- United States

- /

- Machinery

- /

- NYSE:CAT

Should Investors Take a Fresh Look at Caterpillar After Norway Fund's Exit?

Reviewed by Bailey Pemberton

If you’re considering what to do with Caterpillar stock right now, you are definitely not alone. Caterpillar has been on a tear lately, and whether you’re a longtime investor riding those gains or someone eyeing an entry point, there’s plenty to keep your attention. In the past year, shares have climbed an impressive 27.0%. Even more head-turning, the stock has surged 17.7% in just the last thirty days, and the three-year return stands at an eye-popping 194.4%. That kind of performance is tough to ignore, especially when you look at the broader industrial sector.

What’s driving this excitement? For one, speculation is swirling that the “mystery stock” Warren Buffett might be buying is none other than Caterpillar. That rumor alone can send any value-seeker’s heart racing. At the same time, there has been headline-grabbing international news, such as Norway’s sovereign wealth fund recently divesting its positions in Caterpillar, sparking debates about ethics and global investment flows. While that move raised some eyebrows, the market’s reaction has been anything but fearful. Instead, shares have continued pushing higher, hinting that investors may see more opportunity than risk.

But what about valuation? That’s the real crux for any investor looking to put fresh money to work. By the numbers, Caterpillar earns a valuation score of 2 out of 6, which means it looks undervalued in just 2 of the standard valuation checks. So, how do those individual approaches stack up, and what do they really tell us? Let’s break down the methods experts use. Stick around, because there’s an even better way to cut through the noise coming up later in the article.

Caterpillar scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Caterpillar Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model aims to estimate a company's true value by projecting its future cash flows and discounting them back to today's dollars. In essence, it answers the question, "How much are all of Caterpillar's future cash flows worth at this moment?"

Caterpillar's current free cash flow stands at $8.3 Billion, reflecting the company’s strong operational performance. Analyst projections expect steady growth; for example, free cash flow is slated to reach around $13.9 Billion by the end of 2029. While analyst estimates cover the next five years, further projections are extrapolated using reasonable growth assumptions to stretch ten years into the future.

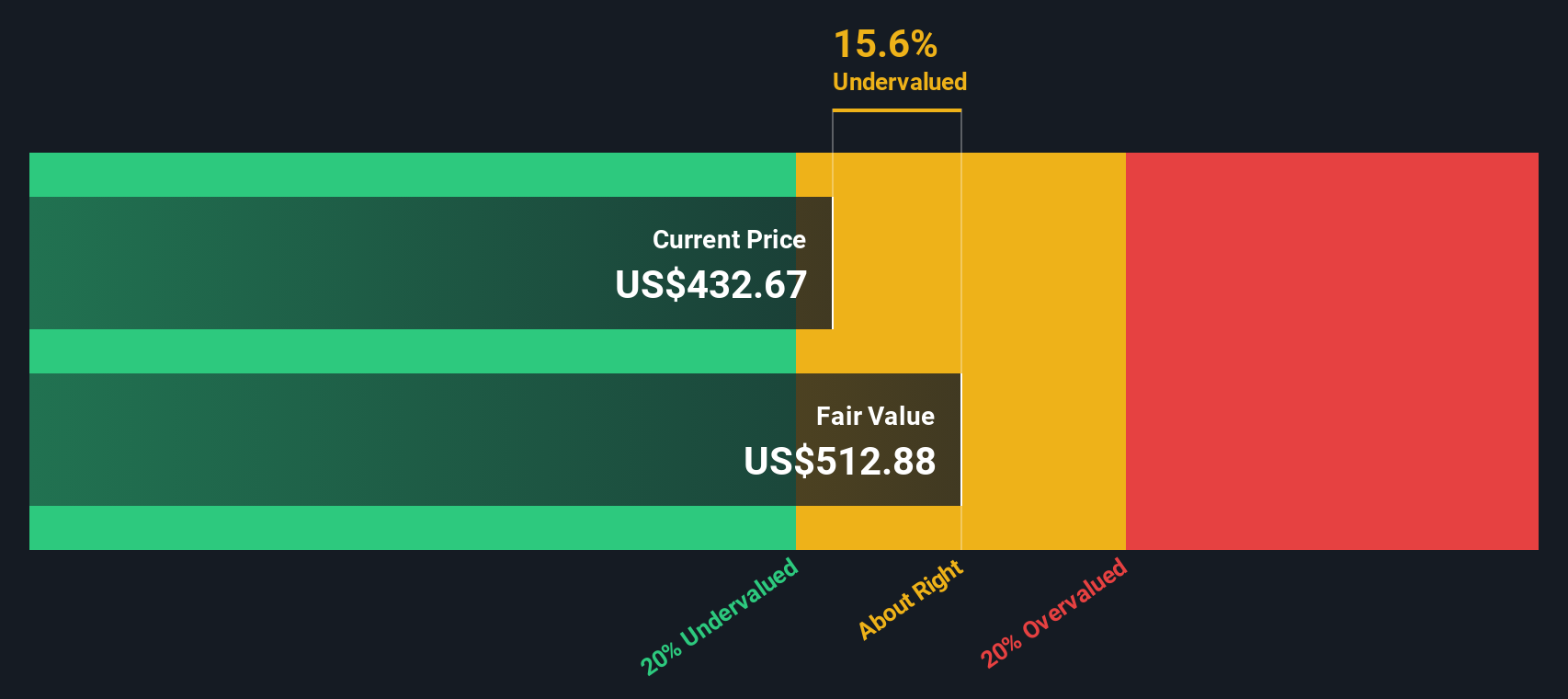

According to the DCF model, Caterpillar’s fair value is $509.16 per share. This calculation suggests the stock is currently trading about 2.2% below its intrinsic value, implying a modest undervaluation.

The takeaway is that DCF analysis indicates Caterpillar is trading right around fair value, with only a very slight discount.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Caterpillar's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Caterpillar Price vs Earnings (PE Ratio Analysis)

The price-to-earnings (PE) ratio is widely regarded as a strong valuation tool for profitable companies like Caterpillar. Since it directly links a company’s share price to its per-share earnings, the PE ratio helps investors judge how much they’re paying for every dollar the company generates in profit.

What’s considered a “fair” PE ratio is not static, as it reflects the company’s earnings growth outlook and the risks facing its business. High growth prospects or low risk usually justify a higher PE, while sluggish growth or elevated risk can push it lower.

Currently, Caterpillar trades at a PE ratio of 24.7x, which is almost exactly in line with the machinery industry average of 24.5x. This figure is above the average of its direct peers at 19.9x. Instead of only comparing to industry or peer averages, Simply Wall St’s “Fair Ratio” analysis considers additional factors. The Fair Ratio for Caterpillar is 35.3x, reflecting its sector, growth potential, profitability, risk profile, and market capitalization.

This indicates Caterpillar’s PE ratio is well below what the Fair Ratio suggests would be reasonable for a company with its specific characteristics. As a result, Caterpillar appears attractively valued using this method.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

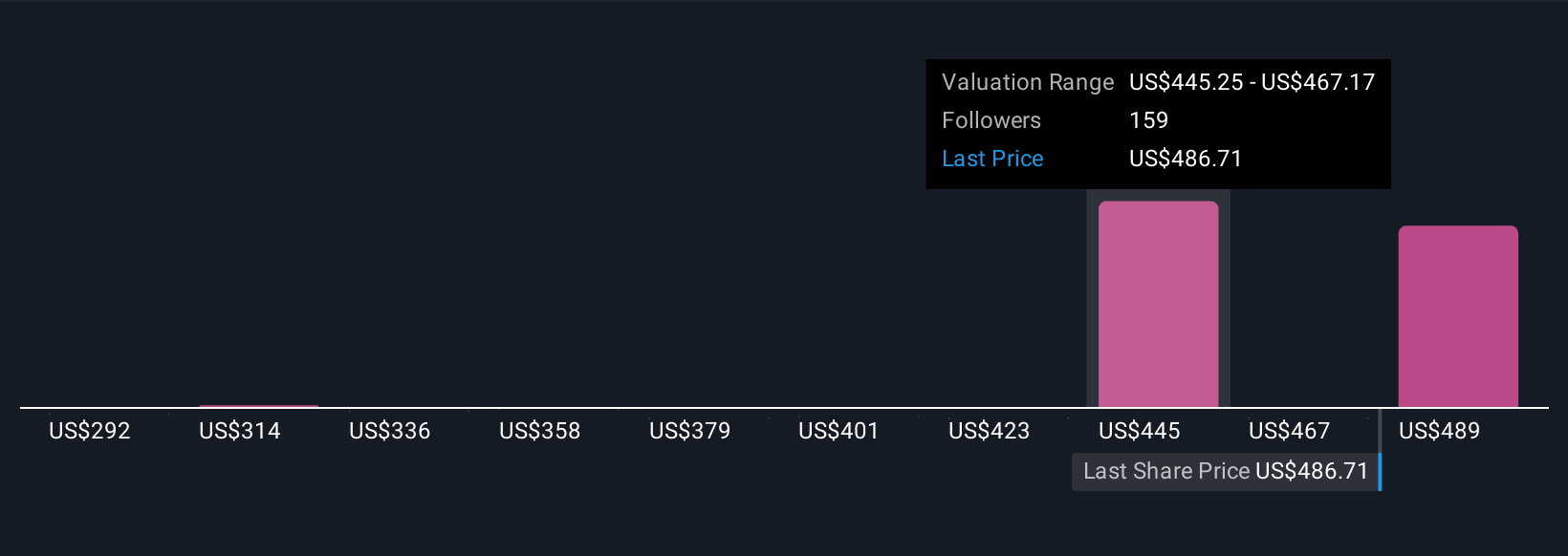

Upgrade Your Decision Making: Choose your Caterpillar Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about what will happen to a company like Caterpillar, combining your expectations about future revenue, profits, and margins into a fair value. This approach makes the numbers personal, not just theoretical. Narratives connect your perspective (the “why” behind your forecast) to a dynamic financial model, letting you see how your outlook translates into a buy, hold, or sell decision by comparing your Fair Value to the current market Price.

Accessible right on the Simply Wall St Community page, where millions of investors share views, Narratives make complex valuation both easy and interactive. What makes Narratives especially valuable is how they update automatically whenever new events, news, or earnings reports appear, so your valuation always stays relevant. For example, one investor may justify a bullish fair value of $507 based on optimism about global infrastructure cycles and margin expansion, while another might argue for a more cautious fair value of $350 due to geopolitical risks and tariff impacts. Both perspectives are clearly traced from their story to their numbers. Narratives empower you to invest with confidence, grounded in your own reasoning and real-time data.

Do you think there's more to the story for Caterpillar? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAT

Caterpillar

Manufactures and sells construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives in the United States and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives