- United States

- /

- Aerospace & Defense

- /

- NYSE:BWXT

BWX Technologies (BWXT): Evaluating Valuation After 60% Year-to-Date Gains in Defense and Nuclear Markets

Reviewed by Simply Wall St

BWX Technologies (BWXT) stock has shown some movement recently, and investors are keeping an eye on key factors shaping its valuation. With a year-to-date gain of 60%, there is plenty to consider around the company's performance and prospects.

See our latest analysis for BWX Technologies.

BWX Technologies’ impressive share price return of nearly 60% so far this year signals strong momentum, fueled in part by ongoing interest in defense and nuclear sectors. While the stock saw some volatility over the past month, its three- and five-year total shareholder returns of 202% and 234% respectively highlight both recent enthusiasm and longer-term confidence from investors.

If BWXT’s strong run has you thinking bigger, there is a world of opportunity in aerospace and defense stocks. See the full list for free.

Given these impressive gains, the big question for investors is whether BWX Technologies still offers untapped value or if its future growth and optimism have already been fully reflected in the current stock price.

Most Popular Narrative: 19% Undervalued

BWX Technologies' most widely followed narrative suggests its fair value sits well above the recent closing price. This hints at significant upside potential driven by sector trends and unique business strengths.

Having a ‘monopoly’ on government contracts regarding nuclear reactor engines on submarines and aircraft carriers helps position BWXT for all government related news in the industry. Being the only contractor that develops, manufactures and maintains the engines for those vehicles almost guarantees consistent multi-billion dollars in contracts from the DoD.

What’s hiding underneath this bold valuation? Hint: a powerful combination of government-backed revenue, acquisitions primed for expansion, and ambitious growth targets. Want to know which numbers have captivated narrative followers? See the quantitative road map powering this upside forecast.

Result: Fair Value of $220 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sudden shifts in government funding or rising regulatory hurdles could quickly challenge this optimistic outlook and change BWXT's growth trajectory.

Find out about the key risks to this BWX Technologies narrative.

Another View: What Do Multiples Say?

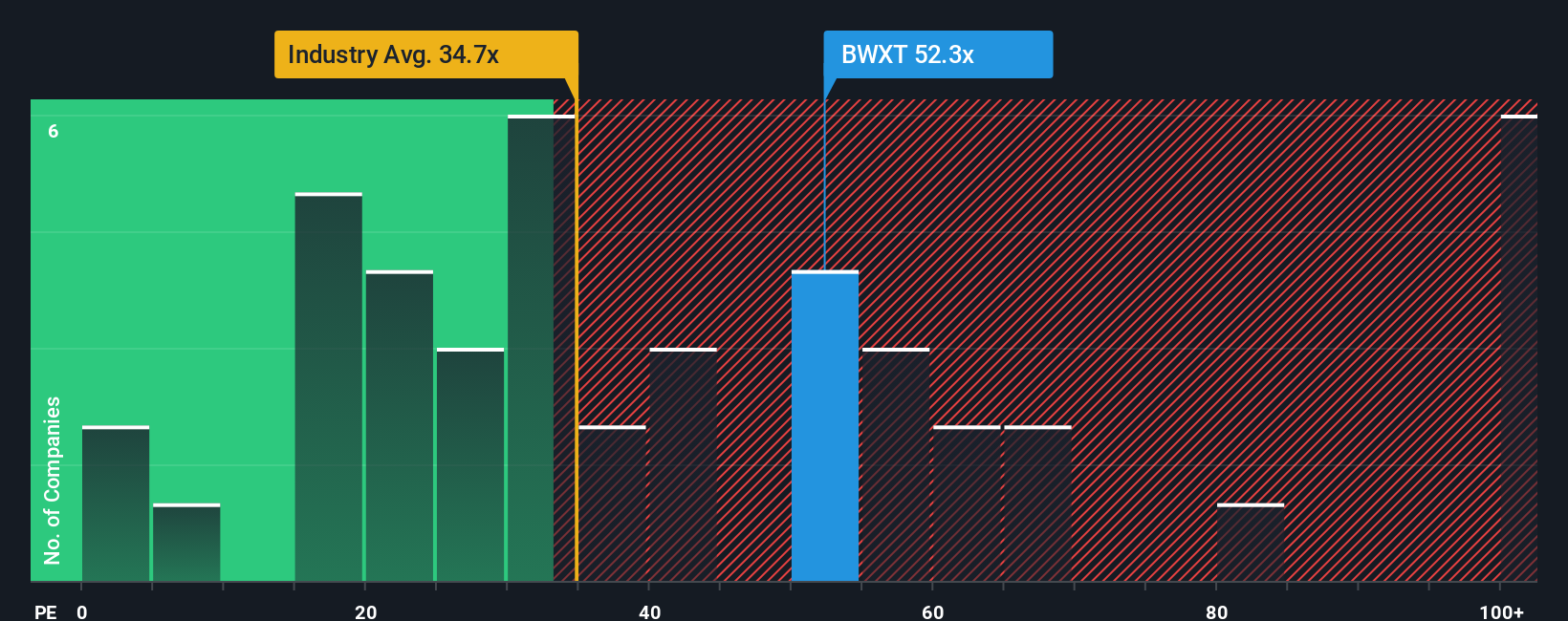

While the most popular narrative sees BWXT as undervalued, the market tells a different story through its price-to-earnings ratio. Trading at 53.1 times earnings, BWXT stands well above both the US Aerospace & Defense industry average of 38.4x and its peer group average of 35.3x. Even compared to a fair ratio estimate of 31.1x, the stock commands a significant premium, signaling that investors may already be pricing in much of the anticipated growth.

When the market stretches so far beyond typical benchmarks, it raises the stakes. Could optimism lead to disappointment if growth slows, or is there a reason for this sustained confidence?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BWX Technologies Narrative

If you see the story differently or want to dig into the fundamentals yourself, you can craft your own view in just a few minutes. Do it your way.

A great starting point for your BWX Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Opportunities extend far beyond one stock, and the smartest investors always stay one step ahead. Use these powerful ideas to spot potential winners before others do.

- Capture tomorrow’s tech trends early on by checking out these 25 AI penny stocks, which are fueling innovation in artificial intelligence and automation.

- Start building a stream of passive income with these 15 dividend stocks with yields > 3%, featuring companies with robust yields and consistent payouts above 3%.

- Position yourself in the rapidly evolving crypto space with these 81 cryptocurrency and blockchain stocks, which are moving the needle in blockchain and digital asset markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BWX Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BWXT

BWX Technologies

Manufactures and sells nuclear components in the United States, Canada, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success