- United States

- /

- Electrical

- /

- NYSE:BE

Bloom Energy (BE) Rallies on Brookfield Deal and ETF Launch: Is Its Data Center Strategy Transformative?

Reviewed by Sasha Jovanovic

- Bloom Energy recently reported strong third-quarter financial results and entered a significant partnership with Brookfield Asset Management to expand its AI infrastructure and energy solutions for data centers, while the launch of new leveraged ETFs tracking Bloom Energy shares heightened market activity.

- The convergence of robust operational performance, partnerships in high-demand sectors, and novel investment products has intensified interest and volatility in Bloom Energy, positioning it at the center of evolving trends in clean energy and data center power solutions.

- We will examine how Bloom Energy's collaboration with Brookfield Asset Management and entry into ETF markets may influence its investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Bloom Energy Investment Narrative Recap

To be a Bloom Energy shareholder, you need confidence in the accelerating demand for data center and AI-related power solutions, and the company’s ability to win large, high-profile clients amid strong competition and rapid technology shifts. The recent news, including strong Q3 results boosted by upfront revenue recognition from the Brookfield partnership, intensifies focus on the sustainability of growth, while short-term volatility from leveraged ETF launches and insider activity does not materially alter the primary catalysts or the biggest risk: execution on manufacturing expansion amid industry cost pressures.

Among recent announcements, the $5 billion Brookfield Asset Management partnership stands out as highly relevant, as it aligns directly with Bloom’s pursuit of hyperscaler and AI factory deployments. This move underscores Bloom's central catalyst, providing rapid, reliable power where grid limitations threaten data center buildouts, while amplifying attention to the risks of large-scale project execution and evolving energy market dynamics.

By contrast, investors should be aware that while operational wins have driven rapid growth, the reliance on large, upfront revenue deals raises questions about the…

Read the full narrative on Bloom Energy (it's free!)

Bloom Energy's narrative projects $2.7 billion in revenue and $395.4 million in earnings by 2028. This requires 19.0% annual revenue growth and a $371.7 million increase in earnings from the current $23.7 million.

Uncover how Bloom Energy's forecasts yield a $111.85 fair value, in line with its current price.

Exploring Other Perspectives

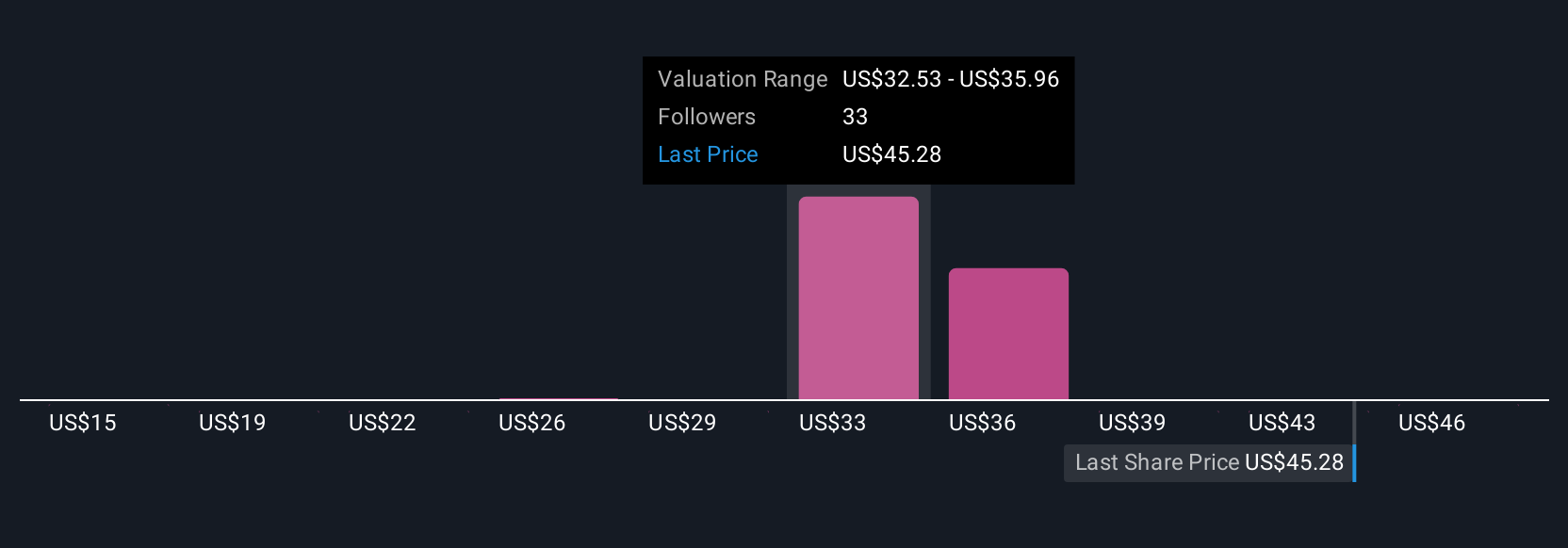

Nine individual estimates from the Simply Wall St Community put Bloom Energy’s fair value between US$15.38 and US$230.14 per share. As you consider this wide spread, keep in mind that execution risk on major manufacturing and data center projects remains front and center for future returns; explore several viewpoints to inform your outlook.

Explore 9 other fair value estimates on Bloom Energy - why the stock might be worth less than half the current price!

Build Your Own Bloom Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bloom Energy research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Bloom Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bloom Energy's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bloom Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BE

Bloom Energy

Designs, manufactures, sells, and installs solid-oxide fuel cell systems for on-site power generation in the United States and internationally.

Exceptional growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives