- United States

- /

- Aerospace & Defense

- /

- NYSE:CRS

Carpenter Technology (CRS): Assessing Valuation After Upgraded 2026-27 Profit Guidance and Growth Targets

Reviewed by Simply Wall St

Carpenter Technology (CRS) just rolled out new earnings guidance for fiscal year 2026, projecting a significant jump in operating income compared to the previous year. The company also outlined targets for continued growth into 2027.

See our latest analysis for Carpenter Technology.

Carpenter Technology’s upbeat guidance comes following a major share buyback, which concluded its latest tranche at the end of September. Momentum has been strong, with a 23.8% 1-month share price return and a 90.95% total shareholder return over the past year. This suggests investor enthusiasm continues to build on both short-term performance and long-term growth potential.

If this kind of momentum has you searching for fast-growing opportunities, now is the ideal time to broaden your search and discover fast growing stocks with high insider ownership

With such impressive gains and upgraded guidance, is Carpenter Technology’s rapid rise a chance to buy before the next leg up, or has the market already factored in all the future growth?

Most Popular Narrative: 9.4% Undervalued

With Carpenter Technology's last close at $306.48 and the narrative’s fair value at $338.10, the most widely followed valuation sees room for future upside beyond recent highs.

The ongoing ramp in global aerospace demand, highlighted by extended lead times, urgent defense orders, and robust multi-year supply contracts, positions Carpenter to accelerate revenue growth as OEM build rates increase, particularly in next-generation and more fuel-efficient aircraft. This supports both top-line expansion and recurring revenues.

Want to know what’s fueling this bullish call? The answer lies in daring assumptions about future growth, rising margins, and a premium profit multiple rivaling the sector’s elite. The surprising drivers that back this valuation target just might change how you see the company’s next big move.

Result: Fair Value of $338.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sharp aerospace downturns or missteps with Carpenter’s major capacity expansion could quickly derail this bullish outlook and have a significant impact on future earnings.

Find out about the key risks to this Carpenter Technology narrative.

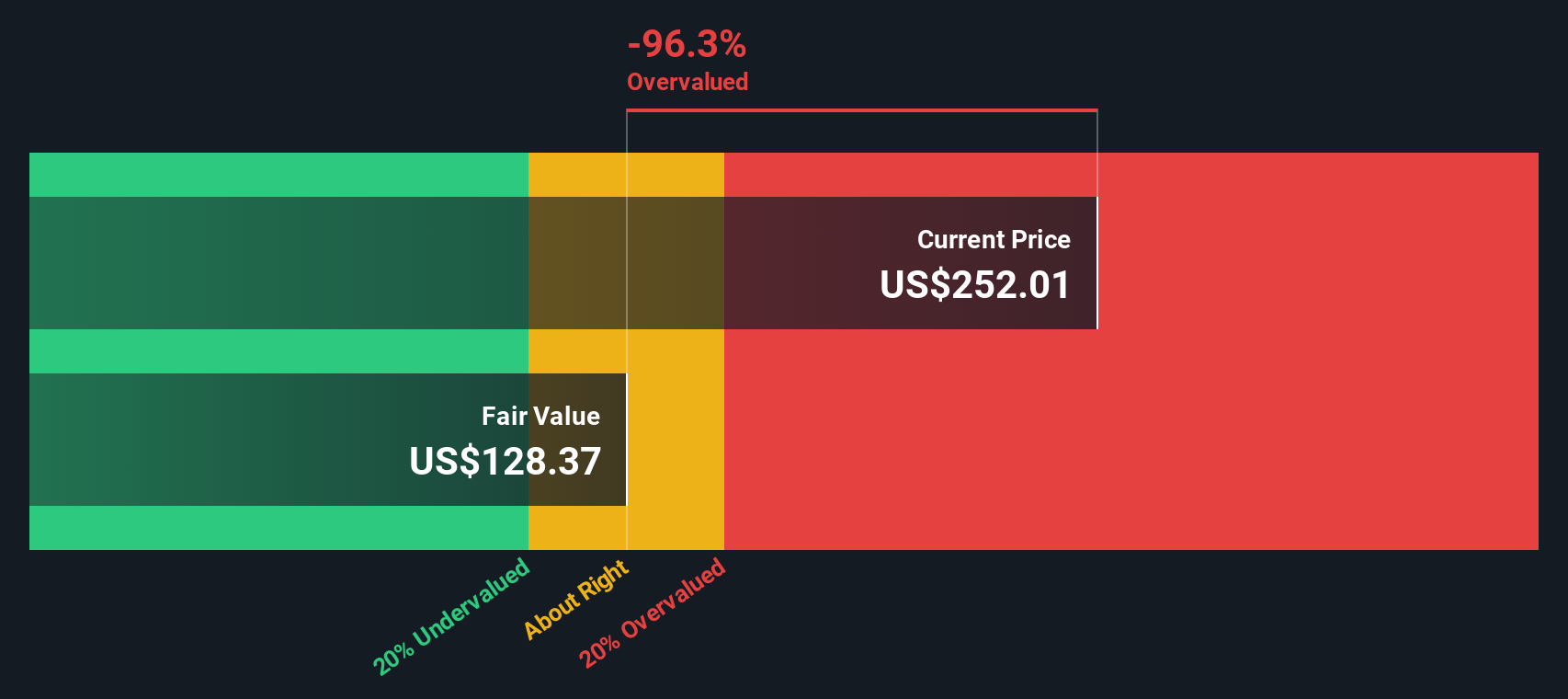

Another View: DCF Model Casts Doubt

While the market’s go-to valuation ratio compares well to industry standards, our DCF model tells a different story. It suggests Carpenter Technology’s shares may actually be trading well above what its future cash flows justify. This calls the current market optimism into question. Is this a rare disconnect, or a sign that profits will need to come through faster?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Carpenter Technology Narrative

If you want to take things into your own hands or have a different perspective, you can quickly build your own take on Carpenter Technology in just a few minutes. Do it your way

A great starting point for your Carpenter Technology research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Set yourself apart by uncovering standout stocks using exclusive tools from Simply Wall Street’s range of screeners. Don’t settle for ordinary opportunities.

- Unlock fresh yield potential and start earning with these 20 dividend stocks with yields > 3% featuring reliable payouts above 3%.

- Harness the AI renaissance to spot tomorrow’s leaders. Check out these 26 AI penny stocks with strong momentum and potential.

- Capitalize on hidden value by targeting these 840 undervalued stocks based on cash flows that may be overlooked by the broader market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRS

Carpenter Technology

Engages in the manufacture, fabrication, and distribution of specialty metals in the United States, Europe, the Asia Pacific, Mexico, Canada, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives