- United States

- /

- Electrical

- /

- NYSE:BW

Benign Growth For Babcock & Wilcox Enterprises, Inc. (NYSE:BW) Underpins Stock's 46% Plummet

Babcock & Wilcox Enterprises, Inc. (NYSE:BW) shareholders won't be pleased to see that the share price has had a very rough month, dropping 46% and undoing the prior period's positive performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 79% loss during that time.

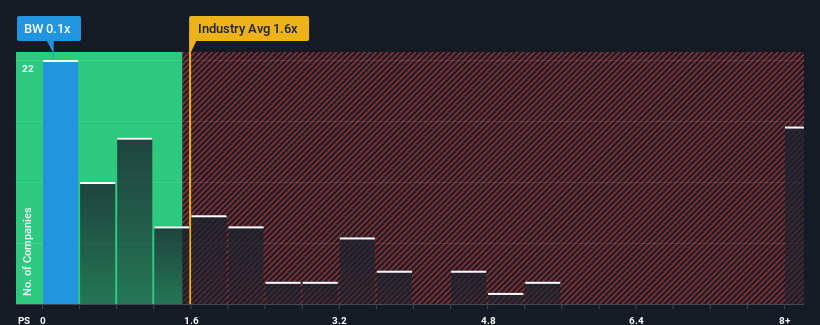

After such a large drop in price, Babcock & Wilcox Enterprises' price-to-sales (or "P/S") ratio of 0.1x might make it look like a buy right now compared to the Electrical industry in the United States, where around half of the companies have P/S ratios above 1.6x and even P/S above 4x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Babcock & Wilcox Enterprises

What Does Babcock & Wilcox Enterprises' Recent Performance Look Like?

Recent times haven't been great for Babcock & Wilcox Enterprises as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Babcock & Wilcox Enterprises.How Is Babcock & Wilcox Enterprises' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Babcock & Wilcox Enterprises' is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 9.1% last year. This was backed up an excellent period prior to see revenue up by 65% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 0.2% over the next year. Meanwhile, the rest of the industry is forecast to expand by 12%, which is noticeably more attractive.

In light of this, it's understandable that Babcock & Wilcox Enterprises' P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Babcock & Wilcox Enterprises' P/S?

Babcock & Wilcox Enterprises' recently weak share price has pulled its P/S back below other Electrical companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Babcock & Wilcox Enterprises maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about these 3 warning signs we've spotted with Babcock & Wilcox Enterprises (including 1 which is significant).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Babcock & Wilcox Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BW

Babcock & Wilcox Enterprises

Provides energy and emissions control solutions to industrial, electrical utility, municipal, and other customers in the United States, Canada, the United Kingdom, Indonesia, and Philippines.

Undervalued moderate.

Similar Companies

Market Insights

Community Narratives