- United States

- /

- Building

- /

- NYSE:CSL

How Cautious Q4 Guidance and Flat 2025 Outlook at Carlisle Companies (CSL) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Carlisle Companies recently reported third quarter results that exceeded analyst expectations, with revenue rising 1% to US$1.35 billion and adjusted earnings of US$5.61 per share.

- Despite this performance, management issued cautious guidance for the fourth quarter and revised its full-year 2025 outlook to flat revenue, highlighting ongoing softness in new construction driven by higher interest rates and economic uncertainty.

- We'll explore how cautious Q4 guidance and a revised flat revenue outlook shape Carlisle Companies' investment narrative in the near term.

Find companies with promising cash flow potential yet trading below their fair value.

Carlisle Companies Investment Narrative Recap

To be a Carlisle Companies shareholder, you need to believe in the continuing resilience of the commercial reroofing market and the company's ability to defend margins even when new construction is soft. The latest guidance for flat full-year revenue and a cautious Q4 outlook do affect near-term confidence, highlighting that construction market challenges, not company execution, remain the primary risk, though they don't fundamentally alter the main long-term catalyst of recurring reroofing demand.

Among recent announcements, Carlisle’s share repurchase program stands out: in the latest quarter, the company bought back 800,000 shares for US$300 million. This move directly reflects the company’s capital allocation discipline but does little to offset concerns about revenue pressure from new construction headwinds, a key risk to watch as management continues to emphasize cost control and efficiency.

However, investors should also be mindful that if softness in new construction proves more persistent than expected...

Read the full narrative on Carlisle Companies (it's free!)

Carlisle Companies' outlook projects $5.8 billion in revenue and $997.0 million in earnings by 2028. This requires 4.9% annual revenue growth and a $193.1 million increase in earnings from the current $803.9 million.

Uncover how Carlisle Companies' forecasts yield a $384.29 fair value, a 16% upside to its current price.

Exploring Other Perspectives

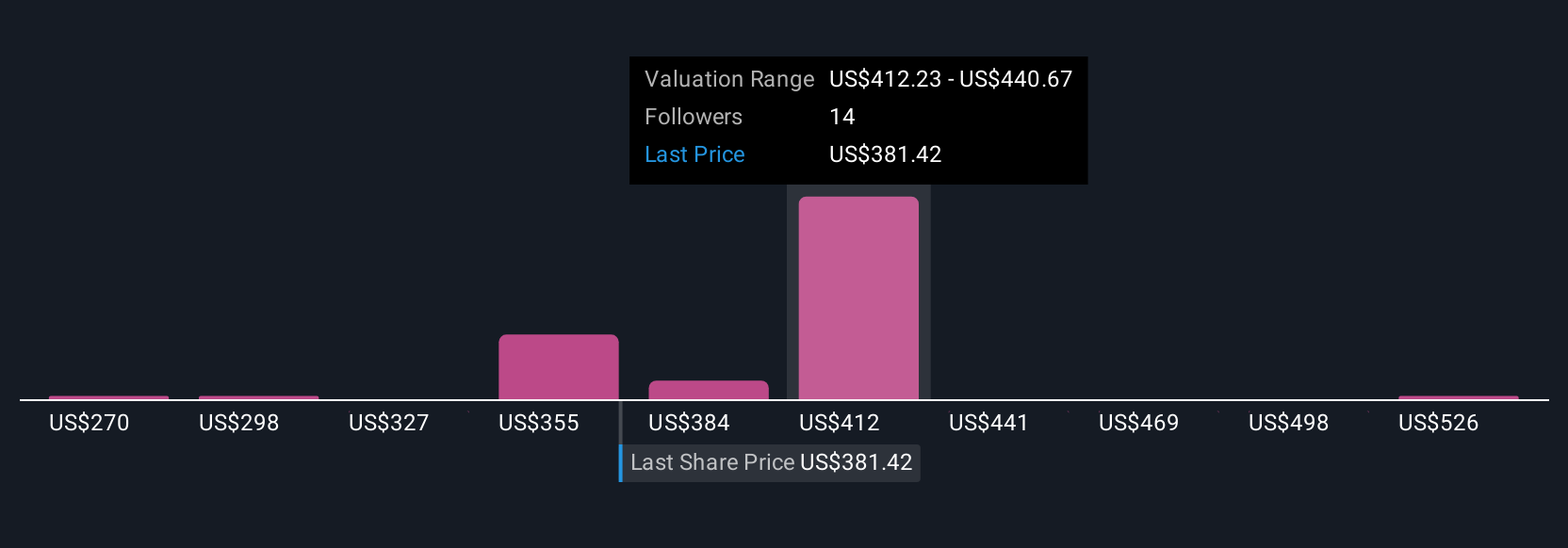

Simply Wall St Community members produced seven fair value estimates for Carlisle Companies, ranging from US$270 to US$554.45 per share. While optimism about recurring reroofing demand drives some of these, shifting construction cycles and margin risks could influence outcomes in ways that differ from professional analyst forecasts.

Explore 7 other fair value estimates on Carlisle Companies - why the stock might be worth 18% less than the current price!

Build Your Own Carlisle Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carlisle Companies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Carlisle Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carlisle Companies' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CSL

Carlisle Companies

Operates as a manufacturer and supplier of building envelope products and solutions in the United States, Europe, North America, and internationally.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives