- United States

- /

- Electrical

- /

- NYSE:BE

Bloom Energy (BE) Premium Valuation Persists Despite $19.9 Million Non-Recurring Loss

Reviewed by Simply Wall St

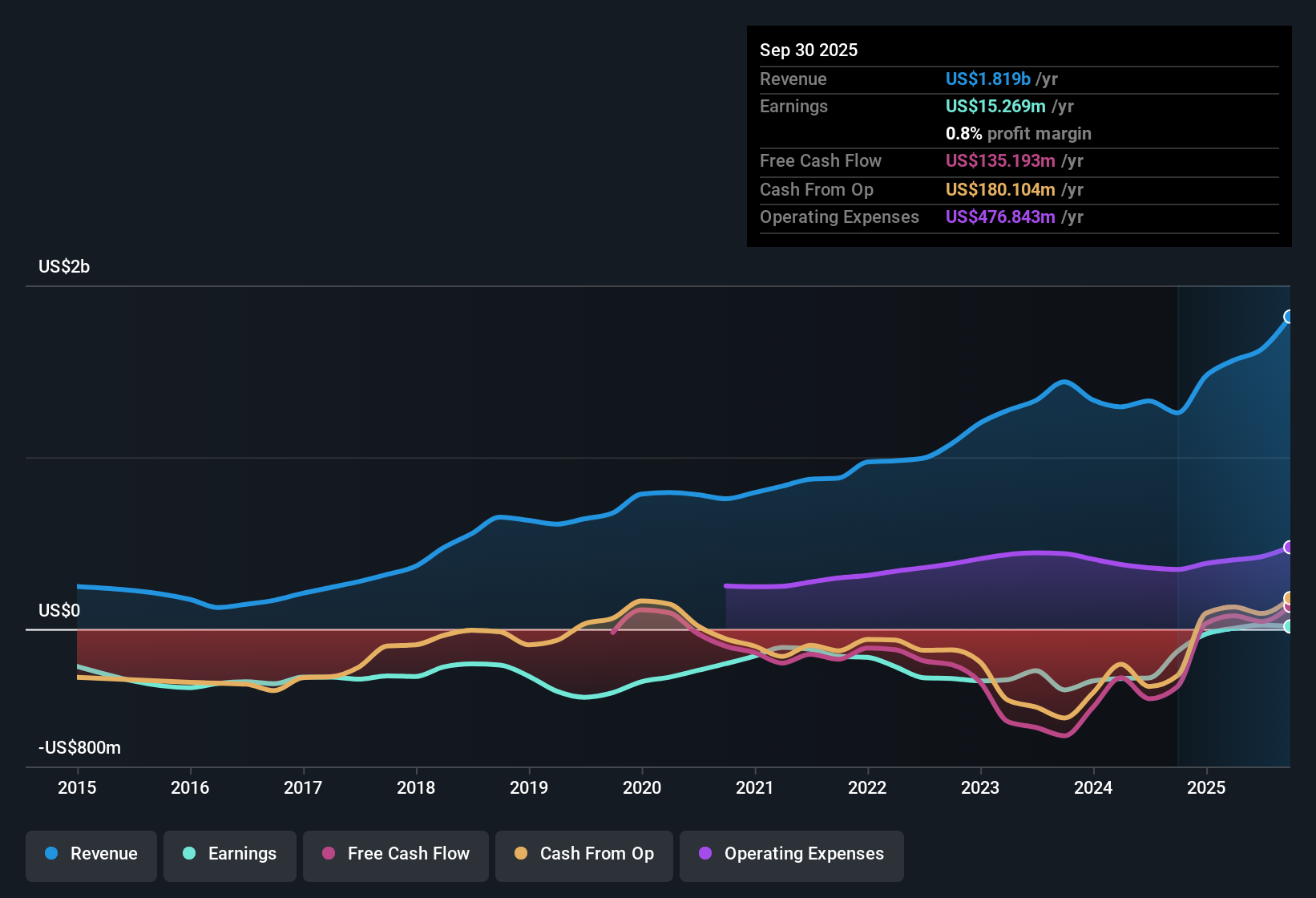

Bloom Energy (BE) reported earnings growth of 12.3% per year over the past five years, and has recently turned profitable, despite a non-recurring loss of $19.9 million impacting its financial results for the twelve months through September 2025. Looking ahead, earnings are forecast to jump 56.8% annually and revenue is projected to grow 29.4% per year, both well ahead of the US market averages. With premium valuation metrics and robust growth expectations, investors will be weighing Bloom Energy’s potential for top-tier expansion against recent volatility and financial risks as they assess the path forward.

See our full analysis for Bloom Energy.Next, we will compare these numbers directly with the most widely followed narratives to see where the stories match up and where they might diverge.

See what the community is saying about Bloom Energy

Margins Expected to Climb After Recent Turnaround

- Consensus narrative highlights that analysts expect Bloom Energy's profit margin to rise from 1.5% today to 14.4% in the next three years. This sharp expected improvement underpins forecasts of durable, high-quality earnings growth.

- According to analysts' consensus view, this projected margin expansion is driven by several factors:

- Ongoing reductions in product costs and the growing share of recurring, higher-margin service revenues are expected to boost both gross and net margins.

- Recent policy tailwinds, including the restoration of U.S. fuel cell investment tax credits, are also expected to support stronger profitability.

Investors are watching closely to see whether these forecasts of stable, rising margins play out as the company scales.

📊 Read the full Bloom Energy Consensus Narrative.Premium Price-To-Sales Ratio Raises Eyebrows

- Bloom trades at a Price-To-Sales ratio of 17.4x, which is significantly above the US Electrical industry average of 2.5x and even surpasses its peer group average of 5.8x. This makes valuation a critical discussion point for risk-aware investors.

- Under the analysts' consensus view, this hefty premium is only justifiable if rapid top-line and margin expansion materialize:

- Forecasts of 29.4% annual revenue growth and a leap in profitability form the backbone of bull arguments, but any stumble on margins or slower market adoption could quickly bring valuation pressures to the forefront.

- The relatively small gap between Bloom's $133.71 share price and the analyst target of $105.48 suggests the market sees much of this upside as already priced in.

Sector Growth Propelled by Policy and Technology Tailwinds

- Consensus narrative points to strong policy supports, such as restored U.S. fuel cell tax credits, and surging demand from AI data centers as key forces behind Bloom's long-term outlook for market expansion and revenue momentum.

- In the analysts' consensus view, product innovation and digital-twin-enabled operating gains could further expand Bloom’s addressable market:

- Widespread grid constraints, lengthy utility connection timelines, and increasing adoption from hyperscaler clients drive urgency in on-site power’s role, supporting revenue durability.

- However, bears might note that Bloom’s reliance on natural gas and execution risks in manufacturing expansion could undermine confidence in these tailwinds if adverse events arise.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Bloom Energy on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you have your own take on the numbers? Share your perspective and craft a personalized narrative in just a few minutes with Do it your way.

A great starting point for your Bloom Energy research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Bloom Energy’s lofty valuation and modest profit margins leave investors exposed if growth or margin improvements fall short of high expectations.

If you want more attractive entry points, check out these 855 undervalued stocks based on cash flows for companies where the fundamentals suggest greater value and less downside risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bloom Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BE

Bloom Energy

Designs, manufactures, sells, and installs solid-oxide fuel cell systems for on-site power generation in the United States and internationally.

Exceptional growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives