- United States

- /

- Aerospace & Defense

- /

- NYSE:BWXT

Can BWXT’s Growth Continue After an 83% Surge and Rising Nuclear Demand?

Reviewed by Bailey Pemberton

Thinking about what to do with BWX Technologies stock? You are definitely not alone. With shares recently closing at $204.03 and a year marked by some eye-catching returns, it is natural for investors to wonder if there is still room for the stock to run, or if it is time to be cautious. You might have noticed that after a significant climb of over 295% in five years and nearly 270% across the past three, the past week showed a slight pullback of -1.8%. However, the 13% gain over the last 30 days and a notable 83% jump year-to-date keep BWX firmly in the growth spotlight.

Much of this energy around the stock is tied to ongoing developments in the company’s core markets. Recent news points to rising demand for nuclear solutions amid a broader transition to clean energy and heightened defense priorities. These factors are fueling interest in industry leaders like BWX Technologies. These storylines have provided a compelling backdrop for the stock’s performance, as investors focus on both growth potential and shifts in perceived risk.

Of course, spectacular gains often spark questions about valuation. BWX’s value score currently sits at 0, with none of the six typical undervaluation checks in its favor, which signals that the market is already pricing in a lot of optimism. But is that the whole story? In the next section, we will break down the main ways analysts gauge if a company’s stock price reflects its true value and provide an idea of an approach that can help cut through the noise.

BWX Technologies scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: BWX Technologies Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the value of a company based on its future cash flows. This model projects these flows forward and then discounts them back to their value today. This method helps identify whether a stock is trading above or below what those future profits might be worth in present-day dollars.

For BWX Technologies, the most recent Free Cash Flow (FCF) was $344.85 million. Analysts forecast continued growth, with projections reaching $419.30 million by the end of 2028. After the initial analyst forecasts, additional years are estimated, bringing projected FCF to roughly $641.38 million by 2035. All numbers are in US dollars and based on company disclosures and extrapolations, with earlier years rooted in direct analyst input.

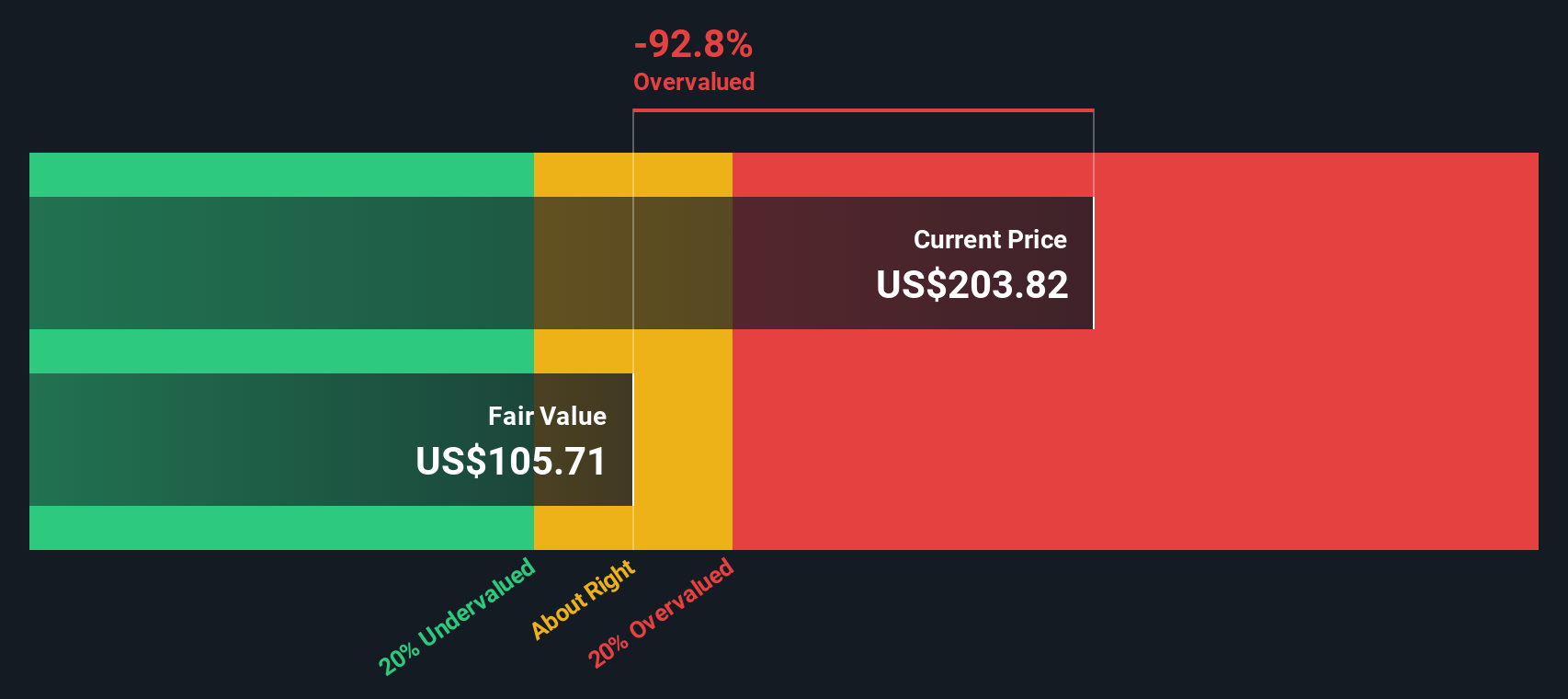

Based on these cash flow projections and the DCF methodology, BWX Technologies' intrinsic value is calculated at $106.14 per share. With the stock's recent closing price of $204.03, the DCF suggests that BWX is currently trading at a 92.2% premium to its intrinsic value. In simple terms, the stock appears significantly overvalued by this measure.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests BWX Technologies may be overvalued by 92.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: BWX Technologies Price vs Earnings

For established, profitable companies like BWX Technologies, the Price-to-Earnings (PE) ratio is a widely used method for assessing value. The PE ratio reflects how much investors are willing to pay for each dollar of earnings, offering a snapshot of market sentiment and expectations. Generally, a higher PE can signal optimism about future growth, while a lower PE might mean muted expectations or higher perceived risk.

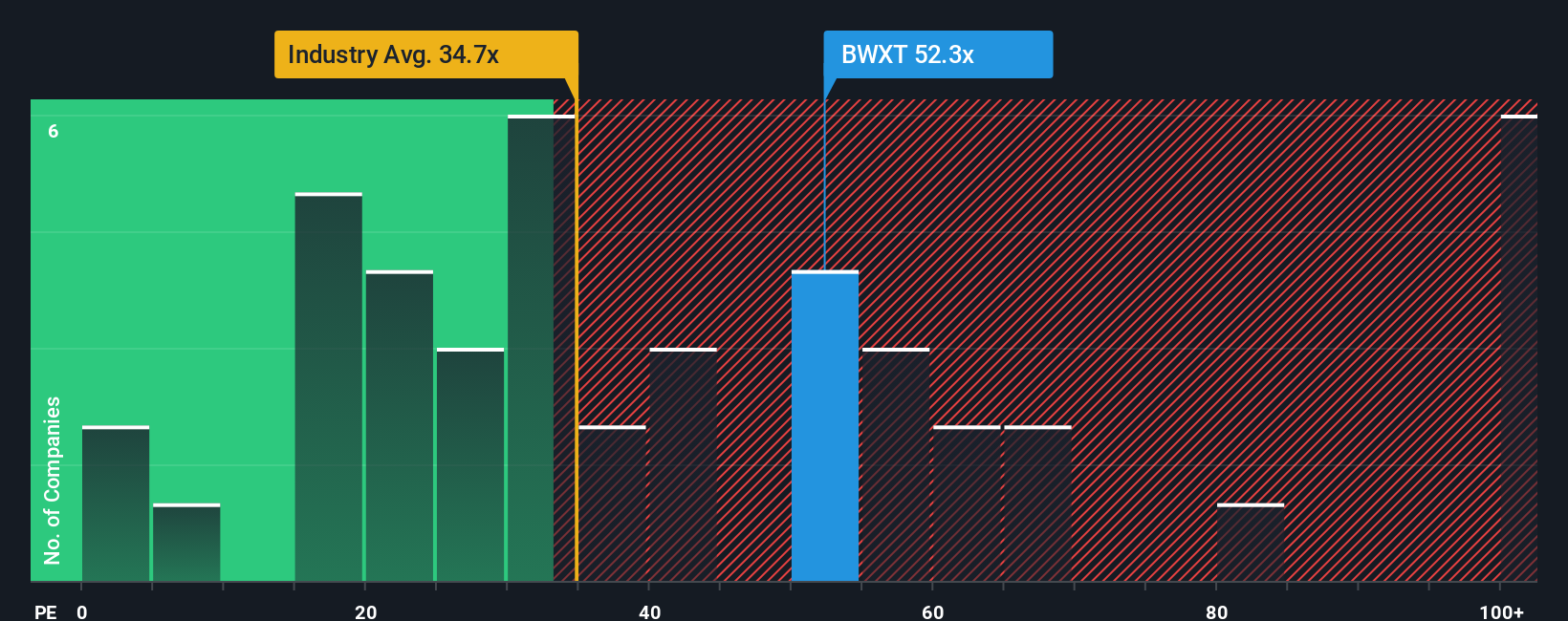

BWX Technologies is currently trading at a PE ratio of 63.4x. To put that in perspective, this is well above the peer average of 36.1x and clearly higher than the broader Aerospace & Defense industry average PE of 40.9x. While high growth prospects and lower risk profiles can justify a premium, extremes can also signal overheated enthusiasm.

Simply Wall St uses a proprietary "Fair Ratio" to gauge what a reasonable PE ratio should be for each company, reflecting factors like growth outlook, profit margins, industry specifics, market size and unique risk considerations. In BWX Technologies' case, the Fair Ratio is 29.3x. This individualized measure is more robust than simple industry or peer comparisons because it blends major valuation drivers into a tailored benchmark.

Comparing BWX Technologies' actual PE of 63.4x to its Fair Ratio of 29.3x highlights a significant gap. This suggests the stock is trading at a substantial premium to what would be considered reasonable based on its fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your BWX Technologies Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple yet powerful tool that lets you create your own view of a company’s future by telling the story behind the numbers. This approach connects your perspective on BWX Technologies’ strategy, growth opportunities, and risks to concrete forecasts for revenue, profits, and fair value.

Instead of just relying on historical data or analyst consensus, Narratives help you tie together BWX Technologies’ unique positioning, such as its government contract dominance or entry into new markets for small modular reactors, with your assumptions about what lies ahead. Narratives on the Simply Wall St Community page (used by millions) let you test your story, compare Fair Value to today’s price, and quickly determine if your investment logic holds up.

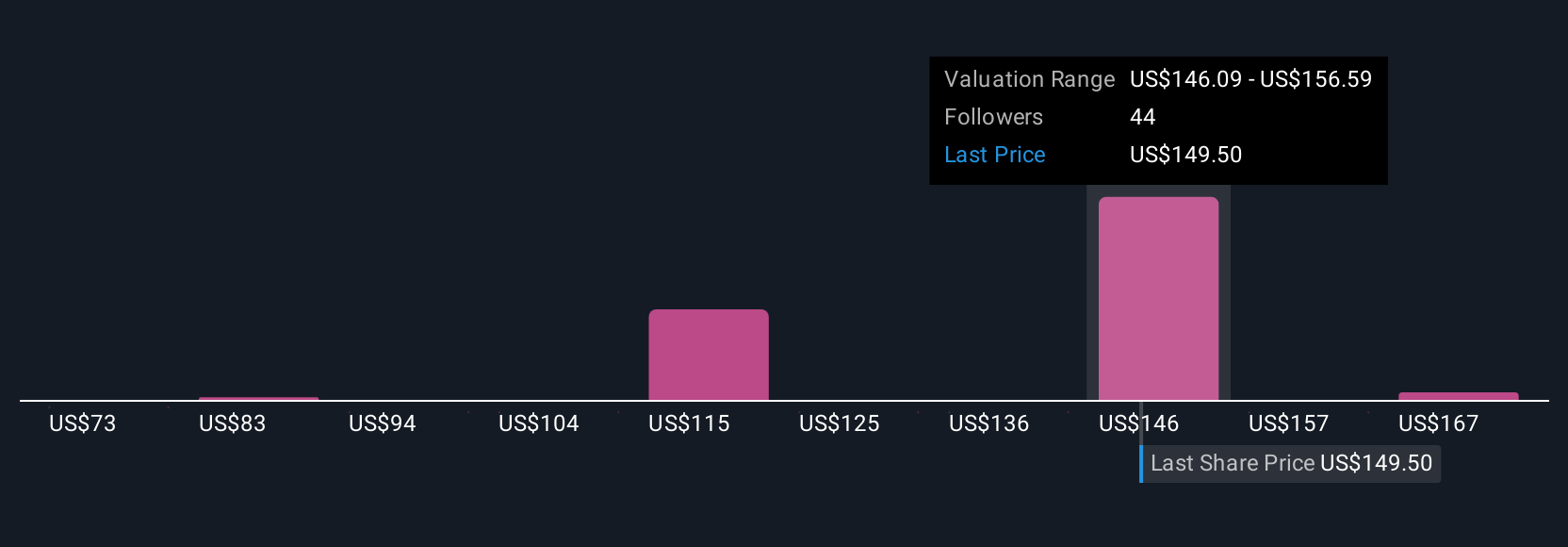

Best of all, Narratives update automatically as new information and earnings become available, keeping your investment thesis fresh and relevant. For example, among recent Narratives for BWX Technologies, the most bullish suggests a fair value of $250 per share, reflecting high confidence in long-term growth and contract wins, while the most bearish estimates just $120, emphasizing margin pressure and funding risks. In seconds, you can see where you fit on the spectrum and make smarter, more personalized decisions.

For BWX Technologies, however, we'll make it really easy for you with previews of two leading BWX Technologies Narratives:

Fair Value Estimate: $220.00

Current valuation: 7.3% below the Narrative's fair value

Forecast Revenue Growth: 16.45%

- Government contract leadership in nuclear propulsion engines for submarines and aircraft carriers anchors a large and recurring revenue base. Over 80% of revenues are sourced from government spending.

- Strategic acquisitions in isotope production and power plant services diversify income streams and bolster future commercial opportunities. However, their impact may take years to be fully realized.

- Risks involve dependence on government and regulatory decisions, which could quickly impact future funding, spending, and public sentiment toward nuclear energy.

Fair Value Estimate: $203.30

Current valuation: 0.4% above the Narrative's fair value

Forecast Revenue Growth: 12.44%

- Strong backlog driven by multi-year defense contracts and technology investments supports recurring revenue growth and earnings stability. Commercial expansion widens addressable markets and service revenues.

- Key risks include overreliance on long-term government contracts, margin pressures in commercial operations, and the potential for supply chain and workforce disruptions to erode profitability.

- The narrative valuation is based on analyst consensus of continued mid-teens revenue growth and improved margins. Bears caution that downside can materialize if major defense awards stall or organic commercial demand sags.

Do you think there's more to the story for BWX Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BWX Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BWXT

BWX Technologies

Manufactures and sells nuclear components in the United States, Canada, and internationally.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives