- United States

- /

- Machinery

- /

- NYSE:CR

Crane (CR) Earnings Jump 43%—Margin Gains Reinforce Bull Case Despite Valuation Concerns

Reviewed by Simply Wall St

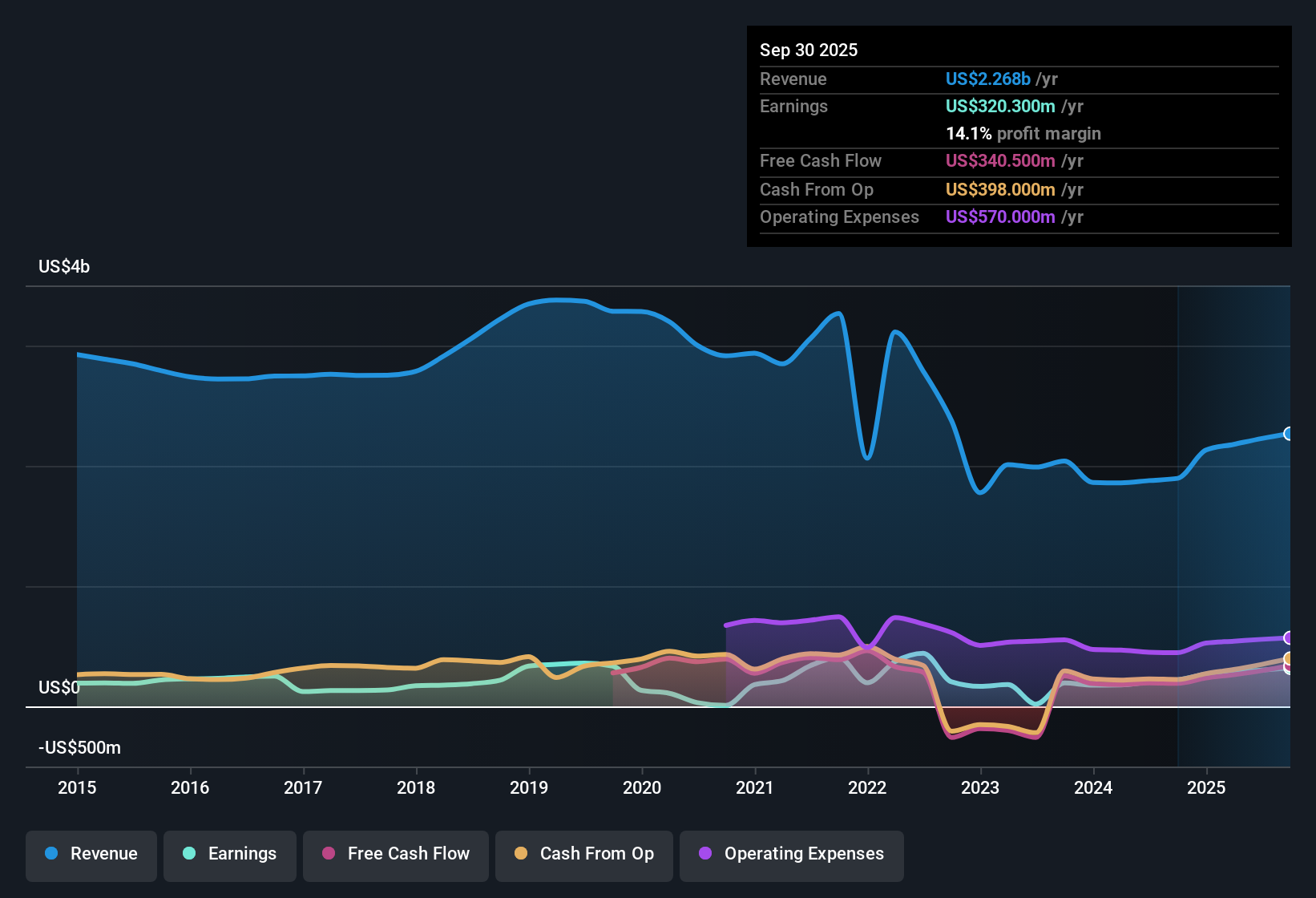

Crane (CR) delivered earnings growth of 43.1% over the past year, a significant acceleration compared to its 5-year average growth rate of 3.3% per year. The company’s net profit margin climbed to 14.1%, up from last year’s 11.5%, and earnings quality was described as high. While profits and revenues are expected to continue growing, both are forecast to lag the broader US market, and shares now trade at a rich 34.4x price-to-earnings multiple, above typical industry and peer averages. With no major risk events or insider selling reported, the latest numbers highlight a compelling mix of strong core performance and valuation that could give some investors pause.

See our full analysis for Crane.Next, we’ll put these results up against the most widely followed narratives on Simply Wall St to see where expectations match reality, and where surprises emerge.

See what the community is saying about Crane

Margin Expansion Signals Strength in Core Segments

- Net profit margins rose to 14.1%, up from 11.5% last year, showing stronger underlying profitability despite increased input cost pressures.

- Analysts' consensus view highlights that persistent growth in advanced sensing and process flow segments is driving margin expansion.

- Recent acquisition of PSI expands capabilities and is expected to support durable earnings in infrastructure and automation markets.

- Exposure to sectors like aerospace and nuclear, combined with disciplined pricing strategies, helps maintain Crane’s competitive edge and supports margin resilience.

Bulls and bears alike are pointing to this margin trend as a crucial test for Crane's future earnings power. See how the consensus narrative breaks it down: 📊 Read the full Crane Consensus Narrative.

Revenue Forecast Trails Market but Shows Resilience

- Revenue growth is forecast at 8.4% per year while the broader US market is expected to grow at a faster pace, positioning Crane as steady but not a high-flyer.

- According to the analysts' consensus narrative, long-cycle visibility in Aerospace & Electronics and new demand for radiation sensing in nuclear energy bolster near-term stability.

- Analysts expect annual revenue growth of 9.1% over the next three years, supported by multi-year backlogs and robust aftermarket business in aerospace.

- However, ongoing cost pressures and exposure to slower markets are flagged as a brake on above-market growth potential.

Premium Valuation Raises Expectation Bar

- Shares now trade at 34.4 times earnings, significantly above the US machinery industry average of 24.7 and the peer average of 21.8. The current share price of $191.29 is just above the DCF fair value of $193.84 but still below the analyst target of $211.88.

- The analysts' consensus view argues that sustaining this valuation premium requires Crane to deliver on ambitious growth and margin targets.

- Analysts model profit margins reaching 16.2% within three years and earnings rising to $468 million by 2028 to justify the price target.

- To agree with the analyst view, investors must believe long-term catalysts like product mix shifts and pricing power will persist in keeping Crane above industry norms.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Crane on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the figures? Share your perspective in just a few minutes and shape your personal narrative. Do it your way

A great starting point for your Crane research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Crane’s revenue growth is projected to lag the broader market, and ongoing cost pressures could limit its ability to exceed these expectations.

If you're looking for businesses with steadier, more consistent performance, check out stable growth stocks screener (2116 results) to discover companies that regularly deliver growth through different market environments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CR

Crane

Manufactures and sells engineered industrial products in the United States, Canada, the United Kingdom, Continental Europe, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives