- United States

- /

- Building

- /

- NYSE:BLDR

Why Builders FirstSource (BLDR) Is Up 5.8% After Fed Rate Cut Hopes Lift Housing Sentiment

Reviewed by Simply Wall St

- Builders FirstSource shares climbed in recent days after Federal Reserve Chair Jerome Powell indicated that interest rate cuts may be on the horizon, igniting optimism for lower financing costs across rate-sensitive sectors.

- This shift in monetary policy expectations is particularly meaningful for the construction supply industry, which benefits from reduced borrowing costs and improved housing market sentiment.

- We'll examine how the prospect of lower interest rates could impact Builders FirstSource's position as outlined in its investment narrative.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 28 companies in the world exploring or producing it. Find the list for free.

Builders FirstSource Investment Narrative Recap

To own Builders FirstSource, investors generally need to believe in a sustained recovery in US housing starts and construction activity, alongside continued industry adoption of digital and value-added solutions. Recent signals from the Fed about potential rate cuts may relieve some pressure on new home demand in the near term, but high exposure to lumber pricing and ongoing softness in housing starts remain the most important catalyst and biggest risk to watch, respectively, and this news does not fully offset those headwinds.

The company’s updated 2025 earnings guidance, with net sales forecast between US$14.8 billion and US$15.6 billion, arrived shortly before the Fed comments, reflecting the current muted demand environment. While optimism around lower rates aligns with management’s emphasis on future market recovery, ongoing revenue and earnings contraction in the most recent quarter underline how sector challenges are still material to Builders FirstSource’s short-term outlook.

Yet, despite potential tailwinds from lower rates, investors should stay mindful of...

Read the full narrative on Builders FirstSource (it's free!)

Builders FirstSource's outlook anticipates $16.4 billion in revenue and $684.5 million in earnings by 2028. This involves a 0.9% annual revenue decline and a $71.9 million decrease in earnings from the current $756.4 million.

Uncover how Builders FirstSource's forecasts yield a $139.00 fair value, a 4% downside to its current price.

Exploring Other Perspectives

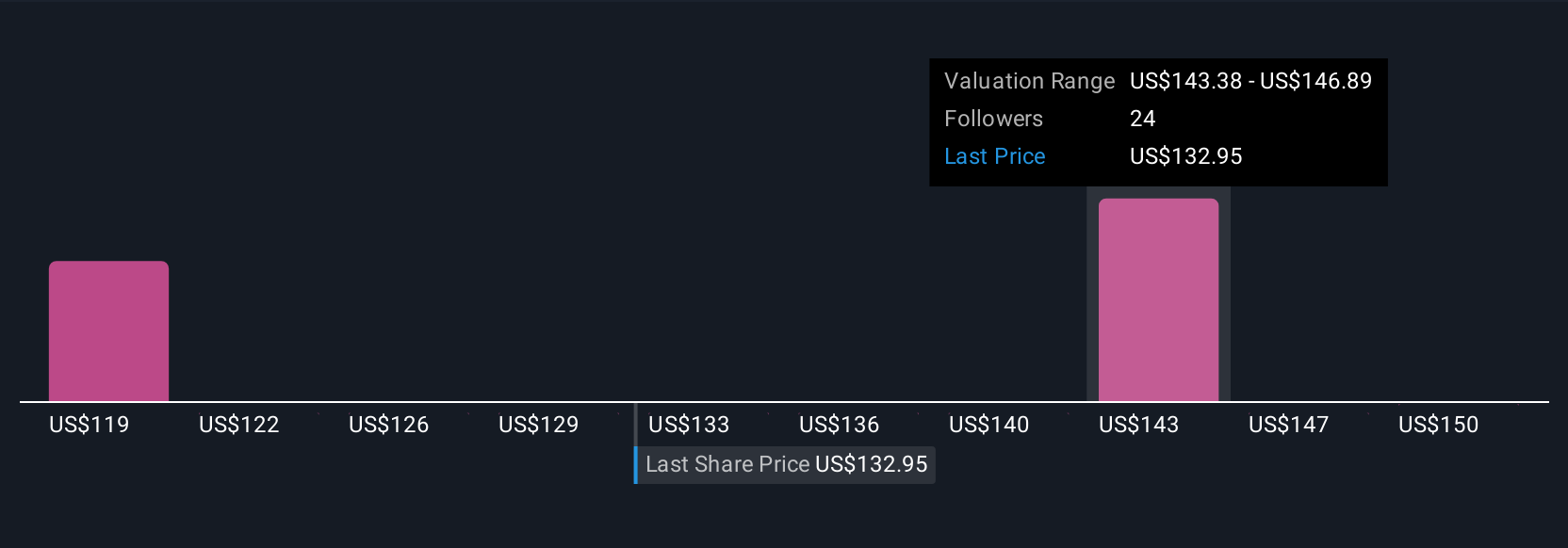

Simply Wall St Community members shared three fair value estimates for Builders FirstSource, ranging from US$120.55 to US$153.90. As opinions vary, remember: ongoing softness in housing starts could continue to influence results, so consider several viewpoints before making any conclusions.

Explore 3 other fair value estimates on Builders FirstSource - why the stock might be worth 17% less than the current price!

Build Your Own Builders FirstSource Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Builders FirstSource research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Builders FirstSource research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Builders FirstSource's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Builders FirstSource might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLDR

Builders FirstSource

Manufactures and supplies building materials, manufactured components, and construction services to professional homebuilders, sub-contractors, remodelers, and consumers in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives