- United States

- /

- Building

- /

- NYSE:CSW

CSW Industrials (CSWI): Examining Valuation After Recent Share Price Fluctuations

Reviewed by Simply Wall St

CSW Industrials (CSW) shares edged higher today, with the stock rising 1% at the close. Investors may be taking a closer look at recent price action, as CSW remains down more than 13% over the past 3 months.

See our latest analysis for CSW Industrials.

CSW Industrials has faced a challenging stretch, with momentum fading after a strong multi-year run. Despite a small rebound today, the stock has a 1-year total shareholder return of -33.1%. It still boasts a remarkable 192% total return over five years, which hints at enduring value for patient investors.

If today’s move has you thinking beyond CSW Industrials, it might be the perfect moment to discover fast growing stocks with high insider ownership.

This recent selloff raises a crucial question for investors: is CSW Industrials now trading at a discount, or are expectations for future growth already fully accounted for in the current stock price?

Most Popular Narrative: 14.9% Undervalued

With the most recent narrative pointing to a fair value of $287.83 for CSW Industrials, shares trade over $40 below this mark, suggesting room for upside if assumptions hold. The analyst-backed fair value creates a notable gap against the last close, igniting a fresh valuation debate after months of sliding share price.

Growing regulatory drivers around building efficiency, indoor air quality, and refrigerant standards (for example, the American Innovation and Manufacturing Act) are accelerating HVAC maintenance and compliance retrofits. CSWI's strengthened value-added product portfolio and recent acquisitions, such as Aspen, directly position the company to capture increased demand, supporting higher revenue growth and potential share gains in the future.

Curious about what powers this bullish price estimate? The forecast hinges on ambitious revenue growth and a future earnings multiple that rivals the best in the industry. Want to know the numbers driving this head-turning valuation? The complete narrative unpacks all the key financial assumptions that make or break this target.

Result: Fair Value of $287.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant risks remain, including heavy dependence on acquisitions and continued margin pressure from input cost inflation. Both of these factors could challenge future growth assumptions.

Find out about the key risks to this CSW Industrials narrative.

Another View: Comparing Market Multiples

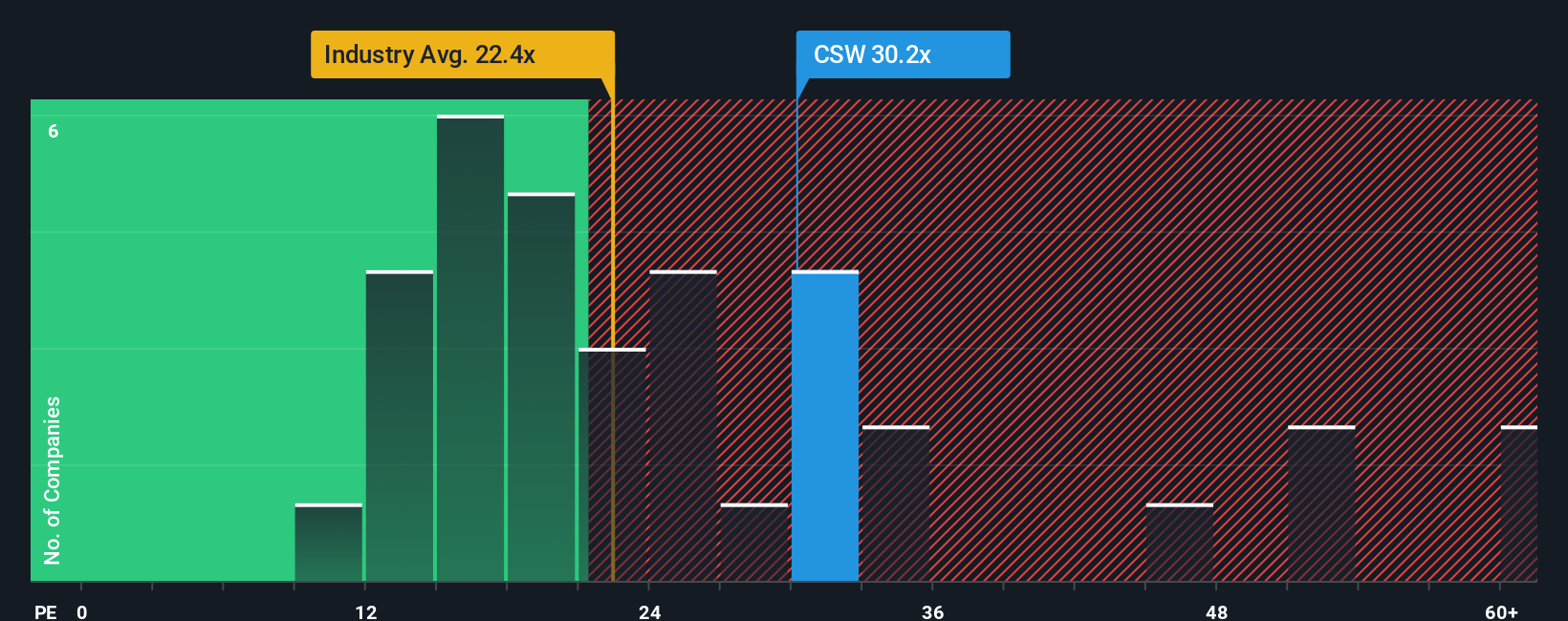

Looking at CSW Industrials through a different lens, the market is currently valuing the company at 29.6 times earnings, which is notably pricier than both the US Building industry average of 19.8x and its peer average of 22.8x. Even compared to the fair ratio of 22.4x, CSW stands out as expensive. This gap suggests investors may be factoring in high expectations. Could this premium signal hidden strength, or is the risk of disappointment now higher?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CSW Industrials Narrative

If you have a different perspective or enjoy digging into the numbers yourself, why not put together your own view in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding CSW Industrials.

Looking for More Investment Ideas?

Smart investors never limit their options. Expand your portfolio by checking out winning stocks through these powerful tools before the next market shift takes you by surprise.

- Unlock upside by scanning these 881 undervalued stocks based on cash flows, a resource packed with stocks trading below their true worth and giving you a head start on value opportunities others might miss.

- Supercharge your returns by tapping into these 17 dividend stocks with yields > 3%, where you’ll find companies delivering reliable yields and robust income potential to help keep your portfolio resilient.

- Seize the potential of game-changing tech by targeting these 27 AI penny stocks, which spotlights companies shaping tomorrow’s industries through advancements in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CSW

CSW Industrials

Provides various industrial products in the United States and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives