- United States

- /

- Aerospace & Defense

- /

- NYSE:CRS

A Fresh Look at Carpenter Technology (CRS) Valuation After a 26% Monthly Share Price Gain

Reviewed by Simply Wall St

See our latest analysis for Carpenter Technology.

Momentum has clearly been building for Carpenter Technology, as the company’s monthly 26% share price return has supercharged what was already an impressive performance this year. With a current share price of $309.42 and a year-to-date share price return of over 76%, Carpenter is rewarding patient investors. The total shareholder return stands at a remarkable 62.7% for the past twelve months, and an eye-catching 676% over three years.

If this kind of turnaround has you thinking about new opportunities, it could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership.

With such a rapid climb, the obvious question is whether Carpenter Technology’s current highs offer real value or reflect all its future potential. This leaves investors to wonder if there is a true buying opportunity or if everything is already priced in.

Most Popular Narrative: 19% Undervalued

With the narrative fair value estimate landing at $382.37, Carpenter Technology's last close at $309.42 gives it substantial room to run, according to the consensus view. This wide gap is drawing investor attention to what sets Carpenter apart from its peers and why future expectations remain so ambitious.

The ongoing ramp in global aerospace demand, highlighted by extended lead times, urgent defense orders, and robust multi-year supply contracts, positions Carpenter to accelerate revenue growth as OEM build rates increase, particularly in next-generation and more fuel-efficient aircraft. This supports both top-line expansion and recurring revenues.

Want to know what’s fueling such bullish sentiment? The narrative hinges on powerful growth assumptions and precise calculations for future margins. There is a story behind Carpenter’s price target; get a glimpse of the underlying forecasts shaping these bold expectations.

Result: Fair Value of $382.37 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, even with these tailwinds, factors such as heavy exposure to aerospace cycles and execution risks on capacity expansion could quickly change the picture for Carpenter Technology.

Find out about the key risks to this Carpenter Technology narrative.

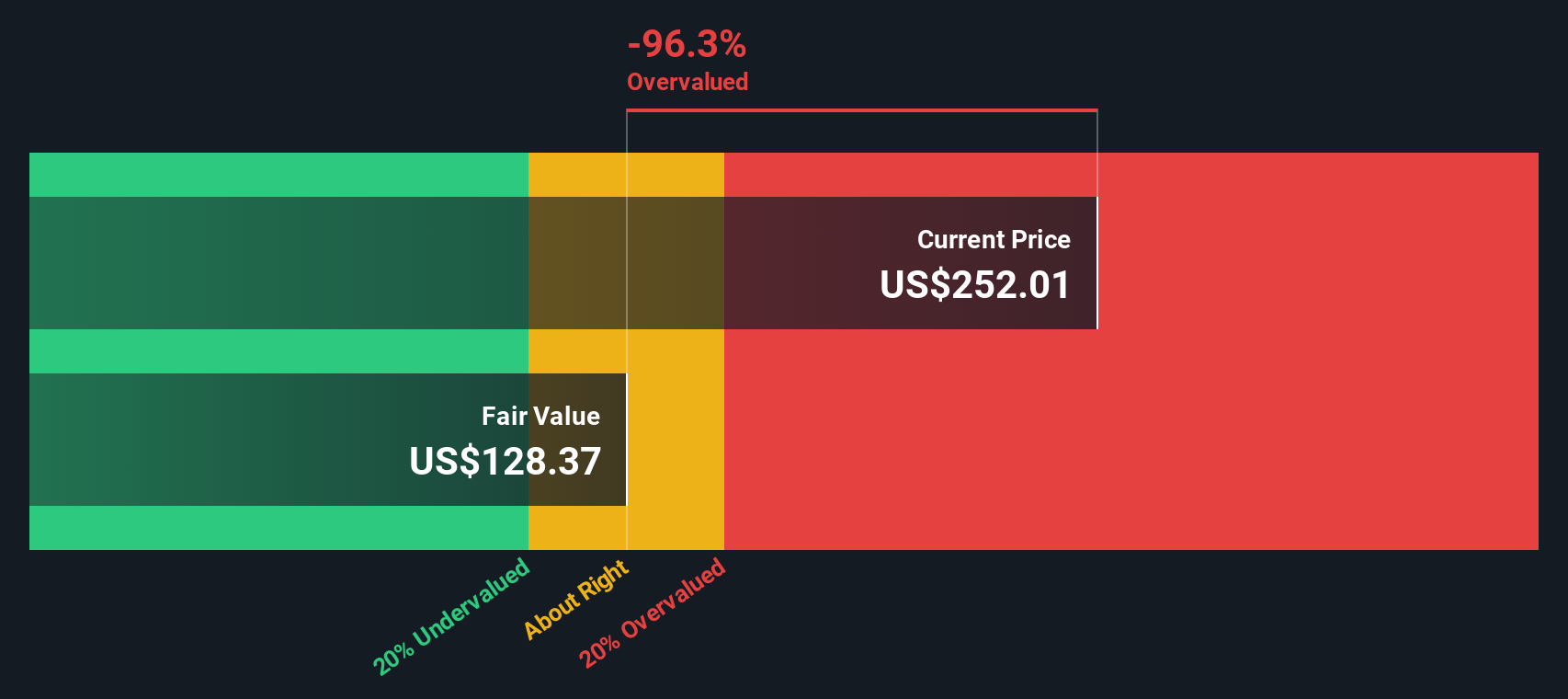

Another View: SWS DCF Model Flags a Contradiction

While analysts see Carpenter Technology as undervalued, the SWS DCF model challenges this optimism. According to our DCF analysis, the current price of $309.42 is well above the calculated fair value of $137.28, suggesting the stock could be overvalued relative to projected cash flows.

Look into how the SWS DCF model arrives at its fair value.

So, which valuation method will prove more reliable for investors weighing Carpenter’s potential from this point forward?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Carpenter Technology for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 917 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Carpenter Technology Narrative

If you want to dig deeper or see the story from your own perspective, it takes just a few minutes to create your own narrative with Carpenter Technology. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Carpenter Technology.

Looking for More Investment Ideas?

Seize new opportunities beyond Carpenter Technology and set yourself up for smart investing decisions. The right screener can open doors to exceptional stocks others might miss.

- Tap into market-leading income by checking out these 17 dividend stocks with yields > 3%, which delivers hefty yields above 3% for steady cashflow potential.

- Spot tomorrow’s innovation leaders with these 25 AI penny stocks, focusing on companies transforming industries through artificial intelligence breakthroughs.

- Catch the next wave of returns by targeting these 917 undervalued stocks based on cash flows, offering compelling value based on strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRS

Carpenter Technology

Engages in the manufacture, fabrication, and distribution of specialty metals in the United States, Europe, the Asia Pacific, Mexico, Canada, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives