- United States

- /

- Machinery

- /

- NYSE:CAT

Caterpillar (CAT) Margin Decline Challenges Bullish Narratives Despite Strong Long-Term Earnings Growth

Reviewed by Simply Wall St

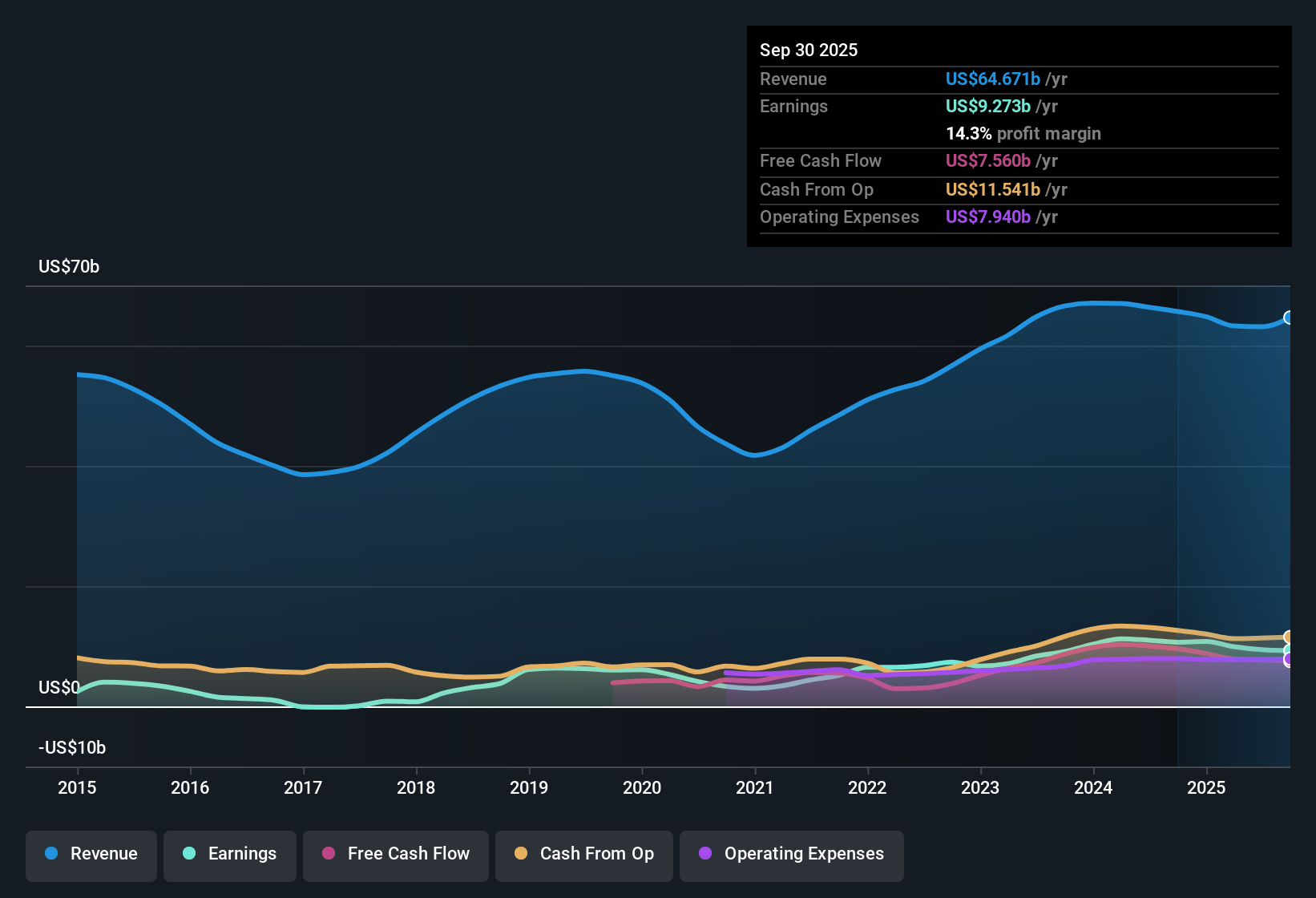

Caterpillar (CAT) reported a 16.39% forecasted annual growth in earnings, outpacing the US market average of 15.9%. Revenue is projected to increase by 5.7% per year, while the company’s current net profit margin is 14.3%, lower than last year’s 16.3%. Although Caterpillar has delivered robust earnings growth averaging 20.7% per year over the past five years, the most recent year saw a dip in earnings and compressed margins. This indicates a shift in profitability dynamics.

See our full analysis for Caterpillar.The real test for Caterpillar is how these numbers compare to the narratives investors are following. Some expectations will be confirmed, while others may be shaken up in the analysis ahead.

See what the community is saying about Caterpillar

Profit Margins Poised for a Rebound

- Analysts forecast Caterpillar’s net profit margins to climb from 14.9% today to 18.2% within three years, implying a turnaround from the recent margin compression even as 2024 started with soft margins versus last year’s 16.3% mark.

- According to the analysts’ consensus view, margin recovery is built on:

- High-margin services and aftermarket sales, plus operational efficiencies as new manufacturing capacity is absorbed, are seen as the main levers for margin expansion.

- Record backlog levels and robust infrastructure demand point to a supportive revenue base, but consensus still assumes cost controls are the differentiator powering margin improvement rather than just sales growth.

- To see how analysts expect these catalysts to evolve for Caterpillar, don’t miss the full Consensus Narrative. 📊 Read the full Caterpillar Consensus Narrative.

Tariffs and Price Competition: Risk to Operating Leverage

- The company faces a potential $1.3 to $1.5 billion pre-tax headwind starting in 2025 if new tariffs are imposed, presenting a direct challenge to profitability at a time when ongoing price competition and cost inflation in core segments are already pressuring margins.

- As highlighted by the consensus narrative:

- Bears argue that exposure to evolving global trade policy and the persistent use of aggressive price incentives could make it tough for the company to recover margin if geopolitical and cost factors deteriorate further.

- Recent declines in profit margins, coupled with ongoing risk of elevated tariffs, increase the likelihood of continued earnings volatility despite otherwise constructive top-line trends.

Premium Valuation Raises Expectations

- Caterpillar trades at a price-to-earnings ratio of 29.2x versus the US Machinery industry average of 24x, and its $577.26 share price sits well above both the DCF fair value of $513.31 and the official analyst price target of 548.96.

- The consensus narrative notes that such a premium reflects confidence in margin recovery and multi-year growth but also heightens the risk if execution falls short:

- With only a 7.8% gap between the current share price and the analyst consensus price target, there is little implied upside; investors are paying up for operational outperformance.

- Unless future earnings growth and profitability outpace expectations, the stock’s elevated valuation could act as a near-term headwind for returns.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Caterpillar on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at these numbers from another angle? In just a few minutes, you can shape your own take on the story. Do it your way

A great starting point for your Caterpillar research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Caterpillar’s premium valuation, recent margin compression, and risk of ongoing earnings volatility highlight the pressure on future returns if execution disappoints.

If you’re looking for opportunities with more upside and lower valuation risks, check out these 834 undervalued stocks based on cash flows that could offer better value for your next idea.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAT

Caterpillar

Manufactures and sells construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives in the United States and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives