- United States

- /

- Electrical

- /

- NYSE:BE

Is Bloom Energy’s Recent 343% Surge Supported by Clean Energy Policy News?

Reviewed by Bailey Pemberton

- Curious if Bloom Energy’s rapid ascent means it is now overvalued, or if there is real substance behind the hype? Let’s break down what has happened and what really matters for investors looking for value.

- Bloom Energy’s stock has had a rollercoaster year, rocketing up an incredible 343.1% year-to-date and 679.7% over the past year. However, it recently pulled back with a 24.3% drop in the last week.

- Momentum picked up following policy updates on clean energy incentives and major federal funding announcements for hydrogen infrastructure. This news has driven investor optimism that Bloom Energy will benefit from increased demand for its fuel cell technology and position itself as a leader in the transition to cleaner power sources.

- On our six-point valuation health check, Bloom Energy scores a 3 out of 6, signaling that it may be undervalued in key areas but not everywhere. Let’s examine the different ways to judge its worth, and why those numbers alone might not tell the full story.

Approach 1: Bloom Energy Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is truly worth by projecting its future cash flows and discounting them back to today's value. This approach aims to capture the long-term earning power of a business, making it a popular choice for evaluating growth stocks like Bloom Energy.

For Bloom Energy, the latest reported Free Cash Flow stands at $94.60 million. Analyst estimates cover the next five years, projecting robust growth. By 2029, Free Cash Flow is expected to reach $1.55 billion. Beyond the fifth year, Simply Wall St extrapolates these trends to map the company’s trajectory over a full decade.

Using these detailed cash flow forecasts, the DCF model calculates an intrinsic value for Bloom Energy of $147.37 per share. Compared to the recent share price, this implies a 29.7% upside, suggesting the stock is currently undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Bloom Energy is undervalued by 29.7%. Track this in your watchlist or portfolio, or discover 874 more undervalued stocks based on cash flows.

Approach 2: Bloom Energy Price vs Sales

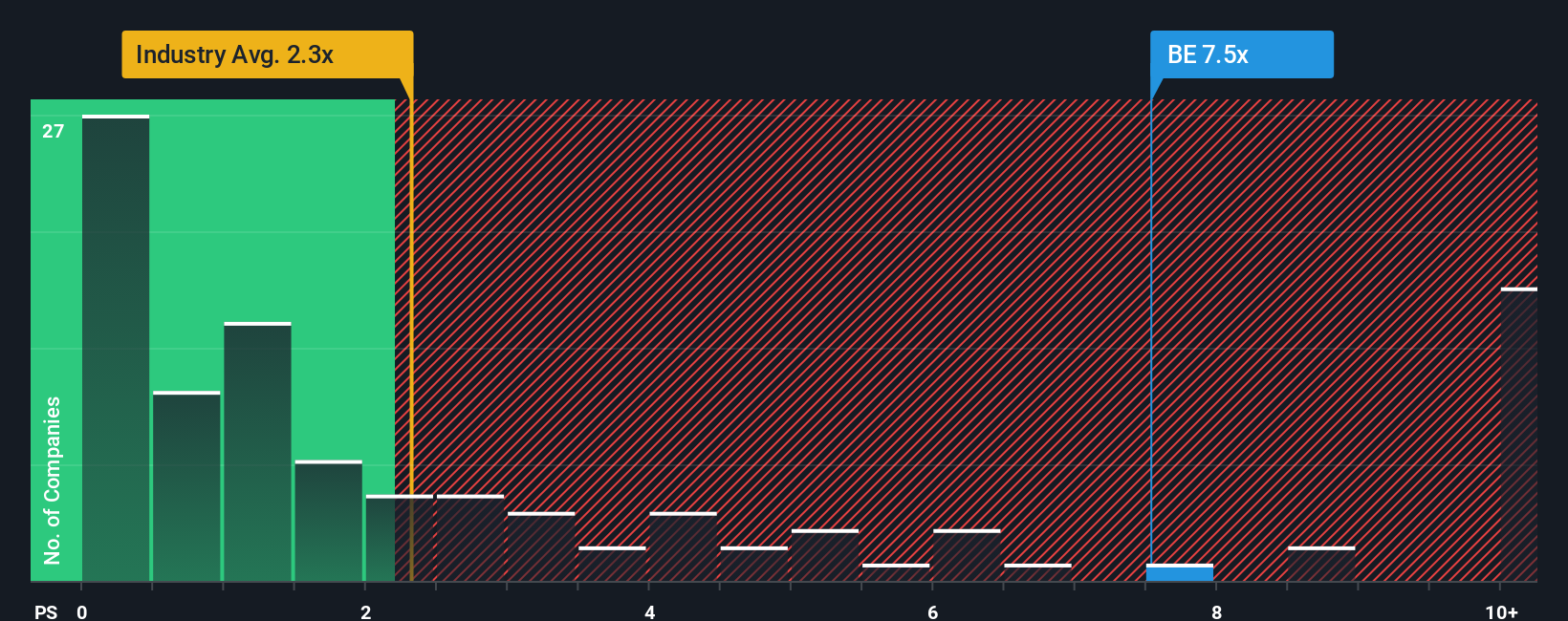

The Price-to-Sales (P/S) ratio is a widely used metric for valuing high-growth or unprofitable companies, as it compares a company’s market capitalization to its total sales. For companies like Bloom Energy that are investing heavily in growth but may not yet be profitable at the net income level, the P/S ratio provides a more meaningful view of valuation than metrics like Price-to-Earnings.

Growth expectations and risk play a big role in determining what counts as a "fair" P/S ratio. Fast-growing companies with strong future prospects often trade at higher P/S multiples, while firms with unpredictable revenue or industry challenges typically see lower ratios.

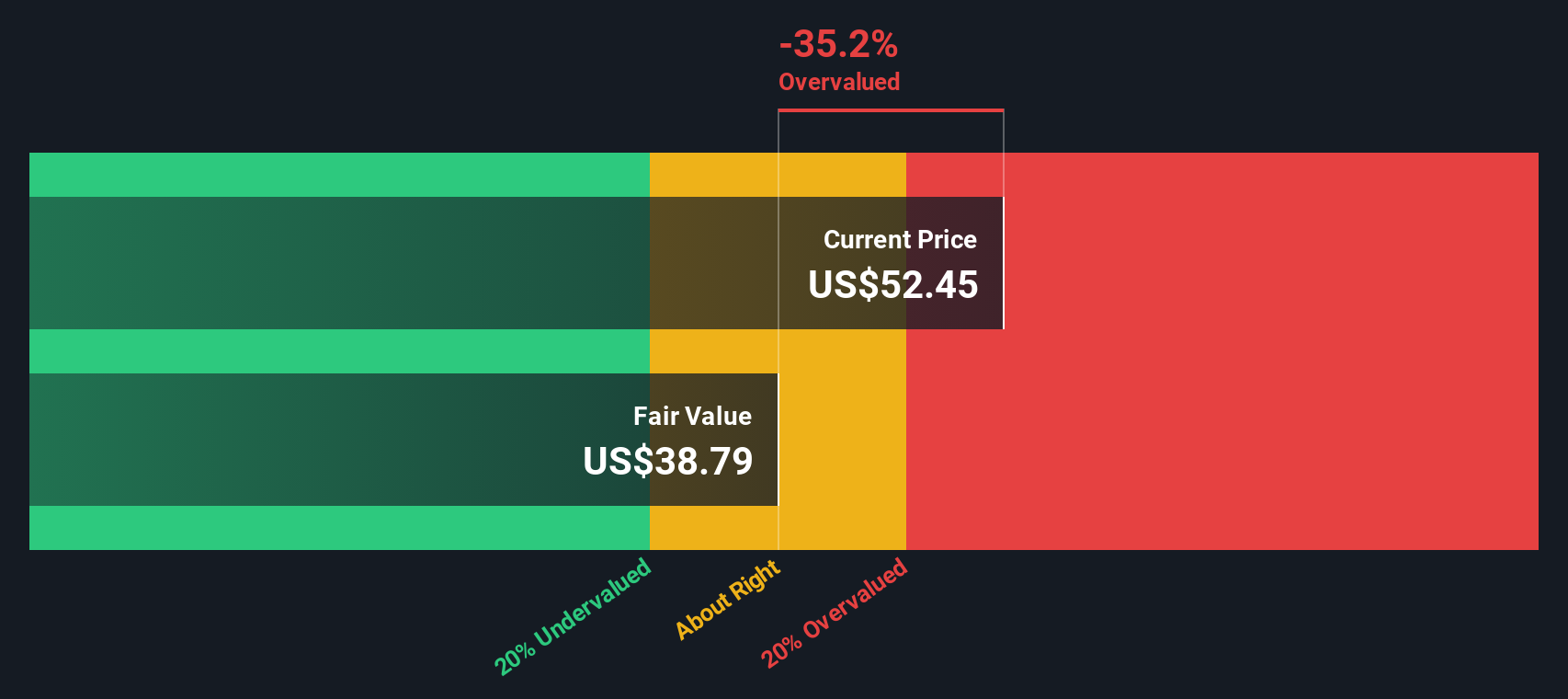

Bloom Energy currently trades at a P/S ratio of 13.47x. This stands far above the electrical industry average of 2.25x and the peer average of 27.76x. At first glance, this high multiple might suggest the stock is expensive, but simple comparisons can be misleading.

This is where the Simply Wall St Fair Ratio comes in. This proprietary metric evaluates the appropriate P/S multiple based on factors like Bloom’s revenue growth, industry characteristics, profit margins, market cap, and company-specific risks, aiming for a more tailored view of valuation.

For Bloom Energy, the Fair Ratio is 10.68x, which is less than its current P/S ratio but not drastically so. Since this difference is small, the stock’s valuation using sales looks roughly appropriate for its growth profile and risk-adjusted outlook.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1401 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bloom Energy Narrative

Earlier, we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives, a simple, user-friendly approach that connects a company's story with the numbers behind its fair value.

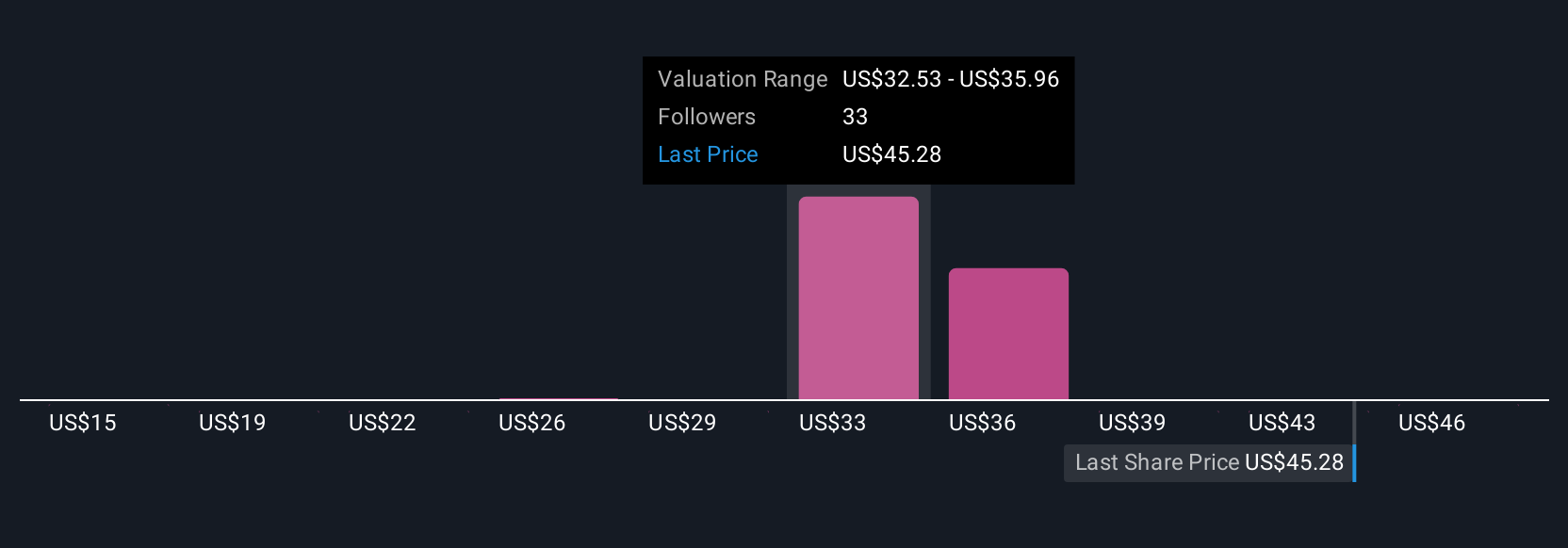

A Narrative is your unique perspective or "story" about a company, especially how you see its future unfolding in terms of revenue, margins, and risks. Rather than relying solely on historical data or analyst forecasts, Narratives let you combine your beliefs about catalysts or challenges with financial forecasts, linking your viewpoint to a calculated fair value and buy/sell decision.

With Simply Wall St's Community page, Narratives are easy to use and available to all investors. Millions already use them to update or refine their investment stance as news breaks or earnings are released, ensuring their fair value is always up to date.

For example, one investor might be optimistic about Bloom Energy's growing AI partnerships and, forecasting higher sales and margins, arrives at a fair value over $48 per share. Another with a more skeptical take on execution risks and competition might settle on a value near $10. This highlights how Narratives make investment decisions more personal and dynamic by tying your view to the latest information and share price.

Do you think there's more to the story for Bloom Energy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bloom Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BE

Bloom Energy

Designs, manufactures, sells, and installs solid-oxide fuel cell systems for on-site power generation in the United States and internationally.

Exceptional growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives