- United States

- /

- Banks

- /

- NYSE:ASB

3 US Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

As the U.S. stock market experiences a rise in futures following key inflation data that reinforces expectations of interest rate cuts, investors are keenly observing opportunities amidst fluctuating indices. In this environment, identifying undervalued stocks can be pivotal for those looking to capitalize on potential discrepancies between current market prices and estimated intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NBT Bancorp (NasdaqGS:NBTB) | $50.53 | $99.93 | 49.4% |

| UMB Financial (NasdaqGS:UMBF) | $125.81 | $245.91 | 48.8% |

| Synovus Financial (NYSE:SNV) | $58.27 | $115.23 | 49.4% |

| Five Star Bancorp (NasdaqGS:FSBC) | $32.82 | $63.93 | 48.7% |

| Datadog (NasdaqGS:DDOG) | $123.41 | $243.63 | 49.3% |

| West Bancorporation (NasdaqGS:WTBA) | $24.02 | $46.86 | 48.7% |

| Pinterest (NYSE:PINS) | $30.67 | $59.54 | 48.5% |

| Advanced Energy Industries (NasdaqGS:AEIS) | $114.29 | $219.49 | 47.9% |

| LifeMD (NasdaqGM:LFMD) | $7.16 | $14.15 | 49.4% |

| Clearfield (NasdaqGM:CLFD) | $33.02 | $64.85 | 49.1% |

Here we highlight a subset of our preferred stocks from the screener.

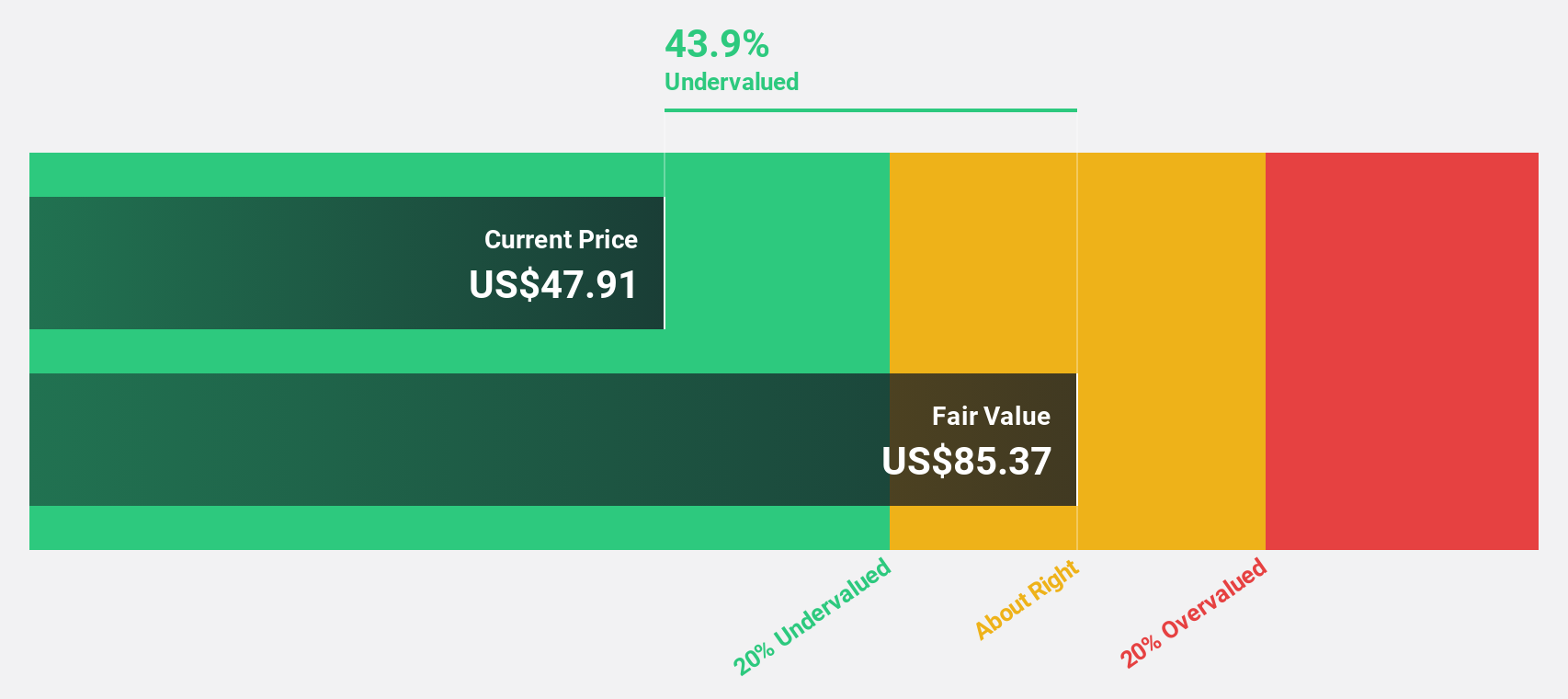

Symbotic (NasdaqGM:SYM)

Overview: Symbotic Inc. is an automation technology company focused on developing technologies to enhance operating efficiencies in modern warehouses, with a market cap of approximately $20.44 billion.

Operations: The company generates revenue from its Industrial Automation & Controls segment, which amounts to $1.68 billion.

Estimated Discount To Fair Value: 27%

Symbotic Inc. is trading at US$34.32, approximately 27% below its estimated fair value of US$46.98, highlighting potential undervaluation based on discounted cash flows. Despite recent shareholder dilution and a volatile share price, the company shows promising revenue growth prospects at 23.5% annually, outpacing the broader U.S. market's growth rate of 8.9%. Recent agreements with Walmart de Mexico y Centroamerica underscore strategic international expansion efforts in warehouse automation systems.

- Our growth report here indicates Symbotic may be poised for an improving outlook.

- Click here to discover the nuances of Symbotic with our detailed financial health report.

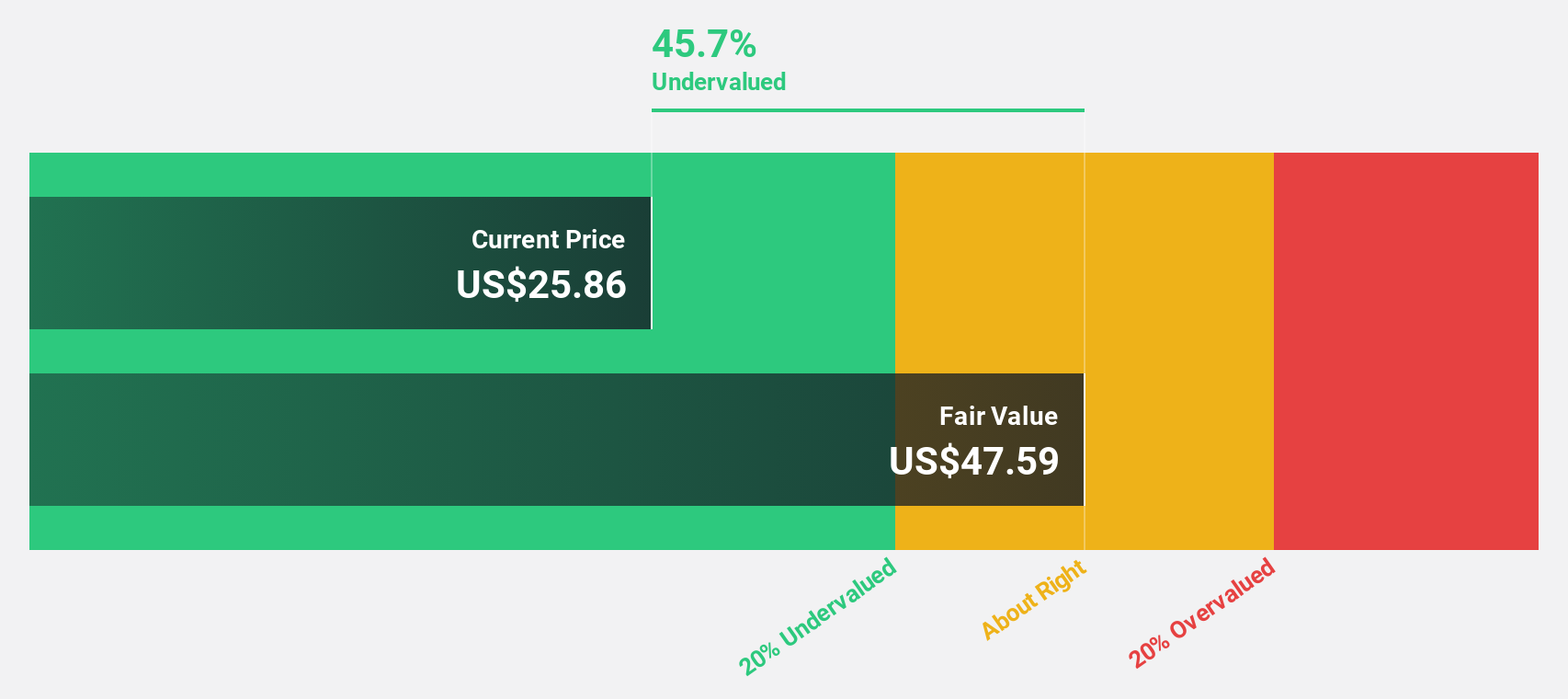

Associated Banc-Corp (NYSE:ASB)

Overview: Associated Banc-Corp is a bank holding company that offers a range of banking and nonbanking products to individuals and businesses in Wisconsin, Illinois, and Minnesota, with a market cap of approximately $4.12 billion.

Operations: The company's revenue segments include Community, Consumer, and Business at $843.01 million and Corporate and Commercial Specialty at $683.40 million.

Estimated Discount To Fair Value: 34.9%

Associated Banc-Corp is trading at US$27.58, significantly below its estimated fair value of US$42.34, indicating potential undervaluation based on discounted cash flows. Despite a decline in profit margins from 29.5% to 18%, earnings are projected to grow at 22.81% annually, surpassing the U.S. market's growth rate of 15.6%. Recent executive appointments aim to strengthen commercial banking operations and drive strategic growth initiatives across key markets in the United States.

- In light of our recent growth report, it seems possible that Associated Banc-Corp's financial performance will exceed current levels.

- Get an in-depth perspective on Associated Banc-Corp's balance sheet by reading our health report here.

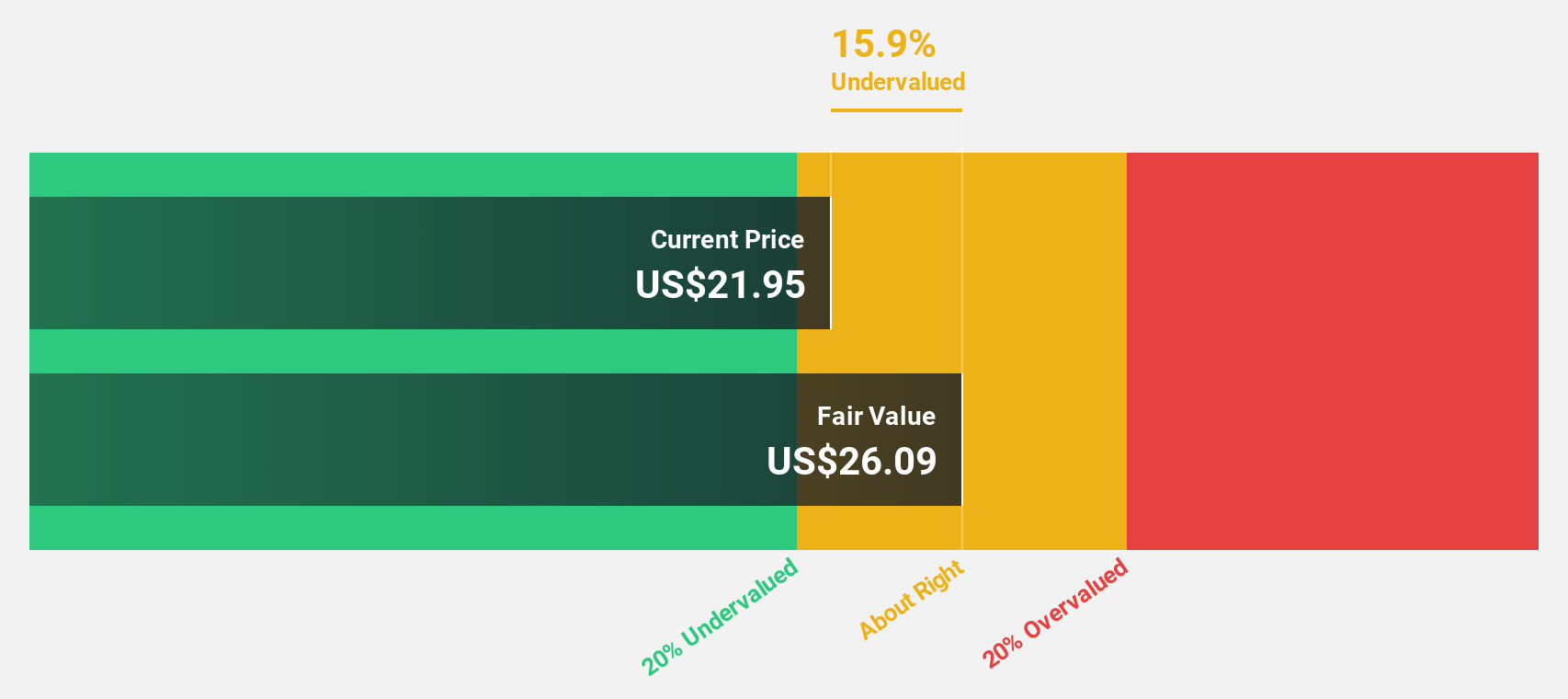

Bloom Energy (NYSE:BE)

Overview: Bloom Energy Corporation designs, manufactures, sells, and installs solid-oxide fuel cell systems for on-site power generation both in the United States and internationally, with a market capitalization of approximately $3.11 billion.

Operations: The company's revenue primarily comes from its Electric Equipment segment, generating $1.26 billion.

Estimated Discount To Fair Value: 24.3%

Bloom Energy is trading at US$13.54, below its estimated fair value of US$17.88, suggesting undervaluation based on discounted cash flows. Despite a volatile share price and past shareholder dilution, earnings are forecast to grow 75.8% annually with profitability expected within three years. Recent strategic partnerships in South Korea and the U.S., including projects with SK Eternix and FPM Development, highlight Bloom's expanding market presence and innovative energy solutions deployment capabilities.

- Our comprehensive growth report raises the possibility that Bloom Energy is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Bloom Energy's balance sheet health report.

Turning Ideas Into Actions

- Reveal the 192 hidden gems among our Undervalued US Stocks Based On Cash Flows screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ASB

Associated Banc-Corp

A bank holding company, provides various banking and nonbanking products to individuals and businesses in Wisconsin, Illinois, and Minnesota.

Flawless balance sheet established dividend payer.