- United States

- /

- Aerospace & Defense

- /

- NYSE:BETA

Eve eVTOL Motor Deal Could Be A Game Changer For BETA Technologies (BETA)

Reviewed by Sasha Jovanovic

- Earlier this week, Eve Air Mobility announced it has chosen BETA Technologies to supply electric pusher motors for its conforming prototypes and future production eVTOL aircraft, a potential 10-year opportunity valued at up to US$1 billion tied to Eve’s 2,800-aircraft backlog.

- The decision follows an extensive testing and validation phase of BETA’s motors, signalling growing confidence in its electric propulsion platform as a core component of next-generation urban air mobility fleets.

- Next, we’ll examine how this long-term Eve supply agreement, alongside BETA’s widened loss profile, reshapes the company’s investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is BETA Technologies' Investment Narrative?

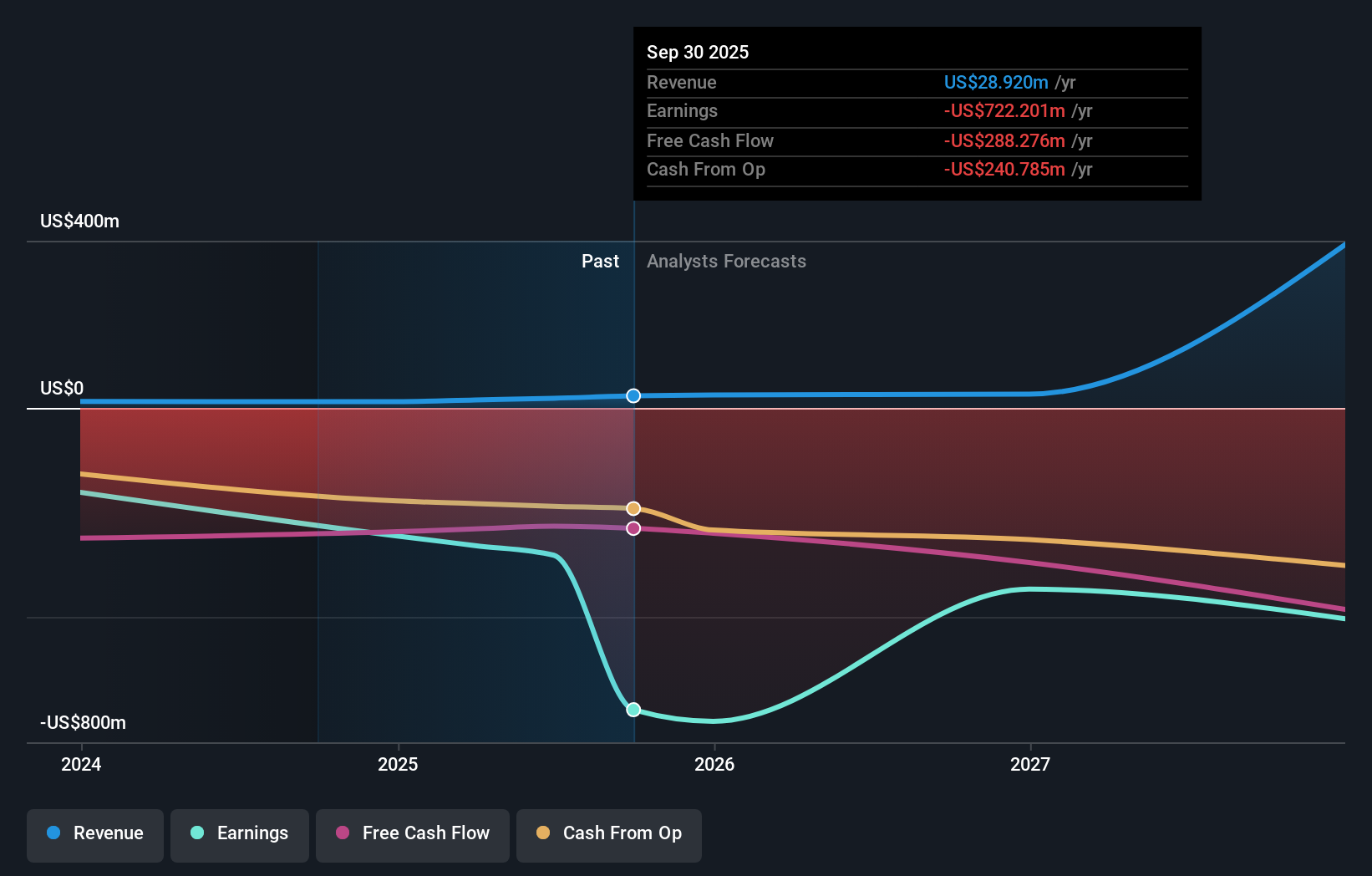

For BETA, you really have to believe that electric aviation becomes a real, scaled business before the company runs out of runway. The Eve Air Mobility motor deal helps that story: a potential US$1 billion, 10‑year opportunity that validates BETA’s propulsion tech and could deepen its role as a critical supplier across urban air mobility. In the near term, though, the key catalysts still sit around certification progress, execution on its 891‑aircraft backlog, and converting early infrastructure and defense partnerships into recurring revenue, all against guidance of just US$29 million to US$33 million in 2025 sales. The widened quarterly net loss of US$437.21 million keeps cash burn and future capital needs front and center, so this new Eve contract may influence sentiment more than fundamentals in the short run.

However, the scale of current losses is something investors should be very aware of. Insights from our recent valuation report point to the potential overvaluation of BETA Technologies shares in the market.Exploring Other Perspectives

Explore another fair value estimate on BETA Technologies - why the stock might be worth just $37.88!

Build Your Own BETA Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BETA Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free BETA Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BETA Technologies' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BETA Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BETA

BETA Technologies

Designs, develops, and manufactures electric aircraft platform and propulsion systems for the aviation industry in the United States.

Excellent balance sheet with limited growth.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026