- United States

- /

- Electrical

- /

- NYSE:BW

Babcock & Wilcox Enterprises, Inc. (NYSE:BW) Surges 25% Yet Its Low P/S Is No Reason For Excitement

Those holding Babcock & Wilcox Enterprises, Inc. (NYSE:BW) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 79% share price decline over the last year.

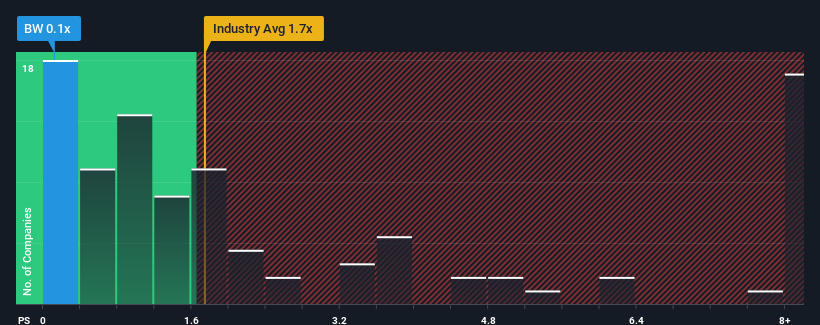

Although its price has surged higher, Babcock & Wilcox Enterprises may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.1x, considering almost half of all companies in the Electrical industry in the United States have P/S ratios greater than 1.7x and even P/S higher than 5x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Babcock & Wilcox Enterprises

How Babcock & Wilcox Enterprises Has Been Performing

Recent times have been advantageous for Babcock & Wilcox Enterprises as its revenues have been rising faster than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Babcock & Wilcox Enterprises' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Babcock & Wilcox Enterprises?

The only time you'd be truly comfortable seeing a P/S as low as Babcock & Wilcox Enterprises' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered an exceptional 31% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 76% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the four analysts covering the company suggest revenue growth is heading into negative territory, declining 5.1% over the next year. That's not great when the rest of the industry is expected to grow by 16%.

In light of this, it's understandable that Babcock & Wilcox Enterprises' P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Babcock & Wilcox Enterprises' P/S

The latest share price surge wasn't enough to lift Babcock & Wilcox Enterprises' P/S close to the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Babcock & Wilcox Enterprises' analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. As other companies in the industry are forecasting revenue growth, Babcock & Wilcox Enterprises' poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

Before you settle on your opinion, we've discovered 2 warning signs for Babcock & Wilcox Enterprises (1 is significant!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Babcock & Wilcox Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BW

Babcock & Wilcox Enterprises

Provides energy and emissions control solutions to industrial, electrical utility, municipal, and other customers in the United States, Canada, the United Kingdom, Indonesia, and Philippines.

Undervalued moderate.

Similar Companies

Market Insights

Community Narratives