- United States

- /

- Building

- /

- NYSE:BLDR

Builders FirstSource (BLDR) Valuation After Recent Share Price Pullback

Reviewed by Simply Wall St

What is happening with Builders FirstSource stock?

Builders FirstSource (BLDR) has quietly lagged the broader market this year, with shares down about 23% year to date and nearly 38% over the past year, despite still solid multi year returns.

See our latest analysis for Builders FirstSource.

With the share price now around $110.01, the stock’s weaker 90 day share price return contrasts sharply with its strong three and five year total shareholder returns. This suggests short term momentum is fading even as the longer term story remains intact.

If Builders FirstSource’s recent pullback has you rethinking your exposure to cyclicals, it could be a good moment to explore fast growing stocks with high insider ownership for other compelling ideas.

With earnings still growing and the stock trading at a modest discount to analyst targets, investors face a pivotal question: is Builders FirstSource undervalued after this pullback, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 18.2% Undervalued

Compared with the last close at $110.01, the most popular narrative points to a materially higher fair value, framing Builders FirstSource as a cyclical recovery play built on margin resilience and consolidation.

The company is investing heavily in digital transformation and value-added solutions (e.g., digital tools, ERP integration, prefabricated components) that are expected to drive higher-margin growth, increase operating efficiency, and strengthen customer relationships as the market recovers, improving both future revenue and net margins.

Want to see what kind of modest top line expectations still support a higher valuation multiple, even as margins edge lower and buybacks quietly shrink the share count? The most followed narrative stitches together slower headline growth, steady profitability, and a richer future earnings multiple to justify its fair value.

Result: Fair Value of $134.41 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained housing softness or renewed commodity price volatility could easily delay the recovery thesis and challenge assumptions on margins and valuation potential.

Find out about the key risks to this Builders FirstSource narrative.

Another Angle on Valuation

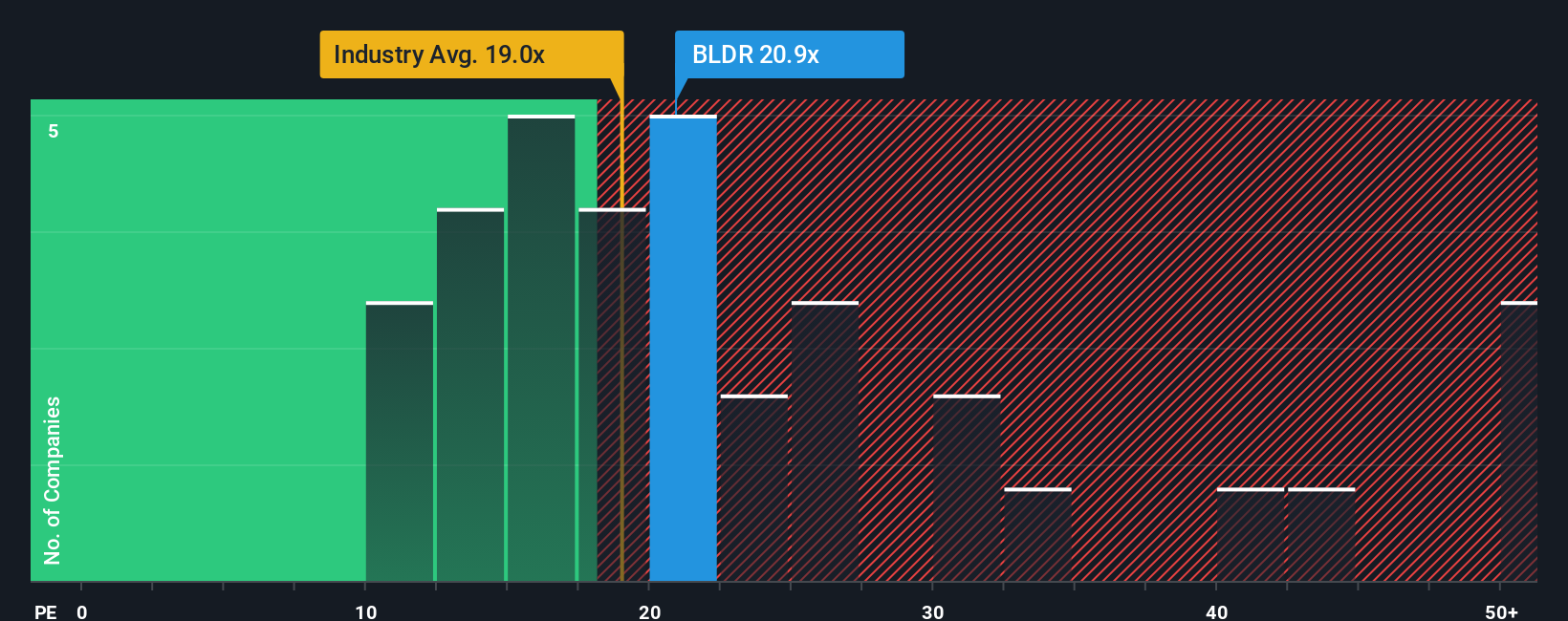

On earnings, the picture is less generous. BLDR trades at 20.5 times earnings, slightly above peers at 20 times and its industry at 19.6 times, yet below a fair ratio of 26.7 times. That mix of mild premium and longer term upside leaves investors asking how much risk is worth taking.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Builders FirstSource Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes, Do it your way.

A great starting point for your Builders FirstSource research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next potential opportunity by using the Simply Wall St Screener to uncover high conviction stocks that match your strategy.

- Capture potential mispricings by targeting companies that look attractively valued on future cash flows with these 905 undervalued stocks based on cash flows.

- Ride structural growth trends in automation and machine learning by screening for innovators and enablers through these 26 AI penny stocks.

- Position your portfolio for compounding income with consistently paid yields above 3 percent using these 15 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Builders FirstSource might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLDR

Builders FirstSource

Manufactures and supplies building materials, manufactured components, and construction services to professional homebuilders, sub-contractors, remodelers, and consumers in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026