- United States

- /

- Machinery

- /

- NYSE:CMI

Analyzing Cummins Value After Its 23% Rally and Alternative Power Expansion in 2025

Reviewed by Bailey Pemberton

- Wondering if Cummins stock is really a good value right now? You are not alone, and today's prices have plenty of investors reassessing what the company is truly worth.

- The share price has surged 23.3% year-to-date and is up 92.9% over the past three years, though it pulled back slightly by 0.9% in the last 30 days.

- That recent shift comes on the back of industry-wide optimism and Cummins' headline-grabbing moves in the alternative power sector, including strategic collaborations and notable acquisitions. These have sparked both excitement and new questions about the company's long-term direction and growth potential.

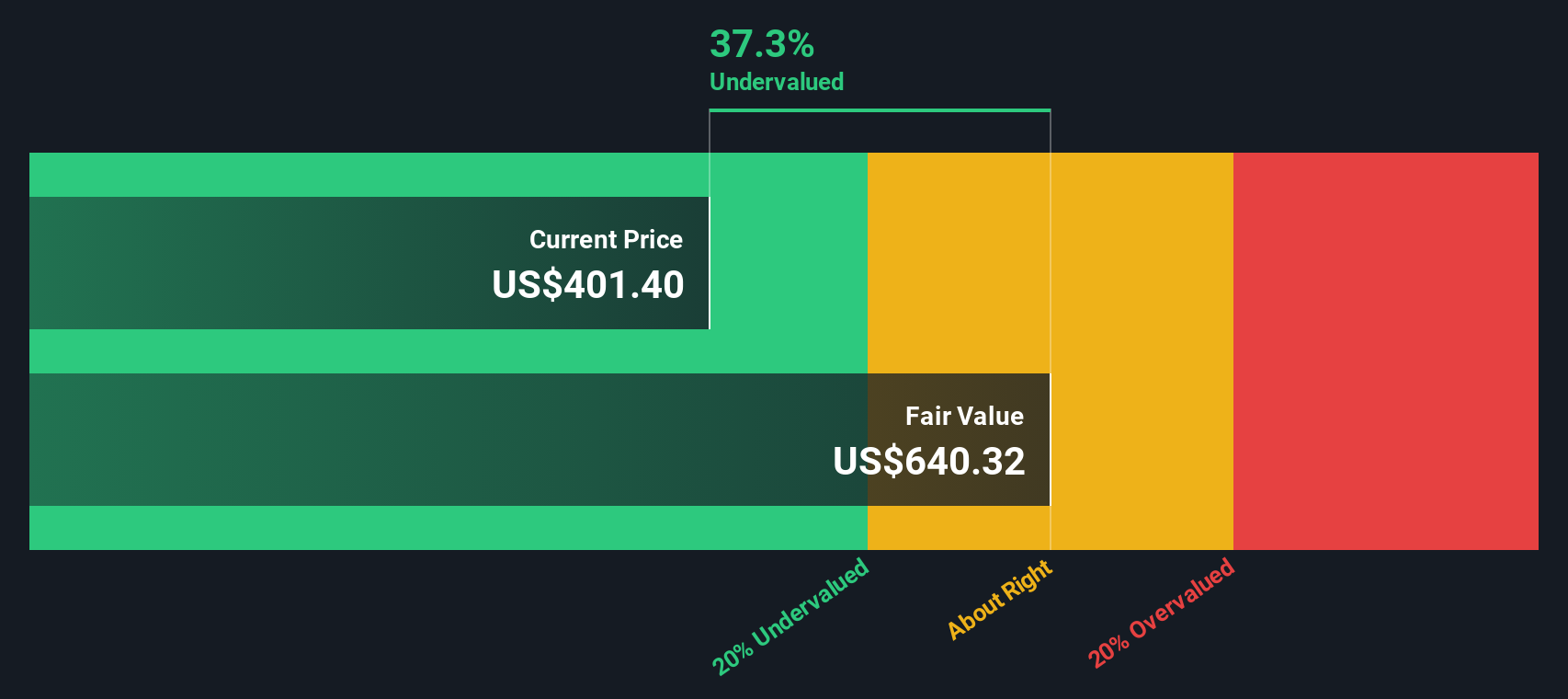

- On our latest valuation review, Cummins scores a 5 out of 6 for undervaluation, which is impressive. However, the real story goes far beyond just the headline numbers. Explore how different valuation methods stack up and see a smarter way to evaluate what this stock is actually worth.

Approach 1: Cummins Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today's dollars. This approach helps investors gauge what a business is truly worth, based not on short-term market swings but on long-term fundamentals.

For Cummins, the most recent reported Free Cash Flow (FCF) stands at $1.67 billion. Analysts expect this figure to steadily climb, with projections indicating Free Cash Flow could reach approximately $4.63 billion by 2029. Beyond these years, values are extrapolated to account for continued growth, but the focus remains on the next decade's expansion. All forecasts here are presented in US dollars.

Based on the DCF model, the intrinsic, or "fair," value per share for Cummins comes out to $597.68. This represents a 28.3% discount compared to the current market price, pointing to a notable degree of undervaluation.

While models can never predict the future perfectly, these figures suggest that Cummins' stock trades well below what its future cash flows may be worth, according to this widely respected methodology.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Cummins is undervalued by 28.3%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Cummins Price vs Earnings (P/E) Ratio

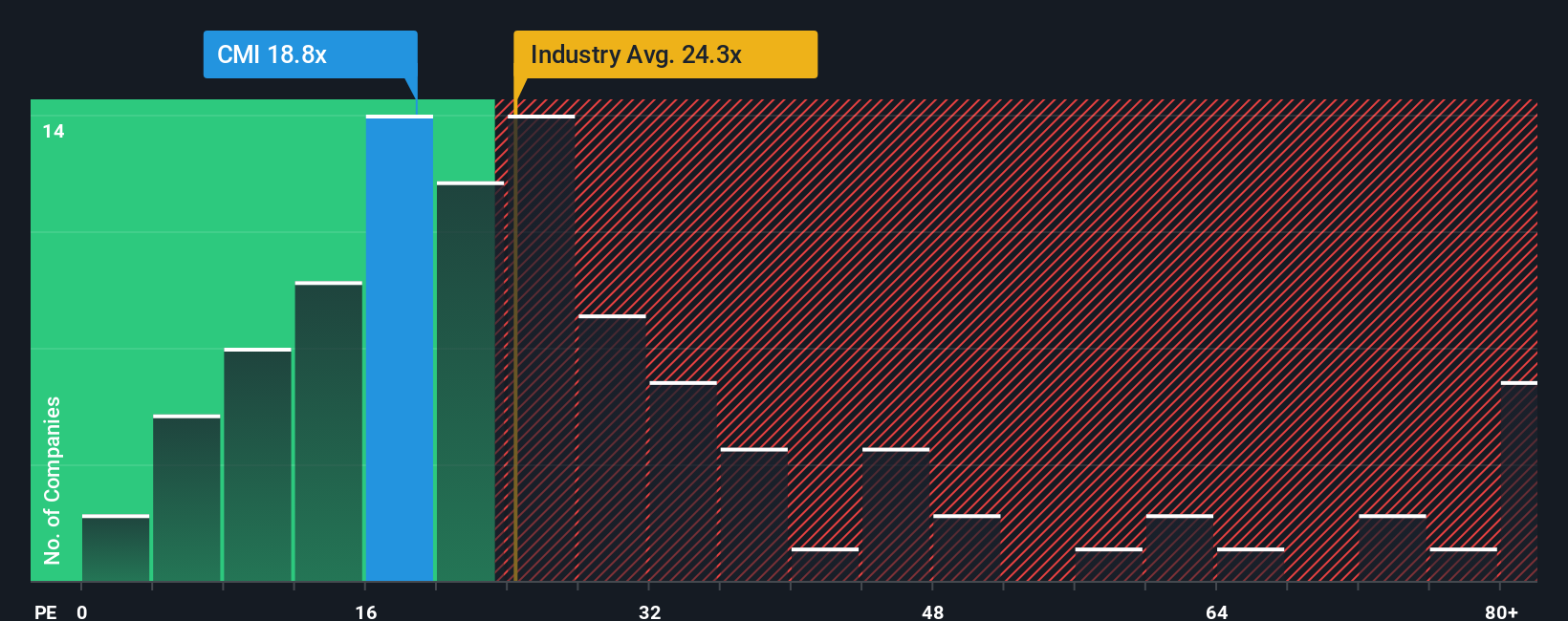

The Price-to-Earnings (P/E) ratio is a widely used and practical valuation metric for consistently profitable companies like Cummins because it directly relates a company's current share price to its earnings per share. This metric allows investors to quickly gauge how much they are paying for each dollar of earnings, which is especially useful when evaluating established, earnings-generating businesses.

A "normal" or fair P/E ratio can vary depending on expectations for growth and the risks specific to the business. Generally, companies expected to grow faster and with more certainty will justify a higher P/E ratio. Riskier or slower-growing firms tend to trade at lower P/E multiples.

Cummins currently trades at a P/E of 20.1x. For context, the average Machinery industry P/E is 23.5x, and its peer group averages 21.9x. This means Cummins is priced more conservatively than both its industry and its main competitors. However, Simply Wall St's proprietary "Fair Ratio" model, which factors in key elements like the company’s earnings growth prospects, profit margins, size, industry, and risk, suggests that a 30.5x multiple is justified for Cummins right now.

By synthesizing these company-specific factors, the Fair Ratio provides a more tailored benchmark for indicating the appropriate valuation because it accounts for real differences in growth potential and risk. Comparing this fair benchmark of 30.5x with the actual 20.1x P/E suggests there may be significant undervaluation at current prices.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

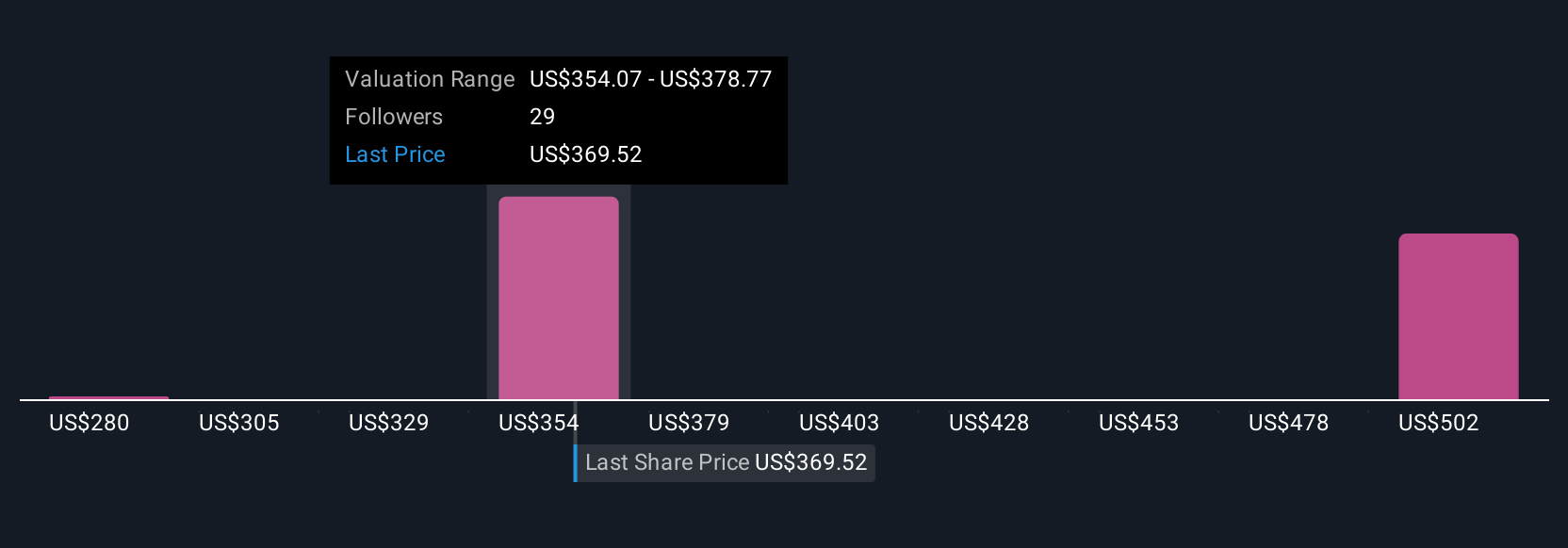

Upgrade Your Decision Making: Choose your Cummins Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple yet powerful investing tool that lets you tell your own story about a company by linking its unique business situation and future outlook to a set of financial forecasts and a fair value estimate. Rather than just relying on consensus numbers, Narratives empower you to translate what you believe about Cummins, whether it is strength in clean energy, risk from market cycles, or upside from AI-driven demand, into your own estimate of earnings, margins, and value.

Narratives connect company stories to numbers, making it easy for any investor to see how factors like new product launches, regulations, or earnings changes might impact fair value. Available for free on Simply Wall St’s Community page, Narratives are dynamic and update instantly as news breaks or earnings reports are released, helping investors confidently decide when the price is right to buy or sell.

For example, some investors forecast Cummins could reach $500 per share due to booming power systems demand and margin expansion, while others see fair value as low as $350 given competition and regulatory risks. Whatever your view, Narratives help you bring your perspective to life and compare it with the market in real time.

Do you think there's more to the story for Cummins? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMI

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives