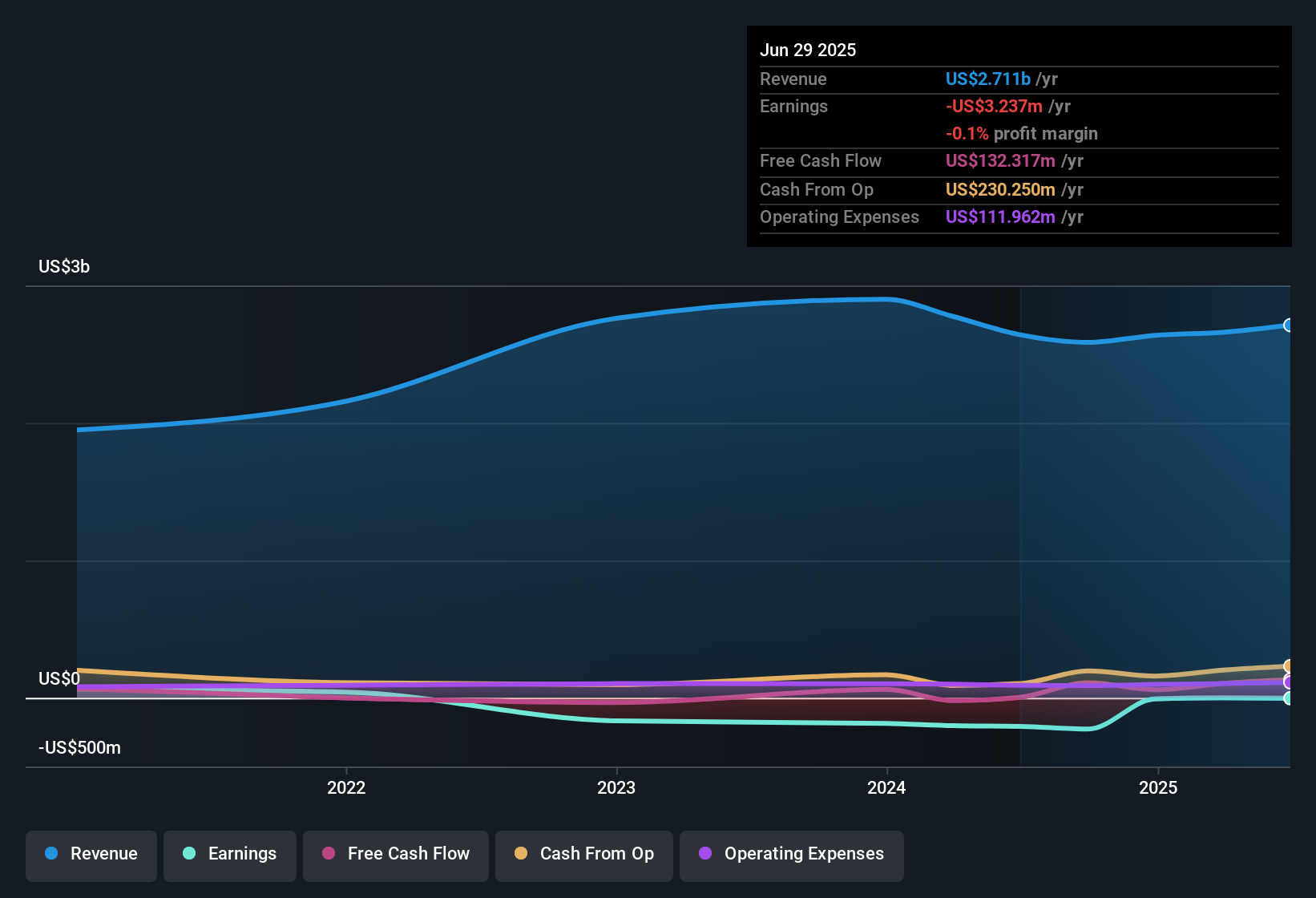

For Centuri Holdings, the current Free Cash Flow (FCF) stands at $125.6 million. Analyst projections suggest FCF could grow to $142.1 million in 2035, with estimates for each intermediate year. These projections rely on direct analyst forecasts through 2027, and from there, the figures are extrapolated to 2035 to factor in long-term potential using a 2 Stage Free Cash Flow to Equity approach.

After analyzing the numbers, the DCF analysis calculates an intrinsic value of $18.02 per share. Based on the most recent share price, this results in a theoretical overvaluation of 12.6%. In simple terms, the market is currently pricing Centuri Holdings above what this cash flow-based valuation would suggest.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Centuri Holdings may be overvalued by 12.6%. Find undervalued stocks or create your own screener to find better value opportunities.

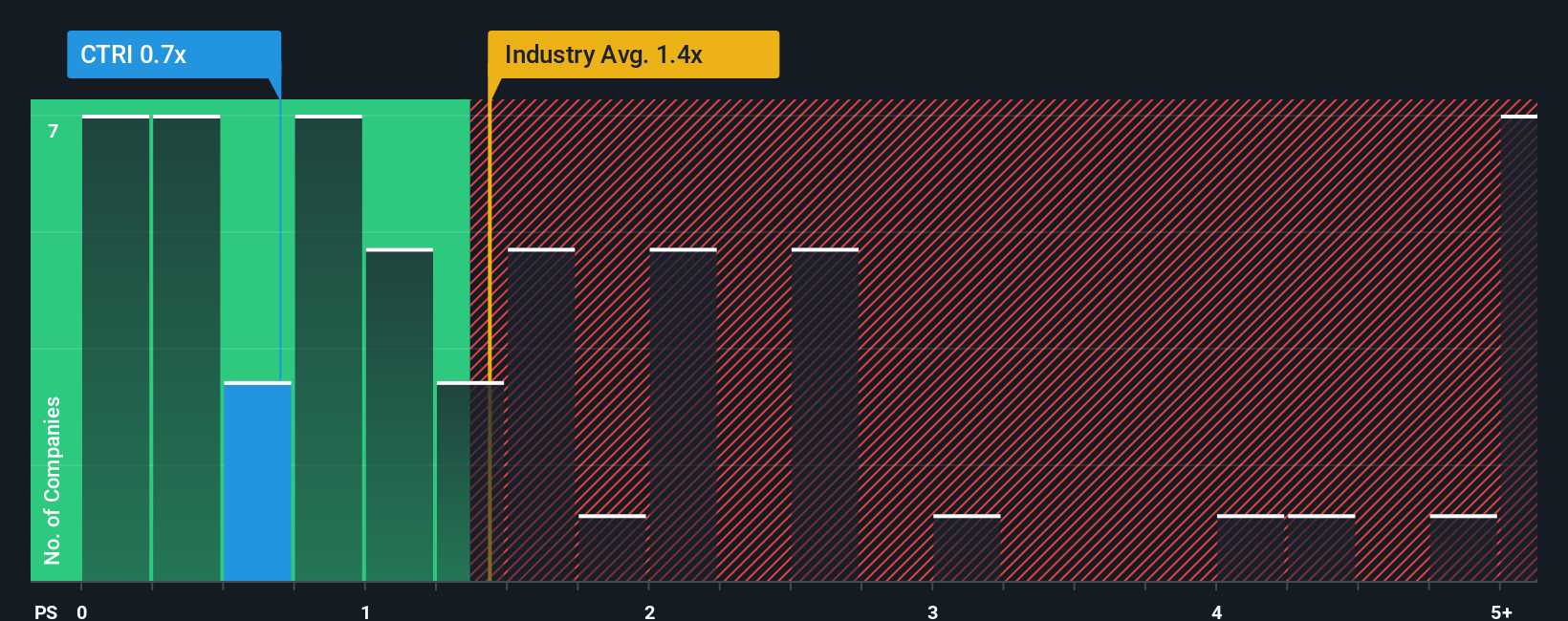

Approach 2: Centuri Holdings Price vs Sales

The Price-to-Sales (P/S) ratio is a valuable valuation metric when analyzing companies like Centuri Holdings, especially those with lower or volatile profitability, or where profits are temporarily depressed. Unlike the P/E ratio, which depends on consistent earnings, P/S allows investors to compare company value relative to revenues. This provides insight into how the market values each dollar of sales. Typically, a lower P/S ratio might hint at undervaluation, but it is essential to examine it in context, considering both growth expectations and company-specific risks.

Centuri’s current P/S ratio is 0.66x. When placed side by side with the construction industry average of 1.53x and a peer average of 1.13x, Centuri’s valuation appears conservative. This may indicate that the market is less optimistic about its future growth or is pricing in higher operational risk. However, simple comparisons can sometimes mislead, as not all companies share the same outlook or risk profile.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio for Centuri Holdings stands at 0.67x. Unlike the industry or peer benchmarks, this proprietary metric incorporates factors such as Centuri’s unique growth prospects, profit margins, risk profile, sector dynamics, and market capitalization. Because it is tailored specifically to the company, the Fair Ratio provides a more balanced view of fair value than a generic industry or peer comparison can.

With Centuri’s current P/S at 0.66x and the Fair Ratio at 0.67x, the stock’s valuation based on sales appears to be well-aligned with its fundamentals.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Centuri Holdings Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a powerful but simple tool that lets you connect your view of a company’s story, such as Centuri Holdings’ future prospects, with your own fair value estimate based on revenue, earnings, and margins. Instead of just looking at the numbers, Narratives allow you to map your perspective to a financial forecast, then see how that translates to what the company is truly worth.

Narratives are built into the Simply Wall St Community page, trusted by millions of investors around the world, making it easy for anyone to create or browse perspectives. With Narratives, you can quickly see if it makes more sense to buy or sell by comparing your estimated fair value with the current market price. Plus, Narratives are kept up to date, automatically reflecting any new developments such as company announcements or earnings updates, so your view stays relevant.

For Centuri Holdings, one investor might believe in rapid infrastructure upgrades giving a high fair value, while another expects sluggish growth and a much lower valuation. Both perspectives are reflected instantly and visually in the platform’s Narrative tools.

Do you think there's more to the story for Centuri Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTRI

Centuri Holdings

Operates as a utility infrastructure services company in North America.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives