- United States

- /

- Aerospace & Defense

- /

- NYSE:CRS

$700 Million Refinancing Could Be A Game Changer For Carpenter Technology (CRS)

Reviewed by Sasha Jovanovic

- Earlier this month, Carpenter Technology Corporation completed a US$700 million private offering of 5.625% senior notes due 2034 and amended its credit agreement to increase revolving commitments to US$500 million and extend the credit facility maturity to 2030.

- This refinancing initiative is intended to repay higher-interest debt and is expected to enhance the company's financial flexibility through improved liquidity and reduced future interest expenses.

- We'll explore how Carpenter Technology's expanded credit facility and lower-cost debt could influence its forward-looking investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Carpenter Technology Investment Narrative Recap

To be a shareholder in Carpenter Technology today, you likely need to believe in the strength of the aerospace cycle and the company’s ability to capture long-term growth through capacity expansion and high-value specialty alloys. The recent refinancing and expanded credit facility improve liquidity and lower interest costs, but do not materially change the most important near-term catalyst, execution of the brownfield expansion, or the main risk of end-market demand volatility in aerospace and defense.

Among recent announcements, Carpenter’s October 2025 earnings guidance stands out as particularly relevant, specifying operating income expectations of US$660 million to US$700 million for FY26. This aligns closely with investor focus on whether management can deliver sustainable profit growth as the debt refinancing helps to reduce future interest expense and preserve cash flow through what could be a capital-intensive growth phase.

However, against this improved financial footing, investors should still be mindful of the potential risk if aerospace demand does not materialize as expected...

Read the full narrative on Carpenter Technology (it's free!)

Carpenter Technology's outlook anticipates $3.6 billion in revenue and $672.3 million in earnings by 2028. This assumes 7.7% annual revenue growth and an earnings increase of $296.5 million from current earnings of $375.8 million.

Uncover how Carpenter Technology's forecasts yield a $382.37 fair value, a 18% upside to its current price.

Exploring Other Perspectives

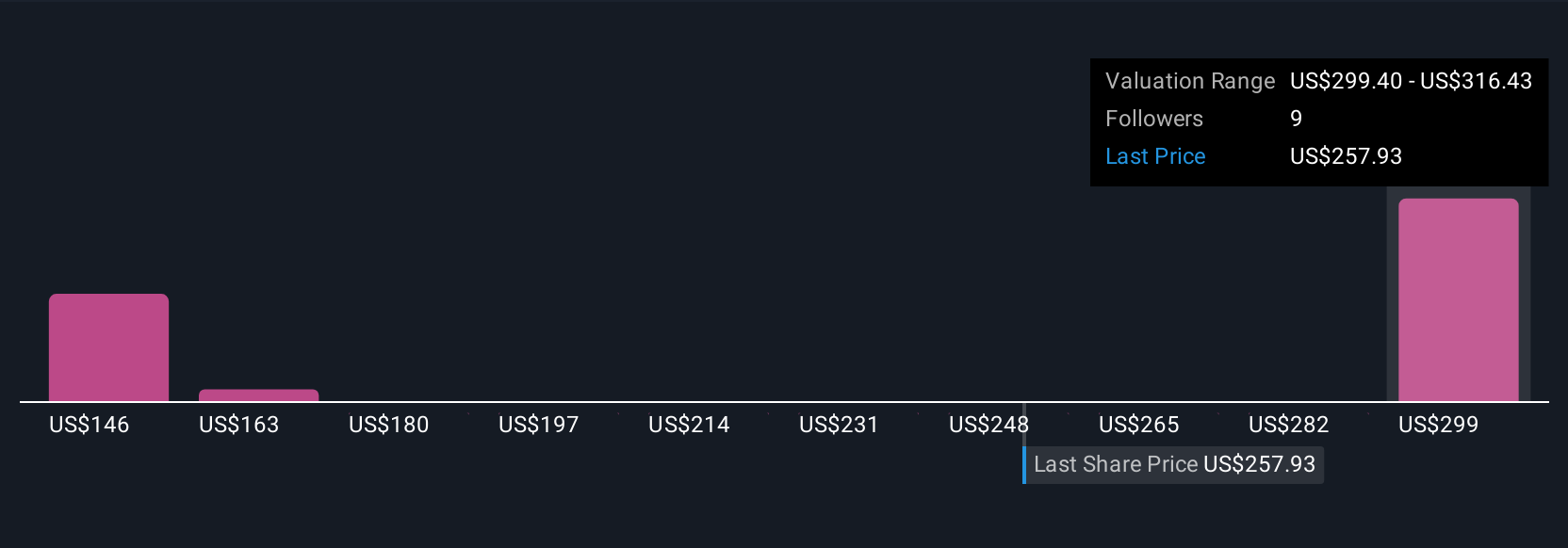

Simply Wall St Community members place Carpenter's fair value between US$136 and US$382 across 3 perspectives. With new debt reducing future interest expenses, the range highlights how much opinions can differ on growth, risk and return potential, see how your outlook compares.

Explore 3 other fair value estimates on Carpenter Technology - why the stock might be worth less than half the current price!

Build Your Own Carpenter Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carpenter Technology research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Carpenter Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carpenter Technology's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRS

Carpenter Technology

Engages in the manufacture, fabrication, and distribution of specialty metals in the United States, Europe, the Asia Pacific, Mexico, Canada, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success